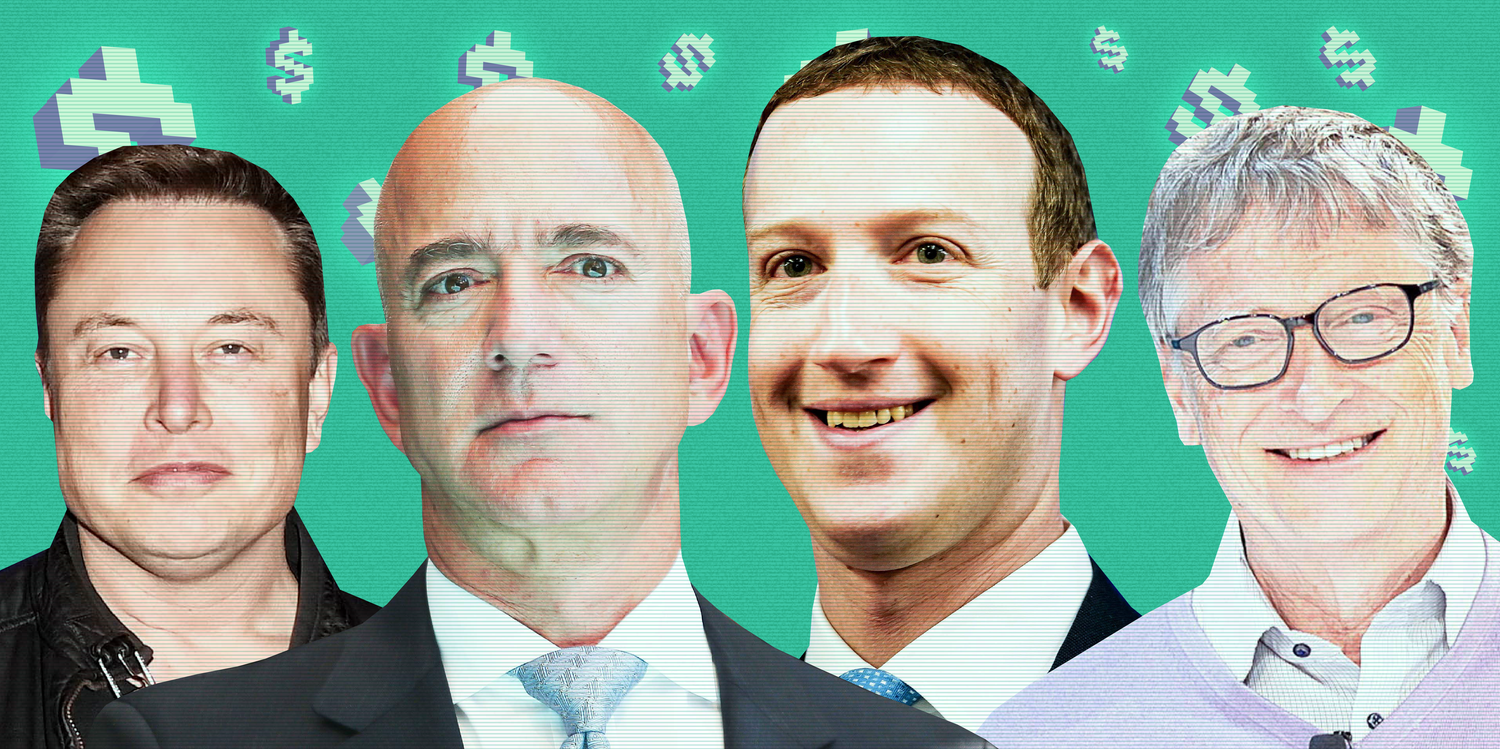

A strong start to the stock market this year has helped reverse some of the big losses billionaires saw in 2022.So far this year, the world’s top 10 billionaires added a collective $213 billion to their net worth.The top billionaires include Bernard Arnault, Elon Musk, Jeff Bezos, Bill Gates, and Warren Buffett. Loading Something is… Continue reading The stock market rally in 2023 has added $213 billion to the wealth of the world’s top 10 billionaires

Howard Marks says rock-bottom rates are history, bitcoin has its uses, and AI won’t replace the best investors. Here are his 8 best quotes from a new interview.

Howard Marks says interest rates won’t return to zero anytime soon. The billionaire investor warns the ballooning US federal debt may cause problems in the future. Marks says AI won’t replace the best investors, and the banking fiasco shone a light on bitcoin. Loading Something is loading. Thanks for signing up! Access your favorite topics… Continue reading Howard Marks says rock-bottom rates are history, bitcoin has its uses, and AI won’t replace the best investors. Here are his 8 best quotes from a new interview.

LinkedIn’s top economist explains the AI trend that could mark a tipping point – and the under-the-radar labor market shifts unfolding now

In an interview with Insider, LinkedIn’s head of macroeconomics broke down labor market trends and AI. LinkedIn data shows the number of jobs on the site mentioning ChatGPT jumped by 51% from 2021 to 2022. AI’s impact is in its early days, he said, but once non-tech firms start using it, the productivity jump could… Continue reading LinkedIn’s top economist explains the AI trend that could mark a tipping point – and the under-the-radar labor market shifts unfolding now

20 stocks expected to outperform the market, including one by 2,637%, according to a fintech company that tracks Wall Street’s top analysts’ price targets

The S&P 500 could see a steeper downturn for the remainder of the year. This could mean a micro-driven market of stock pickers will outperform the broad market. Below is a list of 20 stocks with high upside compiled by TipRanks, a data-driven financial company. US stocks may have an ugly year ahead, says popular… Continue reading 20 stocks expected to outperform the market, including one by 2,637%, according to a fintech company that tracks Wall Street’s top analysts’ price targets

US stocks fall as investors weigh strong bank earnings against weak retail sales data

Matthew Fox Lucas Jackson/Reuters US stocks moved lower on Friday as investors weighed solid bank earnings against weak retail sales data.JPMorgan, Wells Fargo, and Citigroup all posted better-than-feared earnings that indicated a resilient economy.But retail sales dropped 1% in March as consumers scaled back big-ticket purchases. Loading Something is loading. Thanks for signing up! Access… Continue reading US stocks fall as investors weigh strong bank earnings against weak retail sales data

Markets are growing nervous over the prospect of a US default as debt ceiling deadline looms

Investors are getting nervous that the US could default on its debt. Demand for debt insurance has skyrocketed, while demand for US Treasury bills has fallen off, the FT reported. The US could fail to meet its obligations as soon as July this year, the Congressional Budget Office warned. Loading Something is loading. Thanks for… Continue reading Markets are growing nervous over the prospect of a US default as debt ceiling deadline looms

Retail investors are sitting on big losses in their stock portfolios even as the market rallies in 2023

The average retail investor portfolio is down 27% year-to-date, per VandaTrack. US stocks have been surprisingly resilient in 2023 despite looming recession fears and bank chaos. “Growing recession risks could become a stronger headwind holding retail animal spirits at bay.” Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized… Continue reading Retail investors are sitting on big losses in their stock portfolios even as the market rallies in 2023

Demolish office buildings because demand isn’t coming back, hedge fund manager says

Office buildings should be torn down as demand isn’t going to bounce back, Kyle Bass said. Converting office space to apartments isn’t practical either, he told Bloomberg. “It’s one asset class that just has to get redone, and redone meaning demolished,” Bass said. Loading Something is loading. Thanks for signing up! Access your favorite topics… Continue reading Demolish office buildings because demand isn’t coming back, hedge fund manager says