Jennifer Sor Traders work on the floor of the New York Stock Exchange (NYSE) in New York City, New York, U.S., March 10, 2020. Andrew Kelly/Reuters US stocks jumped on Friday, ending the first quarter on a positive note. A key price gauge showed continued signs that inflation is cooling off. The S&P 500 and… Continue reading Dow jumps 400 points to end tumultuous first quarter as markets move on from bank crisis

Markets are headed for a rally right before a recession ‘pounds away at the economy,’ JPMorgan Asset Management CIO says

JPMorgan Asset Management CIO says markets are headed for a “feel good period” before an economic slowdown. Investors should not lean into the fleeting rally next quarter amid a looming recession, JPMorgan’s Bob Michele says. “If we’ve been taught anything this past month, you may see it coming or you may not.” Loading Something is… Continue reading Markets are headed for a rally right before a recession ‘pounds away at the economy,’ JPMorgan Asset Management CIO says

There’s a simple reason why it’s very likely that the stock market bottomed in October

The stock market’s October low likely represented the bottom of the bear market, according to Fundstrat.That’s because 50% of bear markets since 1950 have bottomed in the month of October.”Is it really far-fetched to think markets bottomed [on] October 12? History would suggest it makes sense,” Fundstrat said. Loading Something is loading. Thanks for signing… Continue reading There’s a simple reason why it’s very likely that the stock market bottomed in October

Block gave a ‘robust’ response to brutal short-seller report, and shares of the CashApp parent are looking at 40% upside, Bank of America says

Shares of Block could rise 40% from recent levels, Bank of America said Friday. Block gave a “robust” response to Hindenburg Research’s report raising fraud concerns at the Cash App parent. BofA has a $96 price target on Block and backed its buy rating. Loading Something is loading. Thanks for signing up! Access your favorite… Continue reading Block gave a ‘robust’ response to brutal short-seller report, and shares of the CashApp parent are looking at 40% upside, Bank of America says

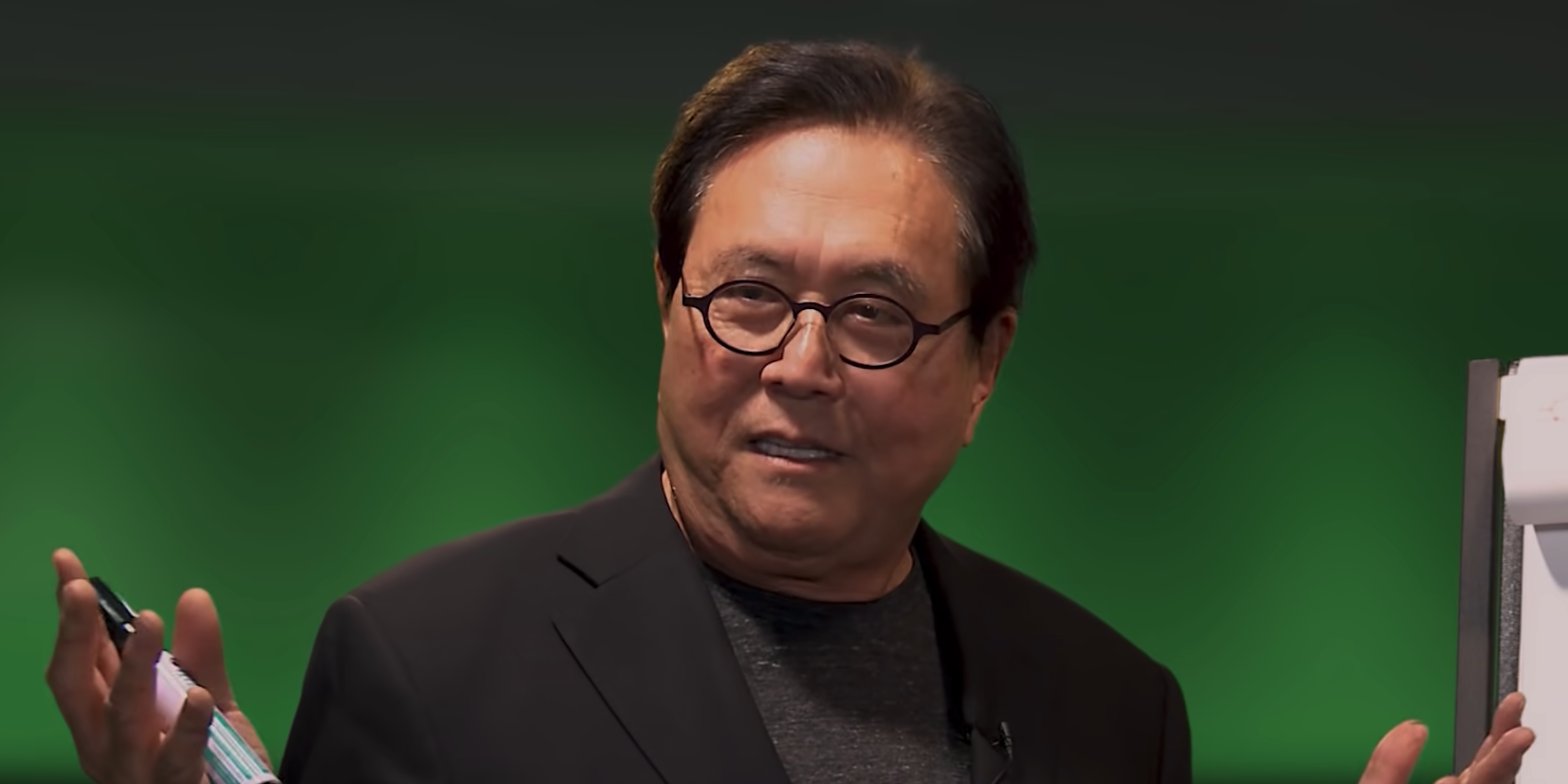

‘Rich Dad Poor Dad’ author Robert Kiyosaki warns the next chapter of the bank crisis will impact on one of the world’s key central banks

The next chapter of the banking crisis will involve the Bank of Japan, according to Robert Kiyosaki. The “Rich Dad Poor Dad” author said the bank’s exposure to derivatives markets is a large risk. Kiyosaki has been bearish for years, predicting the market to crash under the weight of high inflation. Loading Something is loading.… Continue reading ‘Rich Dad Poor Dad’ author Robert Kiyosaki warns the next chapter of the bank crisis will impact on one of the world’s key central banks

US stocks jump as traders put bank crisis behind them and brace for more inflation data

Morgan Chittum Traders on the floor of the New York Stock Exchange (NYSE) Spencer Platt/Getty Images US stocks marched higher on hopes that global banking turmoil has finally settled. The S&P 500 notched gains on Thursday, hitting a three-week high intraday. Investors are looking toward personal consumption expenditures data on Friday for a gauge on… Continue reading US stocks jump as traders put bank crisis behind them and brace for more inflation data

First Citizens Bank, the buyer of SVB’s assets, is run by a billionaire North Carolina family that’s bought over 20 failed banks since 2008

First Citizens Bank, the company that bought the assets of SVB, is run by a family with a wealth of experience buying failed banks. Forbes looked at the billionaire family that’s guided First Citizens’ purchase of more than 20 small banks since 2008. First Citizens will be among the largest 20 banks in the US… Continue reading First Citizens Bank, the buyer of SVB’s assets, is run by a billionaire North Carolina family that’s bought over 20 failed banks since 2008

The bank failures have opened up Pandora’s box, and the huge hole in banks’ balance sheets isn’t going away, strategist says

The recent banking failures have opened up a Pandora’s box, TD strategist Priya Misra warned. The gaping hole in banks’ balance sheets will remain even as volatility fades, she said. That’s putting the US at greater risk for a downturn, which could weigh on equities. Loading Something is loading. Thanks for signing up! Access your… Continue reading The bank failures have opened up Pandora’s box, and the huge hole in banks’ balance sheets isn’t going away, strategist says