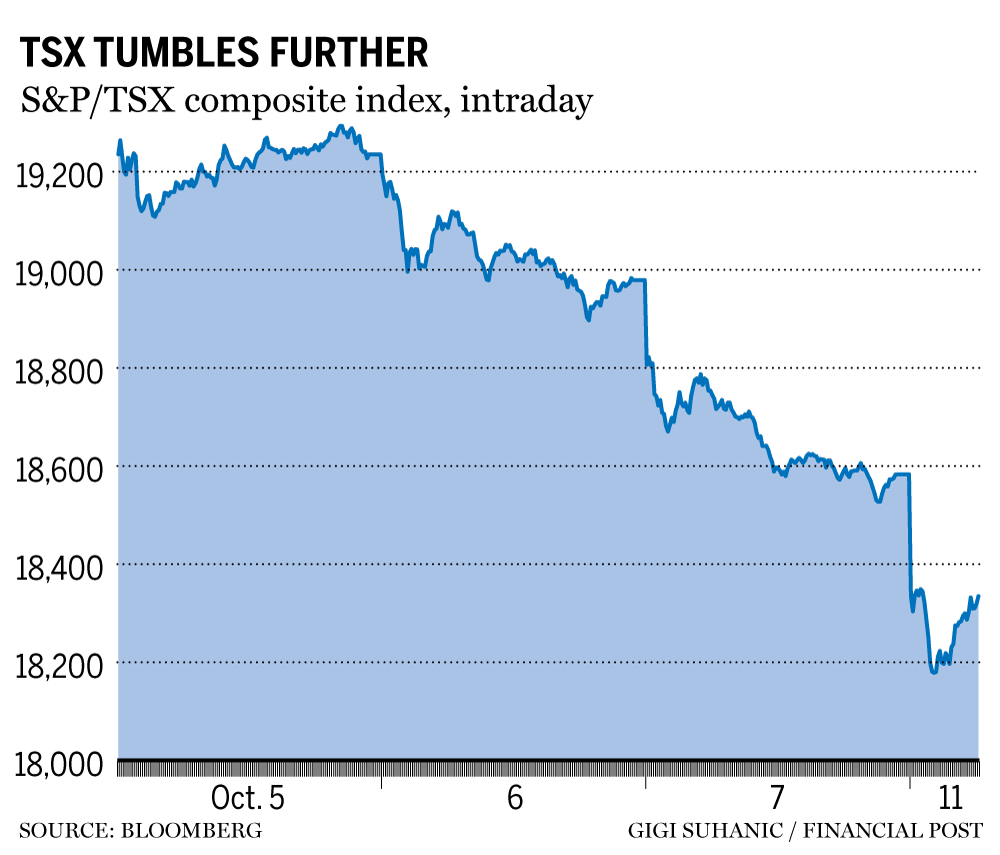

S&P/TSX composite index ended down 366.45 points, or nearly 2%, at 18,216.68 Author of the article: The S&P/TSX composite index fell Tuesday, as worries about a global recession unnerved investors returning from a long weekend, with commodity-linked energy and material stocks among big losers. Photo by REUTERS/Mark Blinch/File Photo Canada’s main stock index fell on… Continue reading TSX is plunging even deeper into the red than U.S. stocks today

Encouraging signs for investors lie ahead despite all the doom and gloom

Martin Pelletier: The probabilities point to a win for those betting on the house rather than persistently against it Traders work on the trading floor at the New York Stock Exchange. Photo by Andrew Kelly/Reuters files I try to do a grateful meditation session every night, which was especially fitting this past Thanksgiving weekend, but… Continue reading Encouraging signs for investors lie ahead despite all the doom and gloom

Five reasons bad news is not always bad news for investors

Peter Hodson: This will help ensure you’re not selling at the exact bottom of this market cycle A trader works on the floor of the New York Stock Exchange in September. Photo by Brendan McDermid/Reuters The nice two-day rally in the markets has given most investors some hope. It has been a long time since… Continue reading Five reasons bad news is not always bad news for investors

‘Someone will get hurt’: Investors and analysts warn on rising market stress

Big swings across asset markets are raising the risk of a financial accident Author of the article: Financial Times Eric Platt and Kate Duguid in New York A sign for Wall Street outside the New York Stock Exchange. Photo by Mike Segar/Reuters files Investors and Wall Street analysts are sounding the alarm about a possible… Continue reading ‘Someone will get hurt’: Investors and analysts warn on rising market stress

‘Ray no longer has the final word’: Ray Dalio gives up control of world’s largest hedge fund

Dalio initiated the succession plan as far back as 2010 Author of the article: Bloomberg News Erik Schatzker Ray Dalio, the billionaire founder of Bridgewater Associates, has given up control of the firm he built into the world’s largest hedge fund. Photo by Simon Dawson/Bloomberg After 12 years of trying, Ray Dalio is finally letting… Continue reading ‘Ray no longer has the final word’: Ray Dalio gives up control of world’s largest hedge fund

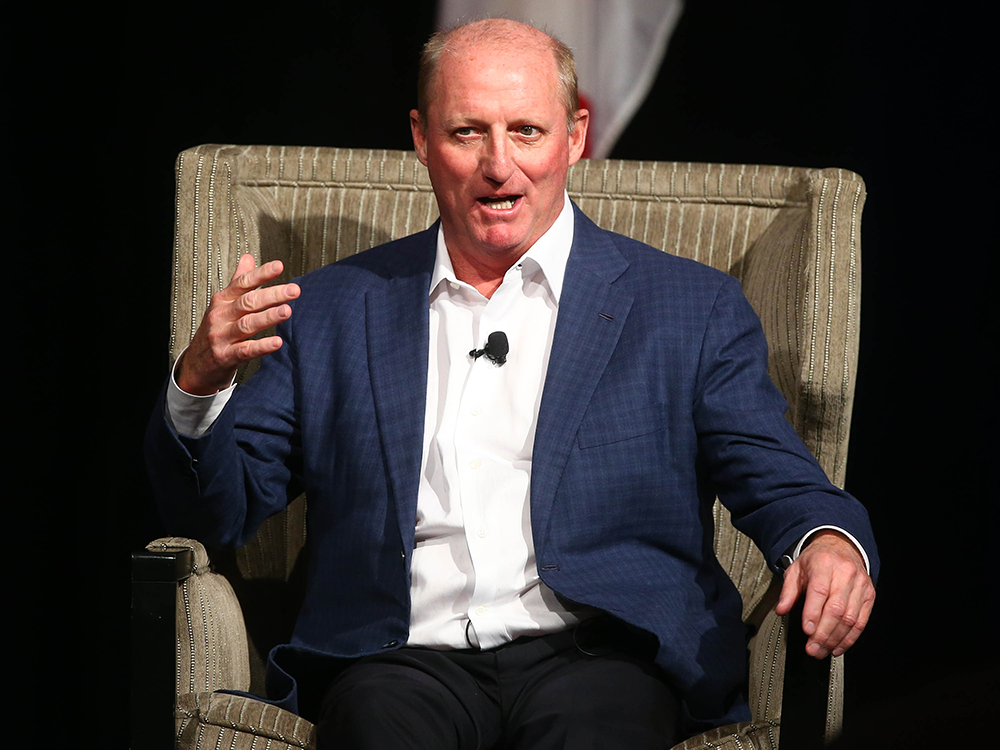

Warren Buffett’s likely successor — a Canadian — buys $68 million of Berkshire stock

Greg Abel invests more skin in the game to the relief of shareholders Author of the article: Bloomberg News Dan Reichl and Katherine Chiglinsky Canadian Greg Abel is the current heir-apparent to investing guru and head of Berkshire Hathaway Warren Buffett. Photo by Jim Wells /Postmedia Greg Abel, who is in line to eventually succeed… Continue reading Warren Buffett’s likely successor — a Canadian — buys $68 million of Berkshire stock

Elon Musk proposes buying Twitter for original price of $54.20 a share

Musk had been trying for months to back out of his contract to acquire Twitter Author of the article: Bloomberg News Jef Feeley and Ed Hammond Elon Musk has made a proposal to buy Twitter for his original offer price. Photo by Jim Watson/AFP via Getty Images Elon Musk is proposing to buy Twitter Inc.… Continue reading Elon Musk proposes buying Twitter for original price of $54.20 a share

David Rosenberg: Equities are generally not pricing in a recession yet, but one asset class is

Canadian equities likely have a bit further to fall, but won’t decline as much as in prior recessionary periods Pedestrians walk past stock market numbers in Toronto’s Financial district in September. Photo by Peter J. Thompson/National Post By David Rosenberg and Brendan Livingstone Advertisement 2 This advertisement has not loaded yet, but your article continues… Continue reading David Rosenberg: Equities are generally not pricing in a recession yet, but one asset class is