Hedge funds have amassed big bets against Italian debt, according to S&P Market Intelligence data. The value of Italian bonds borrowed by investors hit €37.20 billion ($37.30 billion) in late August, and bets had climbed to the highest since the global financial crisis. Italy is facing a national election in September and is dealing with… Continue reading Hedge funds have amassed a $37 billion short bet on Italy’s debt, the biggest since 2008, as the country faces an energy crisis and political uncertainty

Russian oil exports to Asia have fallen by more than 500,000 barrels a day to a 5-month low

Seaborne shipments of Russian oil hit their lowest level since March last week, according to Bloomberg. Flows to Asia are down by about 500,000 barrels per day for the week ending August 26. Half of Russia’s crude exports have been going to customers in Asia since the war in Ukraine began. Loading Something is loading.… Continue reading Russian oil exports to Asia have fallen by more than 500,000 barrels a day to a 5-month low

US stocks drop as bond yields rise amid investor concerns over renewed Fed hawkishness

US stocks ended lower on Monday as investors assessed the Fed’s likely policy path. Fed chair Jerome Powell said on Friday that the central bank’s top priority is taming inflation. Investors are less optimistic toward a Fed pivot even as inflation is showing signs of cooling. Loading Something is loading. US stocks closed lower on… Continue reading US stocks drop as bond yields rise amid investor concerns over renewed Fed hawkishness

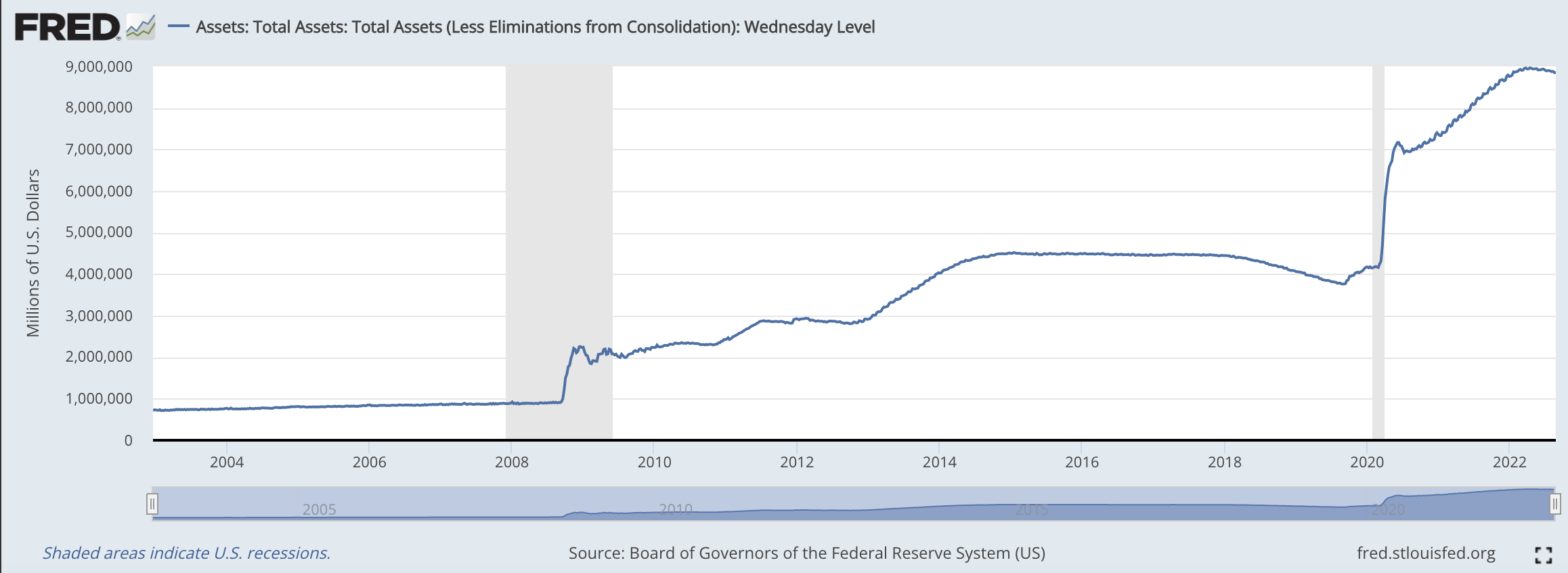

Investors should slash exposure to stocks as the Fed’s balance sheet wind down is about to ramp up alongside further interest rate hikes

The Fed will ramp-up the wind-down of its balance sheet starting in September by $95 billion a month. Investors should consider reducing risk as the wind-down accelerates while interest rates climb, says investment firm Glenmede. The further balance-sheet reduction adds a ‘hard-to-measure’ impact to the stock market. Loading Something is loading. Investors have been focusing… Continue reading Investors should slash exposure to stocks as the Fed’s balance sheet wind down is about to ramp up alongside further interest rate hikes

Digital World Acquisition Corp. extends 4-day decline to 18% as Trump defends Truth Social’s performance and vote looms to delay IPO

Digital World Acquisition Corp. extended its four-day decline to nearly 20% as a vote looms to delay its IPO.The SPAC has agreed to merge with former President Donald Trump’s social media company.Trump defended the recent business performance of Truth Social, saying its business boomed after his Mar-A-Lago home was raided by the FBI. Loading Something… Continue reading Digital World Acquisition Corp. extends 4-day decline to 18% as Trump defends Truth Social’s performance and vote looms to delay IPO

Record prices, dwindling supplies, drought, and policy have sparked a perfect storm for European energy markets with ‘no end in sight’

Europe’s energy crisis is worsening and Bank of America analysts say they see “no end in sight.” Supply constraints, weather, uncertainty from Russia, and Europe’s own policies have made a perfect storm. “This will be a multi-year challenge,” a portfolio manager told Insider. Loading Something is loading. It’s not just Russia’s weaponization of energy that’s… Continue reading Record prices, dwindling supplies, drought, and policy have sparked a perfect storm for European energy markets with ‘no end in sight’

Russia’s central bank says oil production goals proposed by the nation’s finance ministry are too optimistic

Russia’s central bank said that new oil price and production goals proposed by the nation’s finance ministry are too optimistic. In a new budget, the ministry sets the price of Russia’s Urals crude at $60 a barrel and an output of 9.5 million barrels per day. “The base price of oil and oil production seem… Continue reading Russia’s central bank says oil production goals proposed by the nation’s finance ministry are too optimistic

The Fed should go on vacation after this year’s rate hikes to avoid the risk of overdoing its tightening efforts, BlackRock says

The Fed is right to move quickly in raising rates but should pause after this year, BlackRock said Friday. The Fed risks overdoing its tightening and unraveling economic progress since the pandemic. The Fed is expected to raise rates in September by at least 0.5% and as much as 0.75%. Loading Something is loading. BlackRock,… Continue reading The Fed should go on vacation after this year’s rate hikes to avoid the risk of overdoing its tightening efforts, BlackRock says