Carla Mozée Grocery shopping in Rosemead, California on April 21, 2022. Frederic J. Brown/AFP/Getty Images US stocks fell Friday, giving up early gains and failing to build on the sharp rally that occurred in the previous session. Inflation expectations among consumers rose for the first time since March, data showed Friday. Top Wall Street banks… Continue reading US stocks fall to cap off rocky week as traders weigh bank earnings and stubbornly high inflation

BMO’s Brian Belski becomes latest bull to cuts his S&P 500 price target after inflation comes in hotter than expected

BMO’s Brian Belski is the last bull to cut his year-end price target for the S&P 500 amid high inflation.Belski now expects the S&P 500 to end 2022 at 4,300, which sets the index up for a year-end rally of 20%.”Although we have tempered our enthusiasm, we truly believe that stocks can and should rebound… Continue reading BMO’s Brian Belski becomes latest bull to cuts his S&P 500 price target after inflation comes in hotter than expected

Elon Musk raises hopes for a Tesla stock buyback with a one-word tweet to 3rd-biggest shareholder

Elon Musk fueled speculation that Tesla could soon announce its first-ever stock buyback. Responding to a tweet from a top Tesla investor who said only a buyback or a doubling in profit could break the stock’s slump, Musk said “Noted.” Leo KoGuan, who says he is the third largest individual Tesla shareholder, has previously called for… Continue reading Elon Musk raises hopes for a Tesla stock buyback with a one-word tweet to 3rd-biggest shareholder

Stocks have further to fall after the market’s ‘bear hug’ rally as the Fed isn’t ready to pivot from its aggressive rate policy, Bank of America says

The Thursday rally in US stocks was a “bear hug” and not yet the start of a sustainable upswing in equities, Bank of America said Friday. The firm said the rally was ignited in a market that’s oversold and where investors are holding high levels of cash. The “Big Low” in the market is coming… Continue reading Stocks have further to fall after the market’s ‘bear hug’ rally as the Fed isn’t ready to pivot from its aggressive rate policy, Bank of America says

Billionaire investor Mark Mobius says stocks could stay buoyant amid Fed rate hikes and a possible recession

History shows that stocks can still make gains amid the Federal Reserve’s rate hikes, Mark Mobius said. The billionaire investor noted that the key is finding companies that have enough pricing power to weather high inflation. “But there’s no question that the Fed could go much much higher, and there could be a lot more… Continue reading Billionaire investor Mark Mobius says stocks could stay buoyant amid Fed rate hikes and a possible recession

US stocks soar over 2% after September’s higher than expected inflation report sparks wild turnaround

Matthew Fox Drew Angerer/Getty Images US stocks surged more than 2% in a wild trading session after September’s CPI report doubled expectations at 0.4% month-over-month.The September inflation report poured cold water on hopes that the Fed will pivot away from its interest rate hikes anytime soon.Fed Fund Futures are now pricing in a 75 basis… Continue reading US stocks soar over 2% after September’s higher than expected inflation report sparks wild turnaround

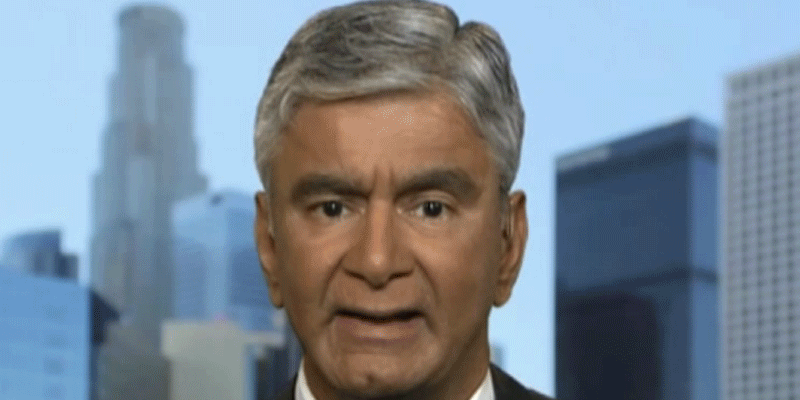

Inflation and bond yields are peaking as demand destruction starts to dominate, economist says

Inflation and bond yields are close to peaking, according to top economist Komal Sri-Kumar. He also told CNBC that he expects a severe recession in the wake of monetary tightening and inflation. “I think we are reaching the point where demand destruction is going to dominate over supply uncertainties, and that’s what is happening.” Loading… Continue reading Inflation and bond yields are peaking as demand destruction starts to dominate, economist says

Wharton professor Jeremy Siegel warns the Fed will drive the economy into a depression if they wait for core inflation to fall back to 2%

Not even September’s stubbornly high CPI report could change Jeremy Siegel’s view that the Fed needs to stop hiking interest rates.Siegel told CNBC on Thursday that the Fed’s focus on lagging indicators is setting the economy up for disaster.”If the Fed waits for the core to get down to 2% year-over-year, it will drive the… Continue reading Wharton professor Jeremy Siegel warns the Fed will drive the economy into a depression if they wait for core inflation to fall back to 2%