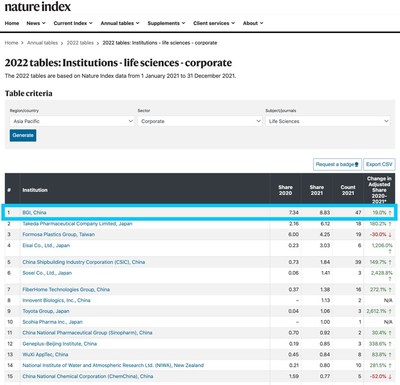

, /PRNewswire/ — BGI has topped the Asia Pacific and China life science corporate institution ranking table for the seventh year running, released in the 2022 Nature Index Annual Tables. With a 19 percent increase in its adjusted share metric, BGI ranked eighth among global life science corporate institutions, which is an improvement over the preceding year’s… Continue reading BGI Ranks No. 1 among APAC and China Life Science Corporations for Seven Consecutive Years: 2022 Nature Index Annual Tables Revealed

Here’s why the stock market is about to kick off a sustained rally into the end of the year, according to JPMorgan

The stock market’s 15% rally off its mid-June low will continue higher into year-end, according to JPMorgan.As earnings revisions reset lower, “risk-reward for equities is not all bad as we move into year-end,” JPMorgan said.The bank said reasonable valuations, depressed investor sentiment, peak Fed hawkishness are all good reasons to stay bullish. Loading Something is… Continue reading Here’s why the stock market is about to kick off a sustained rally into the end of the year, according to JPMorgan

The July jobs report reset the recession clock but 2 warning signs show there are still near-term risks to the stock market

July data showing 528,000 new jobs in the US reset the countdown for a recession, DataTrek said. The rapid growth implies the Fed isn’t done tightening policy yet, and has a way to go still. Despite recalibrating recession risk, there are two near-term warning signs flashing for the stock market. Loading Something is loading. Investors… Continue reading The July jobs report reset the recession clock but 2 warning signs show there are still near-term risks to the stock market

A hot inflation report this week could upset the stock market’s relief rally, even after a strong jobs reported quelled recession fears, Barclays says

The rally in US stocks could lose its footing if the July inflation report unexpectedly shows prices accelerating, Barclays said. The July jobs blowout delivered last week underlined persistent inflation pressures, suggesting the Fed will remain aggressive with rate hikes. The consumer price index report is due Wednesday, and Barclays sees the headline growth rate… Continue reading A hot inflation report this week could upset the stock market’s relief rally, even after a strong jobs reported quelled recession fears, Barclays says

Bitcoin-bull Mike Novogratz’s Galaxy Digital loses $555 million in 2nd quarter amid crypto winter

Galaxy Digital’s net losses deepened to $554.7 million in the second quarter. The losses are more than triple those of last year for the same time period. The financial services company cited the broad crypto downturn as the main reason for its downbeat earnings report. Loading Something is loading. Galaxy Digital reported a $554.7 million… Continue reading Bitcoin-bull Mike Novogratz’s Galaxy Digital loses $555 million in 2nd quarter amid crypto winter

The investment strategist that nailed the stock market bottom in June says risks are skewed to the downside as investors fight the Fed

The investment strategist that nailed the stock market bottom in mid-June sees reason for turning cautious. Truist co-CIO Keith Lerner told Insider that risks are skewed to the downside as the S&P 500 runs into technical resistance.”What’s holding us back is central bank tightening and that valuations are not that compelling,” Lerner said. Loading Something is… Continue reading The investment strategist that nailed the stock market bottom in June says risks are skewed to the downside as investors fight the Fed

The labor market today is hotter than during the 2008 financial crisis but Fed tightening will weaken it, Bank of America says

Current labor market conditions are consistent with historically tight labor markets, Bank of America said in a note. But the labor market has deteriorated slightly, signaling downside ahead for the economy, BofA said. The Fed’s tightening cycle will weaken the labor market, making it hard to achieve a soft landing, analysts added. Loading Something is… Continue reading The labor market today is hotter than during the 2008 financial crisis but Fed tightening will weaken it, Bank of America says

Corporate America’s ‘greedflation’ window of opportunity is closing as consumers tighten their purse strings – and the markets will feel the pinch, experts say

An window of opportunity for companies to boost profits thanks to inflation is shrinking, experts say. Consumers are likely to spend less moving forward, potentially stamping out “greedflation.” Other experts say companies won’t be able to absorb higher input costs and thereby inflate prices. Loading Something is loading. Inflation has been the bane of Americans’… Continue reading Corporate America’s ‘greedflation’ window of opportunity is closing as consumers tighten their purse strings – and the markets will feel the pinch, experts say