JPMorgan CEO Jamie Dimon said the Russia-Ukraine war is the top risk to the global economy. In his view, the conflict in Ukraine represents the biggest geopolitical threat since World War II. He also told Bloomberg that it’s possible the US economy avoids a recession. Loading Something is loading. Thanks for signing up! Access your… Continue reading JPMorgan CEO Jamie Dimon says that the US can still avoid a recession and that the Russia-Ukraine war is the biggest geopolitical threat since World War II

Legendary investor Bill Ackman made billions as COVID struck by dusting off a 2008-crisis-era playbook

Bill Ackman netted billions wagering on something the market thought was a long shot. Ackman used a tool that helped fund managers during the 2008 crisis make billions betting against the housing market. Excerpts from a new book published in Vanity Fair detail how Ackman hit it big betting on an economic cataclysm. Loading Something… Continue reading Legendary investor Bill Ackman made billions as COVID struck by dusting off a 2008-crisis-era playbook

Short-term cash is back in style with yields sizzling around 5%, but watch out for a Fed policy U-turn, says investment strategist

“Boring” money markets funds are in style with short-term bond yields up, said SoFi’s Liz Young. Yields are in the 5% range as investors see the Fed potentially driving up its key rate higher. Young said if the Fed were to swing back to rate cuts, watch out for falling yields. Loading Something is loading.… Continue reading Short-term cash is back in style with yields sizzling around 5%, but watch out for a Fed policy U-turn, says investment strategist

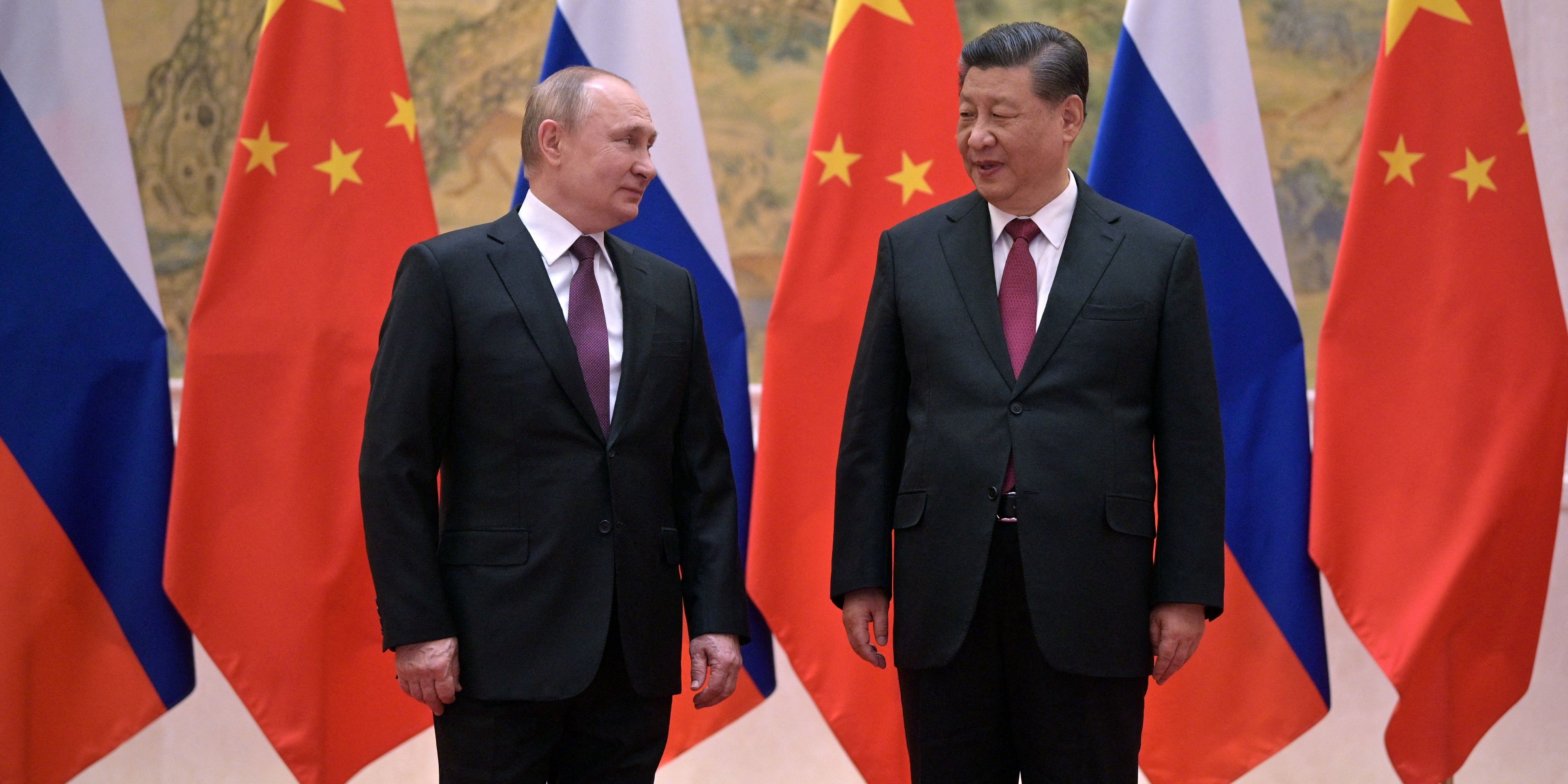

Here’s why experts say Russia and China’s attempts to ‘de-dollarize’ global markets are going nowhere

Plans by Russia and China to challenge the dollar on the world stage are going nowhere, experts say. Russia’s fragile economy and China’s capital controls make both their currencies less appealing. It’ll take a long time for any significant challenge to be mounted against the US dollar, sources told Insider. Loading Something is loading. Thanks… Continue reading Here’s why experts say Russia and China’s attempts to ‘de-dollarize’ global markets are going nowhere

How to invest in the ChatGPT-driven AI boom: Credit Suisse shares 6 stocks they’re labeling as “top picks” as their exposure to AI development opens them up to new revenue streams

ChatGPT has stirred interest in the artificial intelligence space. Now other industry players are throwing their hat in the ring. On Thursday, Credit Suisse highlighted who they think will be winners in the space. Since ChatGPT launched late last year, interest around artificial intelligence and its potential impact on society has steadily grown. Speculation on which… Continue reading How to invest in the ChatGPT-driven AI boom: Credit Suisse shares 6 stocks they’re labeling as “top picks” as their exposure to AI development opens them up to new revenue streams

Bed Bath & Beyond’s stock has crashed to earth after a rollercoaster ride that defied gravity. Here’s a timeline of its chaotic journey, fueled by meme-stock craze and mounting debt.

Bed Bath & Beyond’s stock has been on a rocky ride in the past two years – and now the retailer is on the verge of bankruptcy. The company’s shares have plunged about 91% since early 2021 when it surged amid the meme-stock frenzy. Here’s a timeline of the key events that fueled Bed Bath… Continue reading Bed Bath & Beyond’s stock has crashed to earth after a rollercoaster ride that defied gravity. Here’s a timeline of its chaotic journey, fueled by meme-stock craze and mounting debt.

‘All these tiny ticking time bombs’ are threatening the market, and the coming week could deliver a big shock, trading legend Art Cashin says

Investors aren’t paying enough attention to the risk of quantitative easing, Art Cashin told CNBC. While markets are focused on benchmark rates, the Fed has been slowly shrinking its balance sheet. Meanwhile, the Bank of Japan could signal a big shift soon that would also send yields higher. Loading Something is loading. Thanks for signing… Continue reading ‘All these tiny ticking time bombs’ are threatening the market, and the coming week could deliver a big shock, trading legend Art Cashin says

David Einhorn’s hedge fund crushed the S&P 500 last year. These are the 3 stocks he’s counting on for continued outperformance.

David Einhorn’s hedge fund crushed the stock market last year, returning 37% compared to the S&P 500’s loss of almost 20%.Greenlight Capital found success in shorting speculative tech stocks and owning value-oriented companies last year.These are three stocks Einhorn is bullish on as he seeks to continue his outperformance in 2023. Loading Something is loading.… Continue reading David Einhorn’s hedge fund crushed the S&P 500 last year. These are the 3 stocks he’s counting on for continued outperformance.