From oil to metals to wheat, prices for natural resources have slumped from this year’s highs and the fast deceleration will likely lead what’s been a hot inflationary environment into a deflationary period in the coming months. That’s the view from Societe Generale’s co-head of global strategy Albert Edwards who in a note published Thursday… Continue reading Commodity prices from copper to wheat are collapsing – and that could flip global inflation into deflation, says SocGen

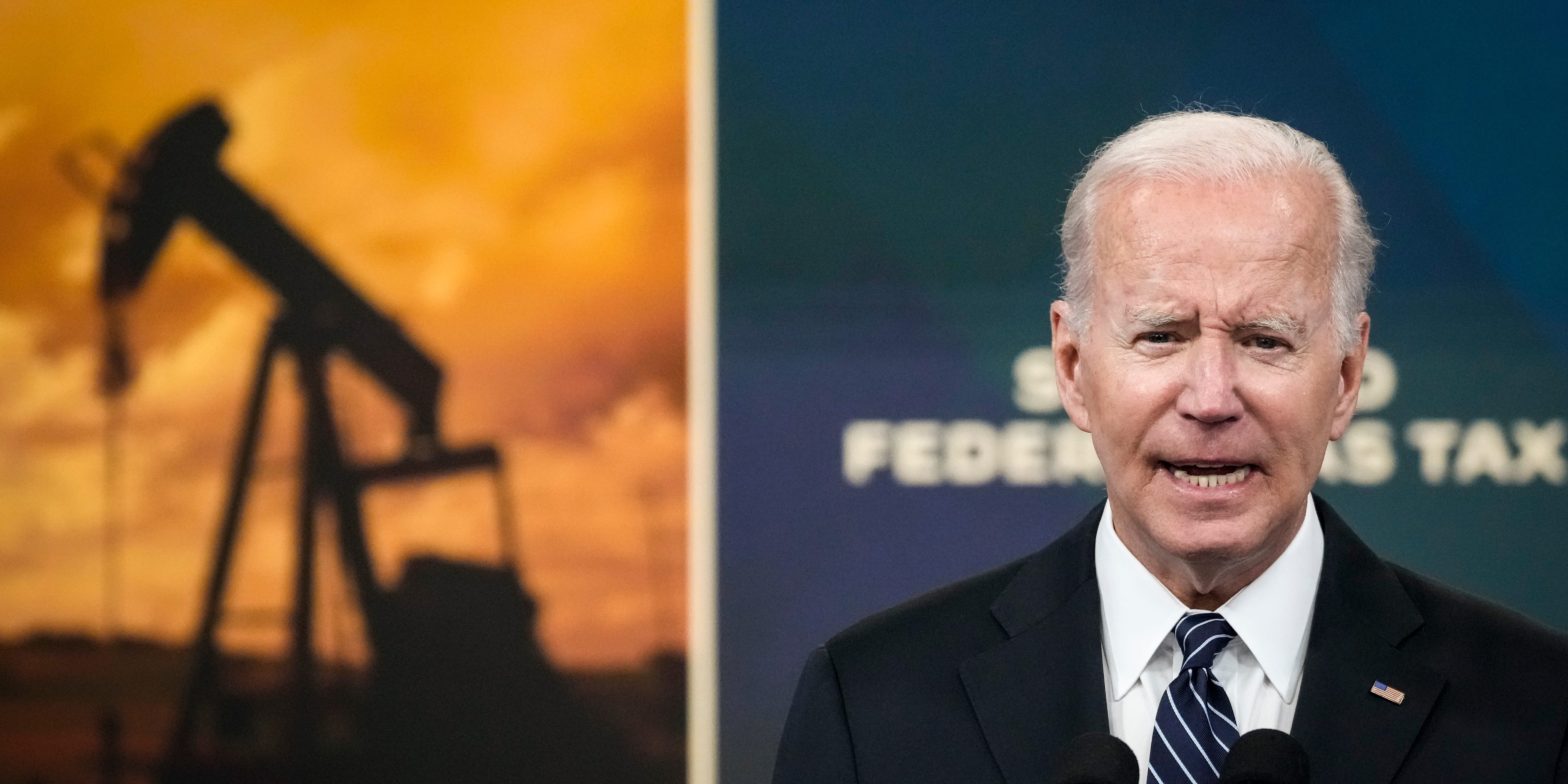

Here’s why tapping the US oil reserve has led to America increasing crude exports – and why even more US energy supplies could be shipped overseas

Since President Joe Biden announced the release of oil from the Strategic Petroleum Reserve to try to tame high gasoline prices, the US has sent more crude to other countries. US supply is expected to hit 13 million barrels per day this summer for the first time since November 2019, according to Rystad Energy. Meanwhile,… Continue reading Here’s why tapping the US oil reserve has led to America increasing crude exports – and why even more US energy supplies could be shipped overseas

Tech giants like Meta and Snap are facing a ‘perfect storm’ of weak growth prospects that could lead to limited upside for stocks already down more than 50% this year

Even after a more than 50% year-to-date decline, the going could get even tougher for digital advertising platforms like Meta, Snap, and YouTube, according to a note from Barclays. The Wall Street firm said “a perfect storm” has arrived for the digital advertising space that could translate into limited upside for the companies impacted in… Continue reading Tech giants like Meta and Snap are facing a ‘perfect storm’ of weak growth prospects that could lead to limited upside for stocks already down more than 50% this year

Commodity prices from copper to wheat are collapsing and that could flip global inflation into deflation, says Societe Generale

From oil to metals to wheat, prices for natural resources have slumped from this year’s highs and the fast deceleration will likely lead what’s been a hot inflationary environment into a deflationary period in the coming months. That’s the view from Societe Generale’s co-head of global strategy Albert Edwards who in a note published Thursday… Continue reading Commodity prices from copper to wheat are collapsing and that could flip global inflation into deflation, says Societe Generale

‘Big Short’ investor Michael Burry, Cathie Wood, and Paul Krugman aren’t stressing about inflation. Here’s why 5 elite market-watchers expect prices to rise slower or even fall.

Theron Mohamed Michael Burry. Jim Spellman/Getty Images Several top-flight investors and commentators were sounding the alarm on high, prolonged inflation only a few weeks ago. Now, some elite market-watchers are predicting prices will rise more slowly in the coming months, and deflation could become the bigger risk. Michael Burry, Cathie Wood, Paul Krugman, Jeremy Siegel,… Continue reading ‘Big Short’ investor Michael Burry, Cathie Wood, and Paul Krugman aren’t stressing about inflation. Here’s why 5 elite market-watchers expect prices to rise slower or even fall.

Goldman Sachs: Buy these 50 stocks with strong dividend growth as recession risk looms after the worst start to the year for the stock market in over five decades

Stocks had their worst first half in more than five decades, and even the top sectors are weakening. Dividend stocks should perform well regardless of the economic environment. Here are 50 stocks that Goldman Sachs noted have high dividend yields and growth. The S&P 500 got off to its worst start to the year since… Continue reading Goldman Sachs: Buy these 50 stocks with strong dividend growth as recession risk looms after the worst start to the year for the stock market in over five decades

Job growth is set to slow and the Fed may regret hiking rates too aggressively going into 2023, JPMorgan Asset Management chief strategist says

The Federal Reserve should be wary of raising interest rates too fast, said JPMorgan Asset Management Chief Strategist David Kelly, who thinks job growth and the economy are set to slow soon. While the US added 372,000 jobs in June — a level typically associated with an economy expanding at a rapid pace— the labor… Continue reading Job growth is set to slow and the Fed may regret hiking rates too aggressively going into 2023, JPMorgan Asset Management chief strategist says

US stocks end mixed but notch weekly gain after strong jobs report

US stocks ended mixed Friday following a choppy day of trading after a strong June jobs report, though all three major indexes notched a gain for the week. The US added 372,000 jobs last month, beating forecasts with the economy inching closer to pre-pandemic employment numbers. But the strong number suggest the Fed will remain… Continue reading US stocks end mixed but notch weekly gain after strong jobs report