Pound falls to record low amid chatter about emergency action by the Bank of England Author of the article: Bloomberg News Sagarika Jaisinghani The new prime minister of the U.K., Liz Truss, has implemented a series of tax cuts she promised during her campaign to take over from Boris Johnson. Photo by Getty Images The… Continue reading Liz Truss tax cuts unleash $500 billion U.K. market selloff

ETFs with largest inflows underperform rivals, studies show

Prevalence of ‘dumb’ retail money offers ‘bankable’ returns if you invest by going against the flow Author of the article: Financial Times Steve Johnson Traders work on the floor of the New York Stock Exchange in New York City. Photo by Spencer Platt/Getty Images files Investors in exchange-traded funds are a barometer of what not… Continue reading ETFs with largest inflows underperform rivals, studies show

What investors can do instead of betting on central banks to stop hiking rates

Martin Pelletier: Investors need to do more than simply ‘wait it out’ Bank of Canada Governor Tiff Macklem takes part in a news conference in Ottawa. Photo by Blair Gable/Reuters files What makes the market’s wild ride this year especially unique is just how broad the selloff has been for both equities and bonds alike,… Continue reading What investors can do instead of betting on central banks to stop hiking rates

Global market storm gathers force as virtually no asset class is spared

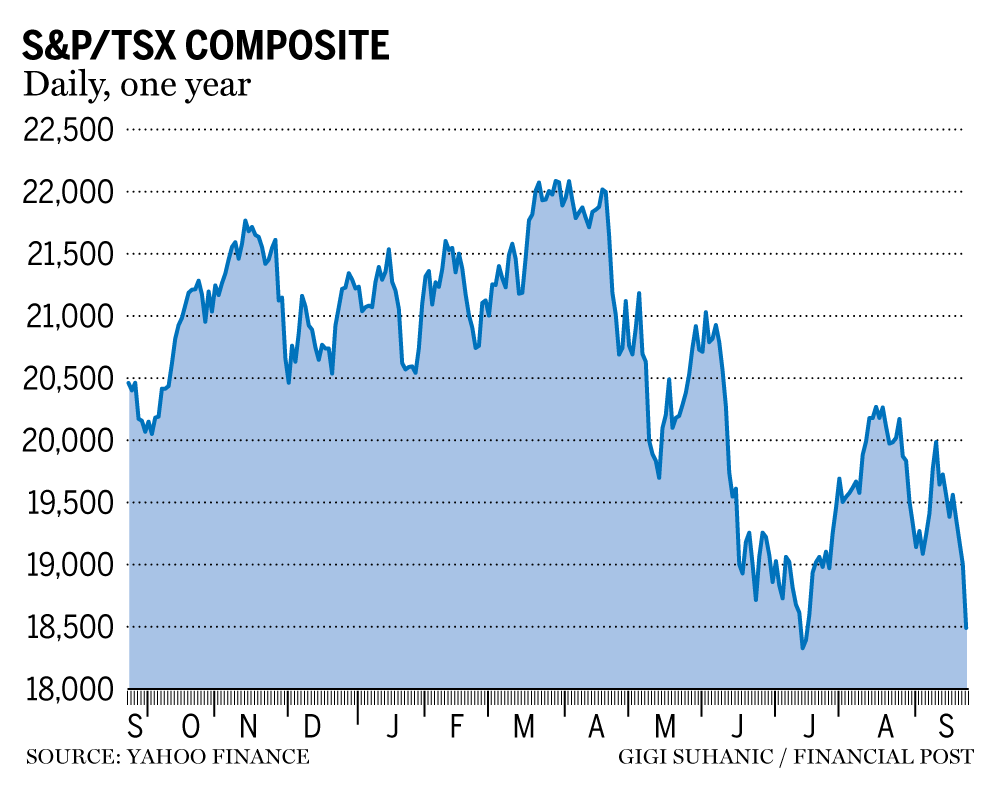

TSX, S&P 500 are getting hammered as sell-off turns ugly Publishing date: Sep 23, 2022 • 7 minutes ago • 4 minute read • 5 Comments A trader reacts on the floor of the New York Stock Exchange. Photo by REUTERS/Brendan McDermid Global markets came under more pressure Friday as the mood over the economic outlook… Continue reading Global market storm gathers force as virtually no asset class is spared

Attendance was high, but spirits were not: Five takeaways from the MoneyShow

Peter Hodson: Every investor had one thing on their mind — inflation A trader works on the floor of the New York Stock Exchange. Photo by Brendan McDermid/Reuters files The Toronto MoneyShow, after a pandemic hiatus, was held last week. It’s a great show: a giant exhibition and forum on all things investment and money… Continue reading Attendance was high, but spirits were not: Five takeaways from the MoneyShow

TSX plunges as stock selloff turns ugly

It’s a sea of red for equity trading desks around the globe Author of the article: Bloomberg News Rita Nazareth Canada’s main stock index plunged Friday, with losses led by energy stocks. Photo by REUTERS/Mark Blinch/File Photo A selloff in the riskier corners of the market deepened as the U.K.’s plan to lift the economy… Continue reading TSX plunges as stock selloff turns ugly

David Rosenberg: Slumping equity risk premiums mean there is more bear market to come

An unusual selloff period compared with history Equity risk premiums typically expand more than they have in this market downturn, writes David Rosenberg. Photo by Getty Images By David Rosenberg and Marius Jongstra Advertisement 2 This advertisement has not loaded yet, but your article continues below. For the better part of the last cycle, going… Continue reading David Rosenberg: Slumping equity risk premiums mean there is more bear market to come

Better governance, oversight give reasons to remain optimistic about the future of ESG investing

Difficult year for ESG investing has served as wake-up call Publishing date: Sep 21, 2022 • 8 hours ago • 4 minute read • 5 Comments Hydrocarbon giant Exxon Mobil Corp. is included in the S&P 500 ESG Index. Photo by Michael Nagle/Bloomberg files Over the past two decades, environmental, social and corporate governance (ESG) investing… Continue reading Better governance, oversight give reasons to remain optimistic about the future of ESG investing