US debt will become unsustainable in roughly 20 years if it doesn’t change course, a Penn Wharton Budget Model determined. After that, no amount of tax hikes or spending cuts could prevent default “whether explicitly or implicitly.” An implicit default would include debt monetization that produces significant inflation. Loading Something is loading. Thanks for signing… Continue reading US debt will become unsustainable and trigger default in about 20 years, if it stays on current path

US debt will become unsustainable and trigger default in about 20 years, if it stays on current path

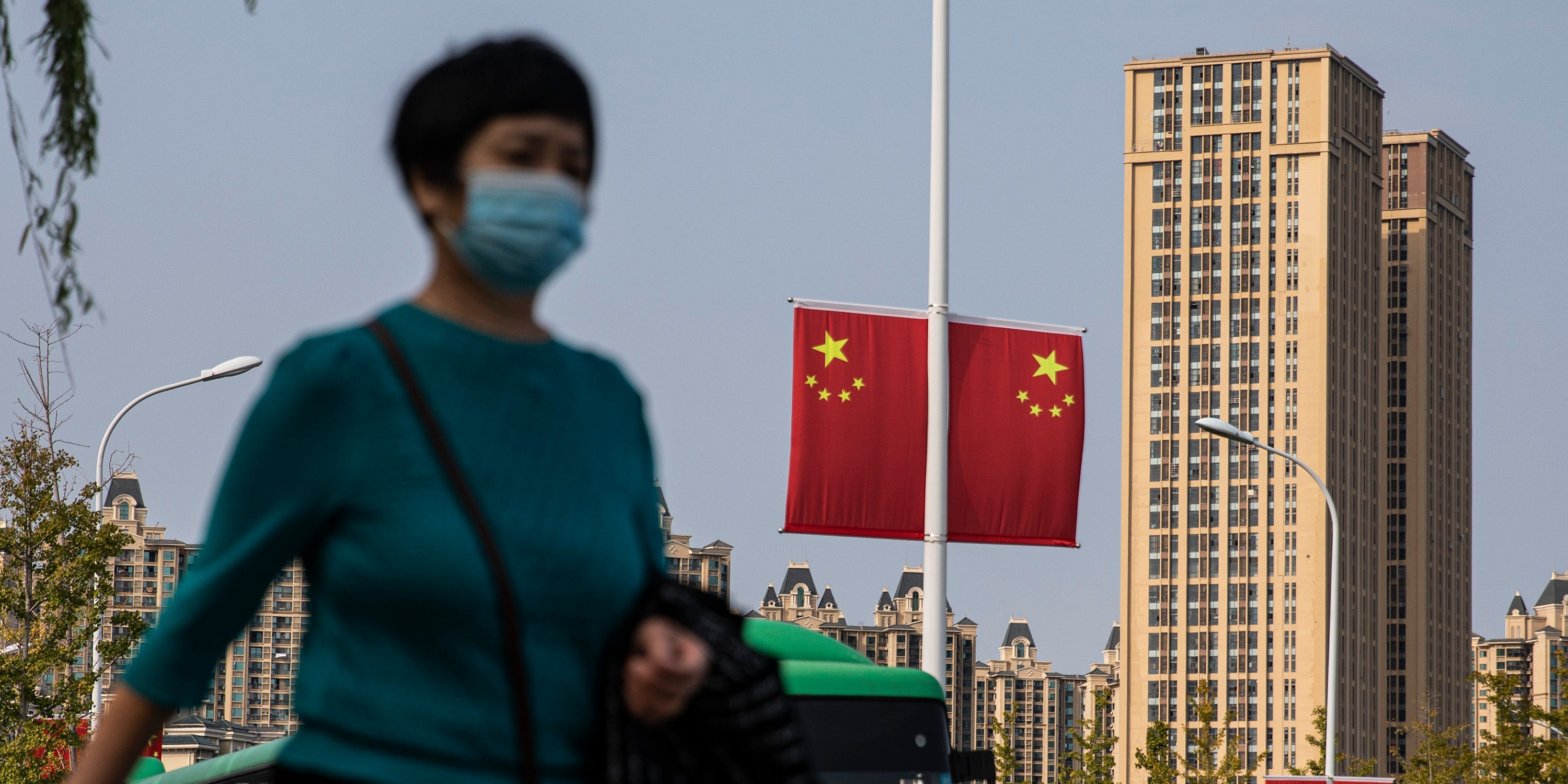

China’s economy is so uncertain that the wealthy are turning to an underground network to secretly move cash out of the country

Some wealthy citizens in China are turning to underground money handlers to move cash, Bloomberg reported. Moving money through these quasi-banking systems is risky and can result in jail time. Some Chinese underground banks settle transfers using funds generated by criminal groups, the report said. Loading Something is loading. Thanks for signing up! Access your… Continue reading China’s economy is so uncertain that the wealthy are turning to an underground network to secretly move cash out of the country

Stocks are still in a bull market but it’s one of the weakest on record

The rally in stocks since October 2022 is one of the weakest bull markets on record, according to Ned Davis Research.Elevated valuations and monetary tightening measures from the Federal Reserve have limited upside potential. These technical signals highlight just how weake the current rally in stocks really is, according to NDR. Loading Something is loading. Thanks… Continue reading Stocks are still in a bull market but it’s one of the weakest on record

The share of consumers who think now is a good time to buy a home is back at an all-time low

Sentiment in the US housing market fell last month, according to Fannie Mae data. That’s largely due to high mortgage rates, with the 30-year fixed rate rising to 7.49% the last week. Buyers are also expecting home prices to rise over the next year, Fannie Mae’s chief economist said. Loading Something is loading. Thanks for… Continue reading The share of consumers who think now is a good time to buy a home is back at an all-time low

Investors warn Evergrande could face an ‘uncontrolled collapse’ that would be a disaster for China’s property sector

A group of Evergrande bond investors sounded the alarm on the troubled Chinese developer, the WSJ reported. Last month, Evergrande cancelled a $19 billion debt restructuring, leading bondholders to warn of wider turmoil. “This will likely lead to the uncontrolled collapse of the group,” the investors wrote. Loading Something is loading. Thanks for signing up!… Continue reading Investors warn Evergrande could face an ‘uncontrolled collapse’ that would be a disaster for China’s property sector

Rising corporate bankruptcies and debt defaults are another headwind for the economy, experts warn

A wave of corporate bankruptcies and debt defaults could rock the economy, experts say. Charles Schwab expects bankruptcies and defaults to peak at some point over the next two quarters. A spike in bankruptcies among US companies could help push the economy into a recession. Loading Something is loading. Thanks for signing up! Access your… Continue reading Rising corporate bankruptcies and debt defaults are another headwind for the economy, experts warn

It’s not just stocks – high bond yields are also laying waste to commodities, currencies, and housing

The Treasury bond market sell-off marks one of the worst crashes in history. High yields are hitting stocks, but other assets across financial markets are also reeling. Commodities, crypto, housing and foreign currencies have been slumping too. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized feed while you’re… Continue reading It’s not just stocks – high bond yields are also laying waste to commodities, currencies, and housing

The 20 US metro areas expected to see the biggest price booms, according to a property-data firm

Home prices have appreciated for a 139th consecutive month, according to CoreLogic. Prices have now gone up by 42% since the start of the pandemic shutdowns in March 2020. These 20 metro areas are expected to see the price biggest spikes over the next year. Would-be homebuyers can’t catch a break. Rising mortgage rates have… Continue reading The 20 US metro areas expected to see the biggest price booms, according to a property-data firm