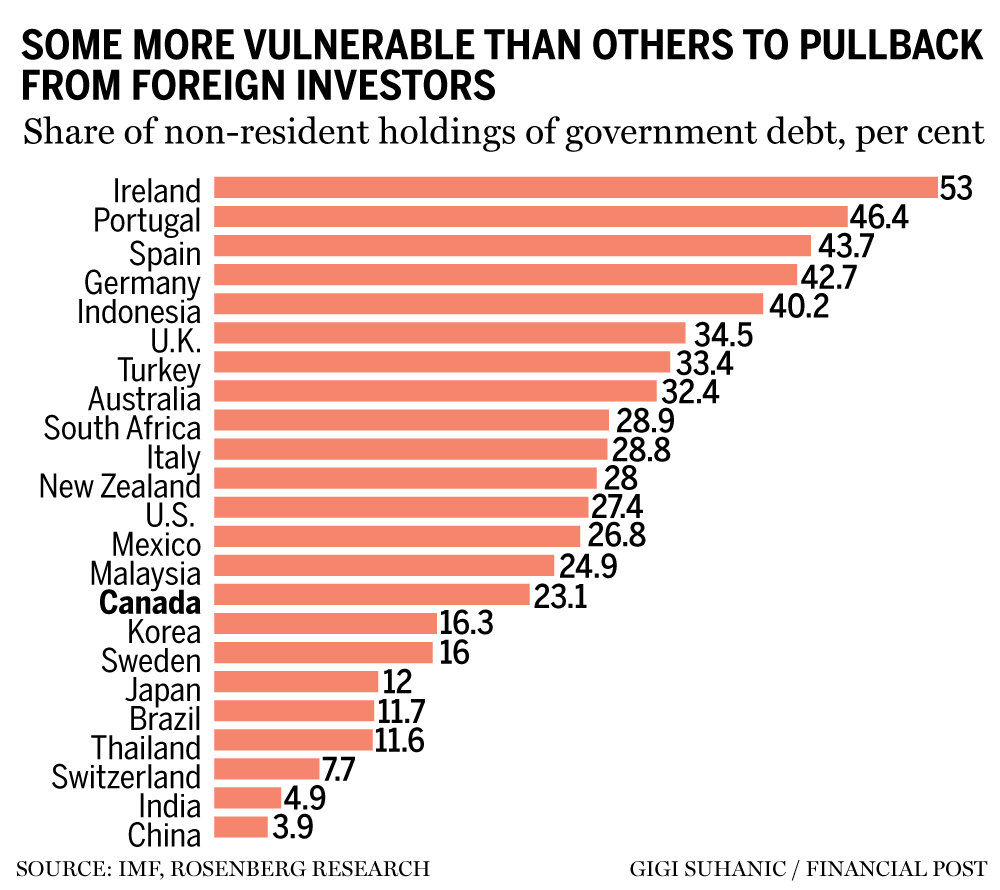

Sharp increase in government debt threatens to derail global economy, meaning investors must be discerning of countries they focus on A group of tourists walk past a temple in Thailand. The country is among countries investors may want to focus on. Photo by Taylor Weidman/Getty Images By David Rosenberg and Krishen Rangasamy Advertisement 2 This… Continue reading David Rosenberg: The economies best positioned to withstand rising rates

Barry Choi: How to decide if you should lock in your mortgage rate or stay with your variable rate

How rising interest rates affect your monthly payments To begin, there are two types of variable-rate mortgages: fixed payment and adjustable rate mortgages. With a fixed payment variable-rate mortgage, your monthly payments stay the same each month. When rates rise and fall, what changes, is the amount of your payment that goes toward interest. As… Continue reading Barry Choi: How to decide if you should lock in your mortgage rate or stay with your variable rate

The markets killed your early retirement dream, but there is a way to Freedom 65

In these turbulent times, staying the course can help get you back on track to retirement Those hoping to claim their freedom from work sooner rather than later should be focusing on eliminating debt before they retire. Photo by Getty Images In an ongoing series, the Financial Post explores personal finance questions tied to life’s… Continue reading The markets killed your early retirement dream, but there is a way to Freedom 65

Investors need to leave the past in the past and focus on doing the right thing in the present

Martin Pelletier: This is one mistake that I promised myself I would not make again regardless of what segment of the market it is in Traders work on the trading floor at the New York Stock Exchange in Manhattan. Photo by Andrew Kelly/Reuters files Someone once told me the past is like a wake behind… Continue reading Investors need to leave the past in the past and focus on doing the right thing in the present

Fundamentals ‘flashing red’ as last pillar of credit crumbles

Corporate credit conditions are worsening, says Janus Henderson Investors Author of the article: Bloomberg News Tasos Vossos A crosswalk sign flashes red in Toronto’s financial district. Photo by Cole Burston/Bloomberg Corporate credit conditions are worsening, with the last of three key measures now “flashing red,” according to a traffic-light system used by Janus Henderson Investors.… Continue reading Fundamentals ‘flashing red’ as last pillar of credit crumbles

Five winning investments in 2022 and their prospects ahead

Peter Hodson: There is always a bull market in something Lithium evaporation ponds in Nevada. A strong lithium sector is fuelling small-cap stock Patriot Battery Metals Inc. Photo by Carlos Barria/Reuters The markets had a decent rally early this week, but let’s face it, it has still been a horrible year for equity investors and… Continue reading Five winning investments in 2022 and their prospects ahead

FP Answers: Should I invest in an RRSP or non-registered account when saving for a home?

Anthony, 25, plans to buy a house soon and wants the biggest down payment possible Anthony wonders what is his best option to maximize his home savings. Photo by Getty Images/iStockphoto By Julie Cazzin with Doug Robinson Advertisement 2 This advertisement has not loaded yet, but your article continues below. Q: I’m 25 years old… Continue reading FP Answers: Should I invest in an RRSP or non-registered account when saving for a home?

Why a business owner who paid himself dividends got into trouble with the CRA

Jamie Golombek: A dividend isn’t legally considered remuneration, which can have severe implications If you’re a business owner who owns an incorporated business, including a professional corporation, dividends are sometimes thought of as a form of remuneration. Photo by Brent Lewin/Bloomberg Many retail investors are certainly familiar with the concept of dividend income, having received… Continue reading Why a business owner who paid himself dividends got into trouble with the CRA