Tesla stock is on pace for its worst year on record as trading in 2022 comes to a close. Shares have lost about 65% from the start of the year. CEO Elon Musk has faced pressure from investors over his preoccupation with Twitter. Loading Something is loading. Thanks for signing up! Access your favorite topics… Continue reading Tesla stock to close out worst year ever with a 65% loss in 2022, wiping out more than $700 billion in market cap

US stocks fall in last trading day of the year, capping worst performance since 2008

Matthew Fox A trader works during the Fed rate announcement on the floor at the New York Stock Exchange (NYSE) in New York, U.S., March 20, 2019. Reuters/Brendan McDermid US stocks moved lower on the last trading day of 2022, ending what has been a tough year for investors.Indexes are poised to close out their… Continue reading US stocks fall in last trading day of the year, capping worst performance since 2008

Warren Buffett has surpassed Jeff Bezos in wealth — and threatens to oust Bill Gates as the 2nd-richest American after Elon Musk

Warren Buffett this year has surpassed Jeff Bezos in wealth and closed in on Bill Gates. Overtaking Gates would make Buffett the second-richest American, after Elon Musk. Berkshire Hathaway stock rose this year, while Microsoft, Amazon, and Tesla shares plunged. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized… Continue reading Warren Buffett has surpassed Jeff Bezos in wealth — and threatens to oust Bill Gates as the 2nd-richest American after Elon Musk

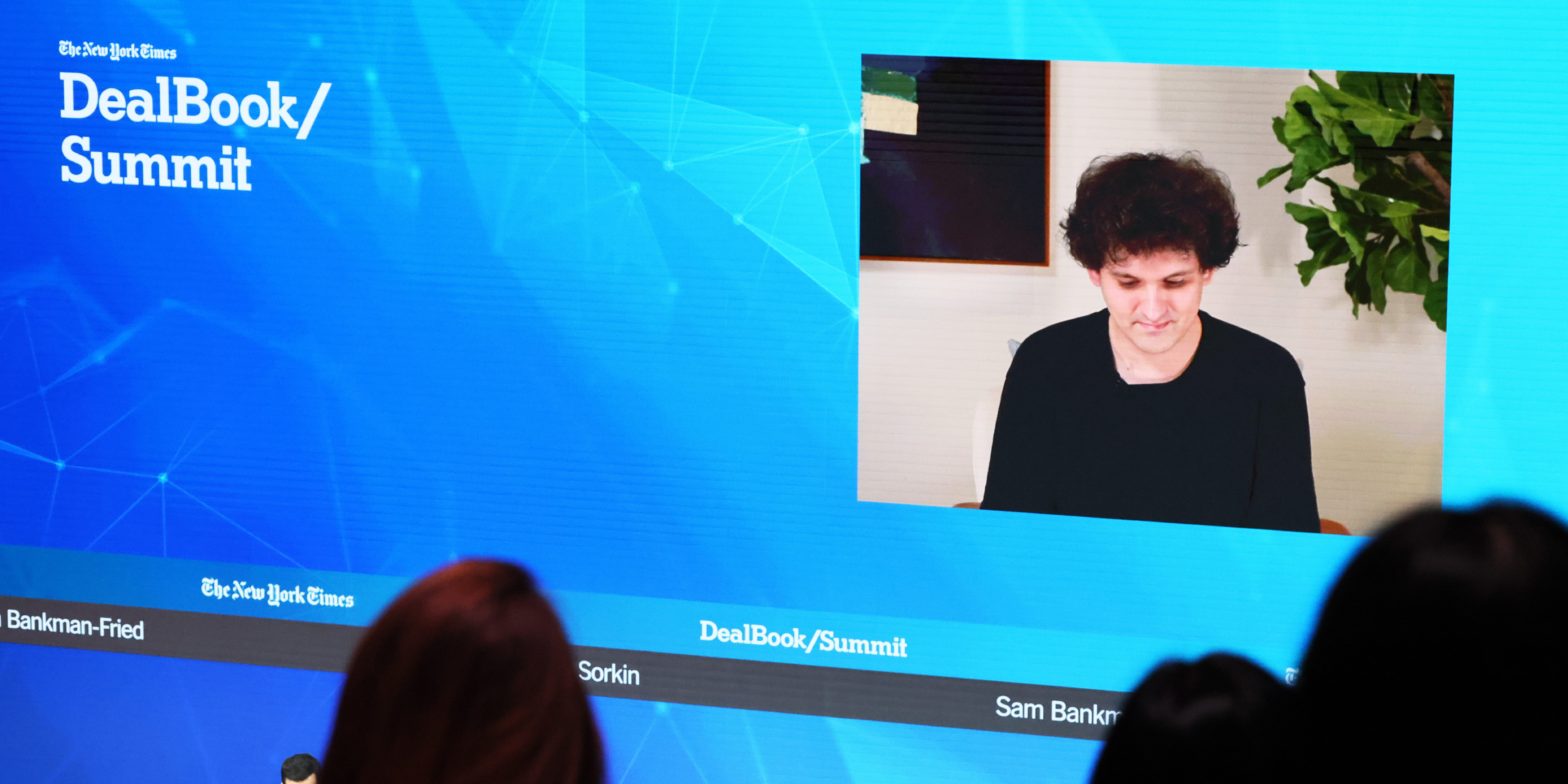

Inside the relationship between Sam Bankman-Fried’s FTX and Solana, the blockchain he championed whose token is down 96% from its highs

Sam Bankman-Fried was a big supporter of Solana, the layer-1 blockchain that bills itself as a faster alternative to Ethereum’s network. He backed projects on its ecosystem, and his firms amassed huge sums of the blockchain’s native token, also called Solana (SOL). The altcoin has crashed 96% from its record high in November 2021, wiping… Continue reading Inside the relationship between Sam Bankman-Fried’s FTX and Solana, the blockchain he championed whose token is down 96% from its highs

Investor sentiment is worse than it was at the depths of the Great Financial Crisis in 2008 – but that suggests a stock market bottom is near, Fundstrat says

Investor sentiment is worse than it was at the depths of the 2008 Great Financial Crisis, according to Fundstrat.But stock market conditions today are not as bad as they were in 2008, suggesting a bottom is near.”The key to 2023 will be to focus on … how things can change rather than … what has… Continue reading Investor sentiment is worse than it was at the depths of the Great Financial Crisis in 2008 – but that suggests a stock market bottom is near, Fundstrat says

Sam Bankman-Fried’s Alameda Research sells $1.7 million in crypto amid bankruptcy and still holds over $112 million in tokens

Alameda Research liquidated $1.7 million worth of cryptocurrencies over the past 24 hours. Data showed that wallets associated with Alameda unloaded Ethereum-based tokens, which were later swapped for bitcoin. The sales come amid bankruptcy proceedings for Sam Bankman-Fried’s crypto empire. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized… Continue reading Sam Bankman-Fried’s Alameda Research sells $1.7 million in crypto amid bankruptcy and still holds over $112 million in tokens

US stocks climb as an increase in jobless claims could signal more relief from Fed rate hikes

Phil Rosen REUTERS/Brendan McDermid US stocks climbed Thursday after tech stocks saw a broad sell off the session prior. The Labor Department reported an increase in jobless claims week-over-week. Each of the three major indexes are still on track for the worst year since 2008. Loading Something is loading. Thanks for signing up! Access your… Continue reading US stocks climb as an increase in jobless claims could signal more relief from Fed rate hikes

Just 5 trading days accounted for 94% of the S&P 500’s decline in 2022 – and they could signal what’s to come in 2023, DataTrek says

Just five trading days in 2022 are responsible for 94% of the S&P 500’s year-to-date decline of 21%. Those days revolve around concerns about inflation, corporate earnings, and the Fed. “This framework of ‘a handful of days make the year’ is also a good one with which to consider 2023,” DataTrek said. Loading Something is… Continue reading Just 5 trading days accounted for 94% of the S&P 500’s decline in 2022 – and they could signal what’s to come in 2023, DataTrek says