US stocks closed mixed Monday as investors look ahead to major earnings reports later this week including those from Microsoft and Apple. The Fed is widely expected to announced a 75-basis-point rate hike on Wednesday. Fresh GDP data is also due this week, with many commentators warning of a technical recession. Loading Something is loading.… Continue reading US stocks trade mixed as Big Tech earnings to kick off while Fed readies next rate hike

The stock market will be rocked lower this week as mega-cap tech firms like Apple, Amazon and Microsoft report earnings, Fairlead Strategies says

The stock market is setup to be rocked lower this week after mega-cap tech firms report earnings, according to Fairlead Strategies.Apple, Amazon, Alphabet, Microsoft, and Meta Platforms are scheduled to report second-quarter earnings this week.”We expect these heavyweights to contribute to downside volatility this week, noting their rallies off the June low have faltered or… Continue reading The stock market will be rocked lower this week as mega-cap tech firms like Apple, Amazon and Microsoft report earnings, Fairlead Strategies says

Nouriel Roubini says predictions for a mild recession are ‘delusional’ as severe financial crisis looms

Hopes for a mild recession are “delusional,” said Nouriel Roubini, the economist who called the 2008 financial crisis. He said debt ratios are historically high, while bailouts during the pandemic have resulted in “zombie corporations.” It runs contrary to what Wall Street banks like Goldman Sachs have been saying about the economy. Loading Something is… Continue reading Nouriel Roubini says predictions for a mild recession are ‘delusional’ as severe financial crisis looms

Crexi Announces Eli Randel as Chief Operating Officer and Shannon Garner as the First Ever Chief People Officer

Randel and Garner’s announcements coincide with Crexi’s move into new headquarters in Playa Vista, CA , /PRNewswire/ — Today, Crexi, the commercial real estate industry’s fastest-growing marketplace and data platform, announced the promotion of Eli Randel to Chief Operating Officer (COO) and Shannon Garner as the first ever Chief People and Culture Officer. Randel, formerly… Continue reading Crexi Announces Eli Randel as Chief Operating Officer and Shannon Garner as the First Ever Chief People Officer

Russia’s Gazprom cuts Nord Stream gas flows to just 20% – less than a week after restarting the pipeline

Russia’s state-run energy giant is cutting flows again, just days after resuming deliveries. Gazprom said it will slash gas flows via the Nord Stream pipeline to 20% starting Wednesday. Natural gas futures in Europe jumped as much as 10% on the news. Loading Something is loading. Russia’s state-run energy giant will cut natural gas flows… Continue reading Russia’s Gazprom cuts Nord Stream gas flows to just 20% – less than a week after restarting the pipeline

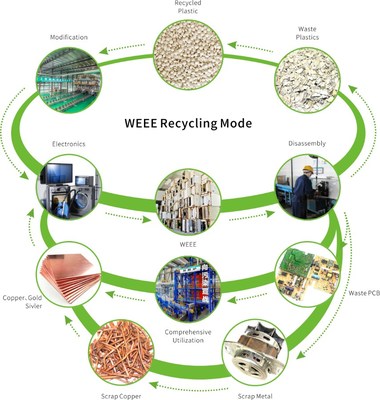

GEM – the global urban mines leader and new energy materials promoter

GEM, as a key company in the first batch of Chinese leading green enterprises planning to list on the Swiss Stock Exchange, has attracted global capital markets and industry attention. , /PRNewswire/ — GEM was founded in China twenty years ago. The founder of the company has a green dream, is dedicated to the world’s… Continue reading GEM – the global urban mines leader and new energy materials promoter

Why the dollar has outperformed gold in its traditional role as an inflation hedge and recession haven

Gold has traditionally been seen as an inflation hedge and a haven during times of economic uncertainty. But despite high inflation and growing fears of a recession, gold has fallen 15% since early March and is down 5% year to date. Meanwhile, the US dollar index has jumped 9% since March and is up 11%… Continue reading Why the dollar has outperformed gold in its traditional role as an inflation hedge and recession haven

A new bull market in stocks won’t get the green light until these 3 things happen, Bank of America says

The start of a new bull market in stocks will require three catalysts, according to Bank of America.While there’s limited upside in the short-term because of depressed sentiment, sell the S&P 500 at 4,200, BofA said.”Don’t think Wall St unwinds financial excesses of past 13 years with a 6-month garden variety bear market,” BofA said.… Continue reading A new bull market in stocks won’t get the green light until these 3 things happen, Bank of America says