One of Wall Street’s biggest bulls is getting less bullish on stocks, according to a Monday note.JPMorgan’s Marko Kolanovic trimmed his overweight exposure to equities due to the rising risk of a Fed policy error.”The increasingly hawkish rhetoric from central banks, and escalation of the war in Ukraine are likely to delay the economic and… Continue reading JPMorgan’s Marko Kolanovic recommends trimming exposure to stocks as risk of a hawkish policy error by the Fed rises

CHESAPEAKE ENERGY CORPORATION PROVIDES 2022 THIRD QUARTER EARNINGS CONFERENCE CALL INFORMATION

, /PRNewswire/ — Chesapeake Energy Corporation (NASDAQ: CHK) today announced that it will release its 2022 third quarter operational and financial results after market close on Tuesday, November 1, 2022. A conference call to discuss the results has been scheduled on Wednesday, November 2, 2022 at 9:00 am EDT. The telephone number to access the… Continue reading CHESAPEAKE ENERGY CORPORATION PROVIDES 2022 THIRD QUARTER EARNINGS CONFERENCE CALL INFORMATION

Dow soars 550 points in big relief rally as investors weigh key earnings reports

Jennifer Sor Photo by Spencer Platt/Getty Images US stocks soared on Monday in a relief rally as investors await a slew of high-profile earnings reports. The Dow jumped 550 points, and the Nasdaq Composite rose more than 3%. Goldman Sachs warned stocks are still to expensive, even after a 25% drop in the S&P 500… Continue reading Dow soars 550 points in big relief rally as investors weigh key earnings reports

Sakhalin oil project hints at the potential collapse of Russian output when new EU sanctions take effect

The Sakhalin-1 project saw production tumble after Exxon refused to accept local insurance for tankers, sourced told Reuters. Western firms stopped insuring tankers operated by state-run Sovcomflot after Russia invaded Ukraine. The EU’s next round of sanctions against Moscow will include a broader ban on Russian oil tanker insurance, among other energy-related services. Loading Something… Continue reading Sakhalin oil project hints at the potential collapse of Russian output when new EU sanctions take effect

Investing legend Mark Mobius sees interest rates climbing to 9% as the Fed battles against scorching inflation

Interest rates could hit 9% as part of the Federal Reserve’s efforts to bring down inflation, Mark Mobius told Bloomberg TV. if inflation is 8%, “the playbook says you’ve got to raise rates higher than inflation,” he said. Investors are pricing in expectations for the fed funds rate to reach 5% in 2023. Loading Something… Continue reading Investing legend Mark Mobius sees interest rates climbing to 9% as the Fed battles against scorching inflation

Wall Street strategists are throwing in the towel and cutting their S&P 500 price targets. That’s often a good sign for the stock market.

More and more Wall Street strategists are throwing in the towel and cutting their year-end price target.JPMorgan, Oppenheimer, and BMO are the latest Wall Street bulls to lower their expectations.Wall Street strategists getting less bullish on the stock market has served as a contrarian buy signal in the past. Loading Something is loading. Thanks for… Continue reading Wall Street strategists are throwing in the towel and cutting their S&P 500 price targets. That’s often a good sign for the stock market.

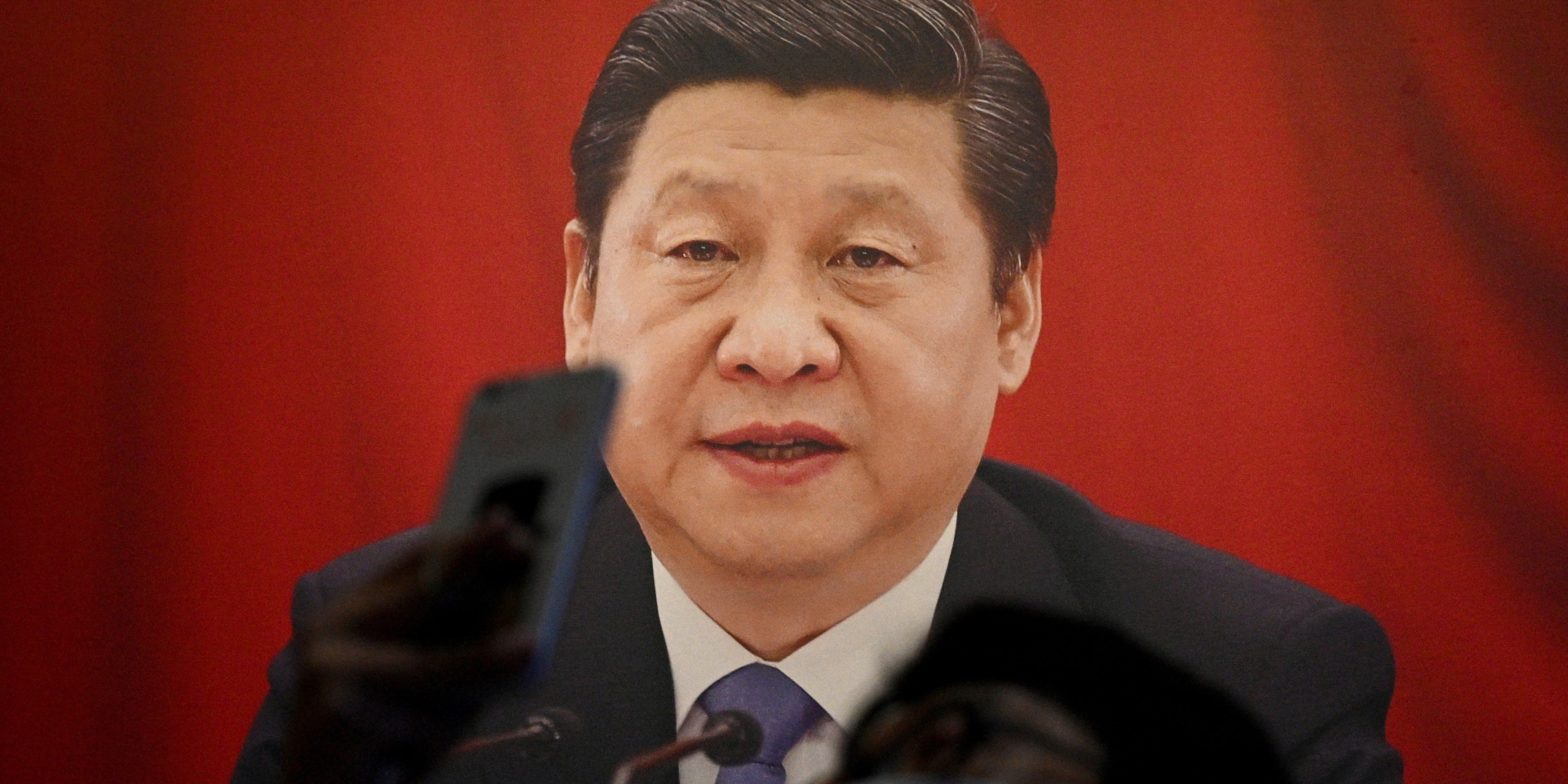

China is facing a full-blown debt crisis with $8 trillion at risk as Xi Jinping eyes an unprecedented 3rd term

China’s mounting local government debt is already a crisis, experts say, with nearly $8 trillion at risk. Bonds issued by local government financing vehicles are on the verge of default amid a broader property market crash. The grim financial picture comes as Xi Jinping seeks an unprecedented third term as China’s leader. Loading Something is… Continue reading China is facing a full-blown debt crisis with $8 trillion at risk as Xi Jinping eyes an unprecedented 3rd term

Jamie Dimon’s prediction of a 20% sell-off is too aggressive, but still expect more downside until interest rates peak, Goldman global stock strategist says

Stocks won’t plunge 20% like Jamie Dimon predicted, Goldman Sachs’ global stock strategist told CNBC. That’s because financial conditions like private-sector balance sheets remain strong. But stocks haven’t found a bottom yet, and more downside is to be expected until interest rates or inflation peak, Peter Oppenheimer said. Loading Something is loading. Thanks for signing… Continue reading Jamie Dimon’s prediction of a 20% sell-off is too aggressive, but still expect more downside until interest rates peak, Goldman global stock strategist says