Casino stocks are slumping – and that could be bad news for the US economy. The sector plunging could be a signal that Americans are about to start spending less. Top investor Jim Chanos has touted the Las Vegas strip as a potential economic indicator in the past. Loading Something is loading. Thanks for signing… Continue reading Las Vegas casino stocks are flirting with a bear market. That might be a sign an economic downturn is coming.

US stocks jump, reversing up after bond yields come off highs

Filip De Mott STAN HONDA/AFP via Getty Images) US stocks rebounded sharply Friday, after a spike in bond yields in the morning. September’s jobs report came in hotter than expected, and could indicate higher Federal Reserve rates. The United Auto Workers indicated significant progress in talks with carmakers, helping boost market optimism. Loading Something is… Continue reading US stocks jump, reversing up after bond yields come off highs

Here are all the ways market history is repeating itself amid panic over surging bond yields

In recent weeks, stocks, bonds, and housing have all drawn comparisons with previous episodes in US market history. Stocks are reminding some analysts of the late 1980s and 2008, while bond vigilantes are reliving the 1990s. The housing market also looks eerily like the early 1980s, when mortgage rates soared. Loading Something is loading. Thanks… Continue reading Here are all the ways market history is repeating itself amid panic over surging bond yields

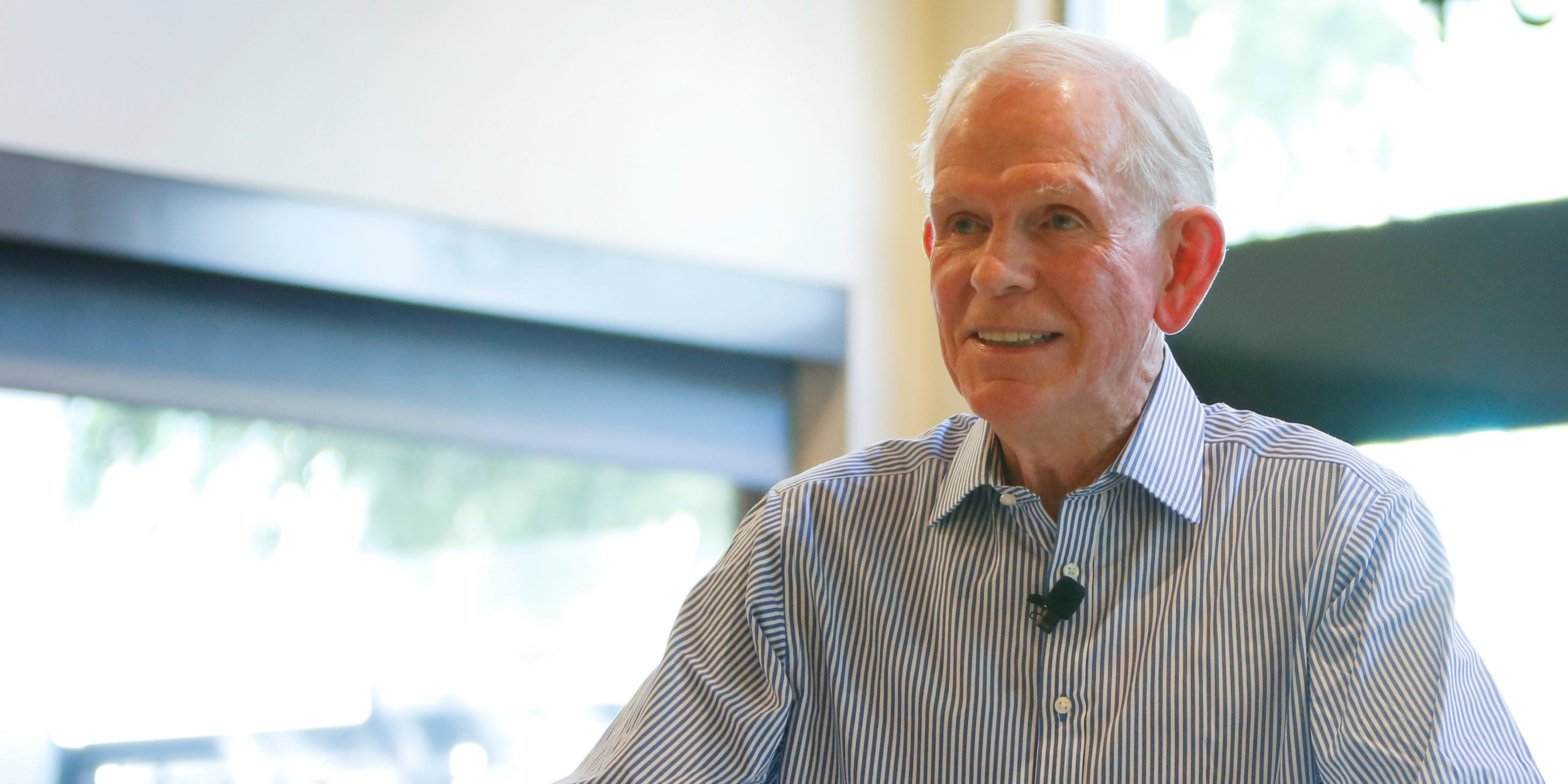

Be ready for the S&P 500 to crash by 50%, house prices to slide, and a recession to strike, Jeremy Grantham says. Here are the elite investor’s 16 best quotes from a new interview.

Stocks are in a bubble and could crash by over 50% if it ends badly, Jeremy Grantham says. The elite investor sees house prices falling and predicts a recession will strike next year. Here are his 16 best quotes from a new interview, including comments about bitcoin and AI. Loading Something is loading. Thanks for… Continue reading Be ready for the S&P 500 to crash by 50%, house prices to slide, and a recession to strike, Jeremy Grantham says. Here are the elite investor’s 16 best quotes from a new interview.

Wall Street’s dream scenario is dead

Wall Street’s vision of a Goldilocks scenario for the stock market and economy is unraveling.The Fed’s “higher for longer” mantra has dashed hopes that a recession is avoidable.The US economy is feeling the lagging effects of tight monetary policy as risk factors converge. Loading Something is loading. Thanks for signing up! Access your favorite topics… Continue reading Wall Street’s dream scenario is dead

The bond market meltdown is going to get worse before it gets better

The collapse in Treasury bonds is one of the worst market crashes in history, and more downside could still be looming. Four market veterans told Insider what could come next and how the bond market could ripple through stocks and the economy. Experts forecast that a recession could hit in 2024 and 10-year Treasury yields… Continue reading The bond market meltdown is going to get worse before it gets better

Goldman Sachs: These 21 companies can endure higher borrowing costs and provide stability as the Fed’s battle against inflation continues to hurt bottom lines

Fed Chair Jerome Powell may keep interest rates higher for longer, biting into company profits. Stocks across the market have seen lower returns on equity this year, according to Goldman Sachs. But 21 companies can handle the restrictive monetary policy and provide investors with stability. The Federal Reserve’s higher-for-longer monetary policy has had an enormous… Continue reading Goldman Sachs: These 21 companies can endure higher borrowing costs and provide stability as the Fed’s battle against inflation continues to hurt bottom lines

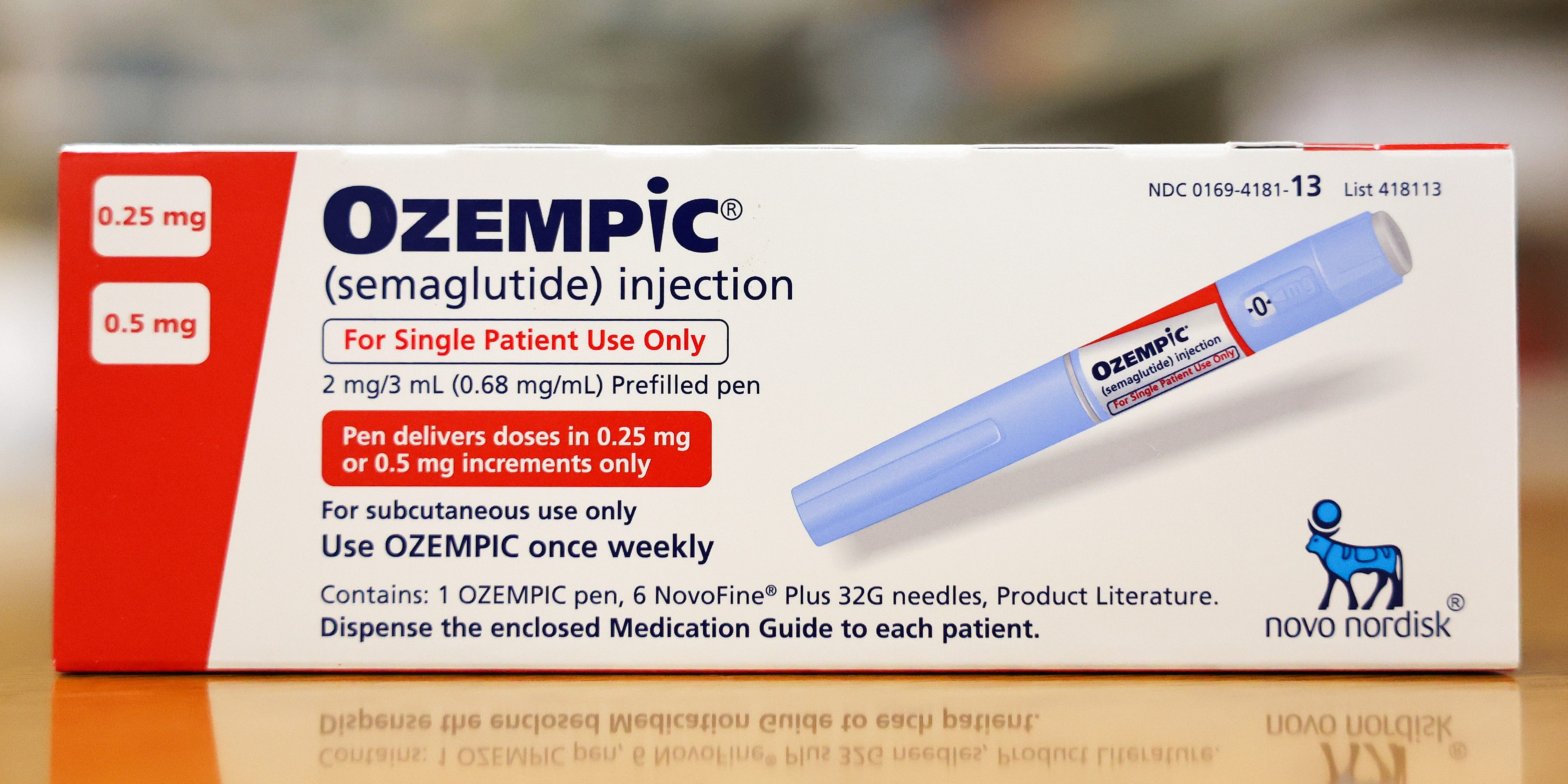

Food retailers and producers are getting slammed as GLP-1 drugs like Ozempic raise growing alarms about demand

The rise of GLP-1 drugs is driving consumer staples stocks lower as patients eat less food.Shares of PepsiCo, Coca-Cola, Walmart, and Costco have been slammed on the prospect of less food demand.The CEO of Walmart’s US division said they are already seeing patients using GLP-1 drugs buy less food at the retailer. Loading Something is… Continue reading Food retailers and producers are getting slammed as GLP-1 drugs like Ozempic raise growing alarms about demand