US credit card debt hit $1 trillion for the first time ever this year. That’s actually not excessive when considering factors like wage growth, experts told Insider. Economists say a consumer debt crisis is unlikely, unless the US tips into a steep recession. Loading Something is loading. Thanks for signing up! Access your favorite topics… Continue reading America’s $1 trillion credit card bill really isn’t as bad as it seems

A teacher-turned-entrepreneur shares the ‘brilliantly simple’ business book that helped her buy a local bookstore and make it profitable

After a decade of teaching, Adah Fitzgerald bought a small-town bookstore in Davidson, North Carolina. Her top business book recommendation is Michael Gerber’s “The E-Myth.” It’s a nuts-and-bolts business book that helped her take her small business from break-even to profitable. Adah Fitzgerald grew up in a family of readers and surrounded by books, so… Continue reading A teacher-turned-entrepreneur shares the ‘brilliantly simple’ business book that helped her buy a local bookstore and make it profitable

US commercial-property concerns keep mounting – experts warn of ‘massive’ debt refinancing risk and an economic ‘doom loop’

Concerns about the US commercial-property market are mounting as experts warn of worse times ahead. Mohamed El-Erian has warned of looming “massive” debt refinancings, while others see the risk of an economic “doom loop.” Here is a selection of the latest expert warnings about the US commercial real-estate market. Loading Something is loading. Thanks for… Continue reading US commercial-property concerns keep mounting – experts warn of ‘massive’ debt refinancing risk and an economic ‘doom loop’

A fund manager at a $250 billion firm that aims to capture megatrends shares the top 10 stocks pulled from its 12 strategies

Gertjan van der Geer says megatrends are shifts that have significant impact and occur over decades. To avoid getting sucked into hype cycles, several megatrends need to converge to create a fund. These are the top 10 stocks across the firm’s 12 thematic funds. Hopping on trends can be fun and even very profitable. This… Continue reading A fund manager at a $250 billion firm that aims to capture megatrends shares the top 10 stocks pulled from its 12 strategies

US debt interest payments are unsustainable and flash ‘huge warning signs’ as they take over federal spending, budget expert warns

The trajectory of US debt interest payments is not sustainable, Maya MacGuineas told Insider. Interest will eclipse defense spending in four years, the Committee for a Responsible Federal Budget president said. By 2051, interest payments will be the single largest federal expenditure, topping Social Security. Loading Something is loading. Thanks for signing up! Access your… Continue reading US debt interest payments are unsustainable and flash ‘huge warning signs’ as they take over federal spending, budget expert warns

Crypto is growing up: Goodbye yacht parties and NFTs, hello regulation and practical tech

The three-day Messari Mainnet conference in New York was less expensive and less fun than it was a year ago. Gone were the Reddit bros and yacht parties, and in their place came suits and talk of regulation. Insider’s Phil Rosen caught up with dozens of attendees and executives at the conference. Loading Something is… Continue reading Crypto is growing up: Goodbye yacht parties and NFTs, hello regulation and practical tech

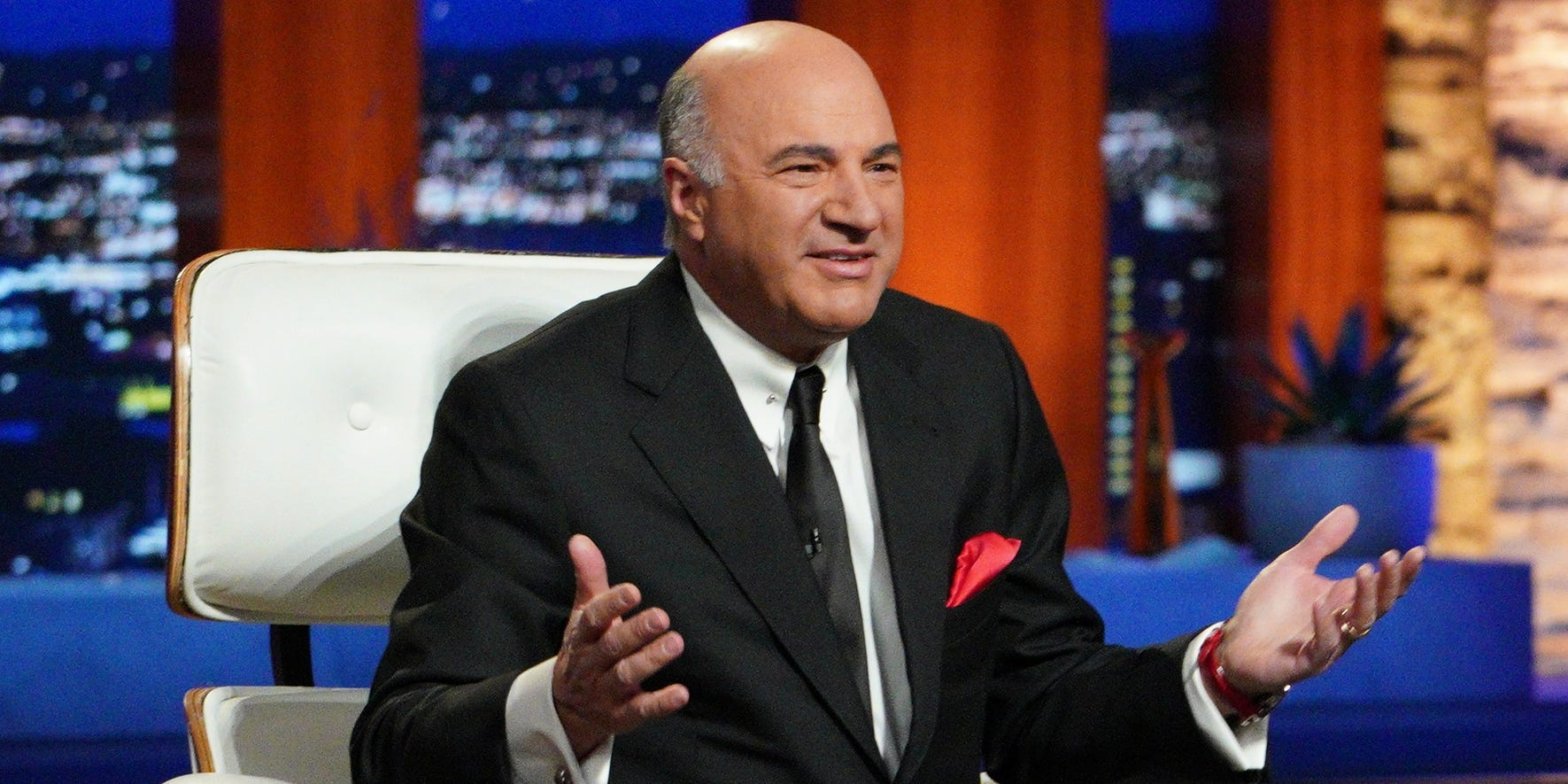

‘Shark Tank’ investor Kevin O’Leary likely made over 20 times his money on a startup selling genetic-testing kits for cats

Kevin O’Leary probably made over 20 times his money from one “Shark Tank” investment. He purchased a small stake in Basepaws, a startup offering at-home genetic testing for cats. Basepaws was acquired for over $50 million by Zoetis last year, netting O’Leary a monster return. Loading Something is loading. Thanks for signing up! Access your… Continue reading ‘Shark Tank’ investor Kevin O’Leary likely made over 20 times his money on a startup selling genetic-testing kits for cats

How two former Goldman Sachs traders built the No. 1 US coal exporting business

Two ex-Goldman bankers have made their fortune betting on a non-renewable resource, Bloomberg reported. Peter Bradley and Spencer Sloan have built a $1 billion commodities firm over the last eight years. Javelin Global Commodities is now the No. 1 US coal exporter despite the environmental concerns associated with the fuel. Loading Something is loading. Thanks… Continue reading How two former Goldman Sachs traders built the No. 1 US coal exporting business