The US is likely to dodge stagflation and will suffer “slowflation” instead, which history shows is a better environment for stocks, according to UBS strategists. Stock markets have faltered in 2022 as investors grappled with inflation fears and the prospect of stalled growth, uncertain as to how deep the economic pain will be. One keen… Continue reading The US will avoid stagflation and will suffer milder ‘slowflation’ instead, because inflation has already peaked: UBS

Russia wants to weaken the ruble through purchases of ‘friendly’ currencies

Russia is weighing weakening the ruble by purchasing “friendly” currencies to influence its exchange rate, Reuters first reported. Moscow’s finance minister Anton Siulanov told a conference on Wednesday that watering down Russia’s native currency could be achieved “through cross-rates with the dollar and the euro.” The ruble has soared to seven-year highs thanks in large… Continue reading Russia wants to weaken the ruble through purchases of ‘friendly’ currencies

‘Big Short’ investor Michael Burry predicts inflation will slow later this year — and the Fed will reverse course and cut interest rates

Retailers’ overflowing inventories will lead to slower inflation, spurring the Federal Reserve to reverse course on interest rates and cease shrinking its balance sheet, Michael Burry predicted in a tweet on Monday. “This supply glut at retail is the Bullwhip Effect,” he wrote. “Deflationary pulses from this- -> disinflation in CPI later this year –>… Continue reading ‘Big Short’ investor Michael Burry predicts inflation will slow later this year — and the Fed will reverse course and cut interest rates

Crypto exchange CoinFlex will issue $47 million worth of recovery tokens after halting customer withdrawals

Cryptocurrency exchange CoinFlex announced that it would issue up to $47 million of recovery tokens as the firm looks to resume withdrawals after halting them in the wake of a large account running into difficulties. The exchange halted customer withdrawals in mid-June, revealing in a whitepaper yesterday that the issue stemmed from a high profile customer… Continue reading Crypto exchange CoinFlex will issue $47 million worth of recovery tokens after halting customer withdrawals

Central banks must prioritize inflation over recession in a ‘historically unprecedented’ situation, BIS urges

Central banks should try to minimize an economic downturn if possible, but must prioritize taming inflation above any other goal, the Bank for International Settlements has urged. If they don’t bring inflation under control, they run the risk that the current sky-high rates of price rises become entrenched, according to strategists at BIS, which coordinates… Continue reading Central banks must prioritize inflation over recession in a ‘historically unprecedented’ situation, BIS urges

Exxon Mobil CEO sees oil climbing further: ‘They always say that the cure to high prices is high prices’

Exxon Mobil’s CEO thinks oil prices have room to climb higher before they push companies to invest more on increased production. Brent crude rose 1.2% to $116.42 a barrel on Tuesday and has soared nearly 50% so far this year amid resurgent demand, limited growth in output, and Russia’s war on Ukraine. “They always say… Continue reading Exxon Mobil CEO sees oil climbing further: ‘They always say that the cure to high prices is high prices’

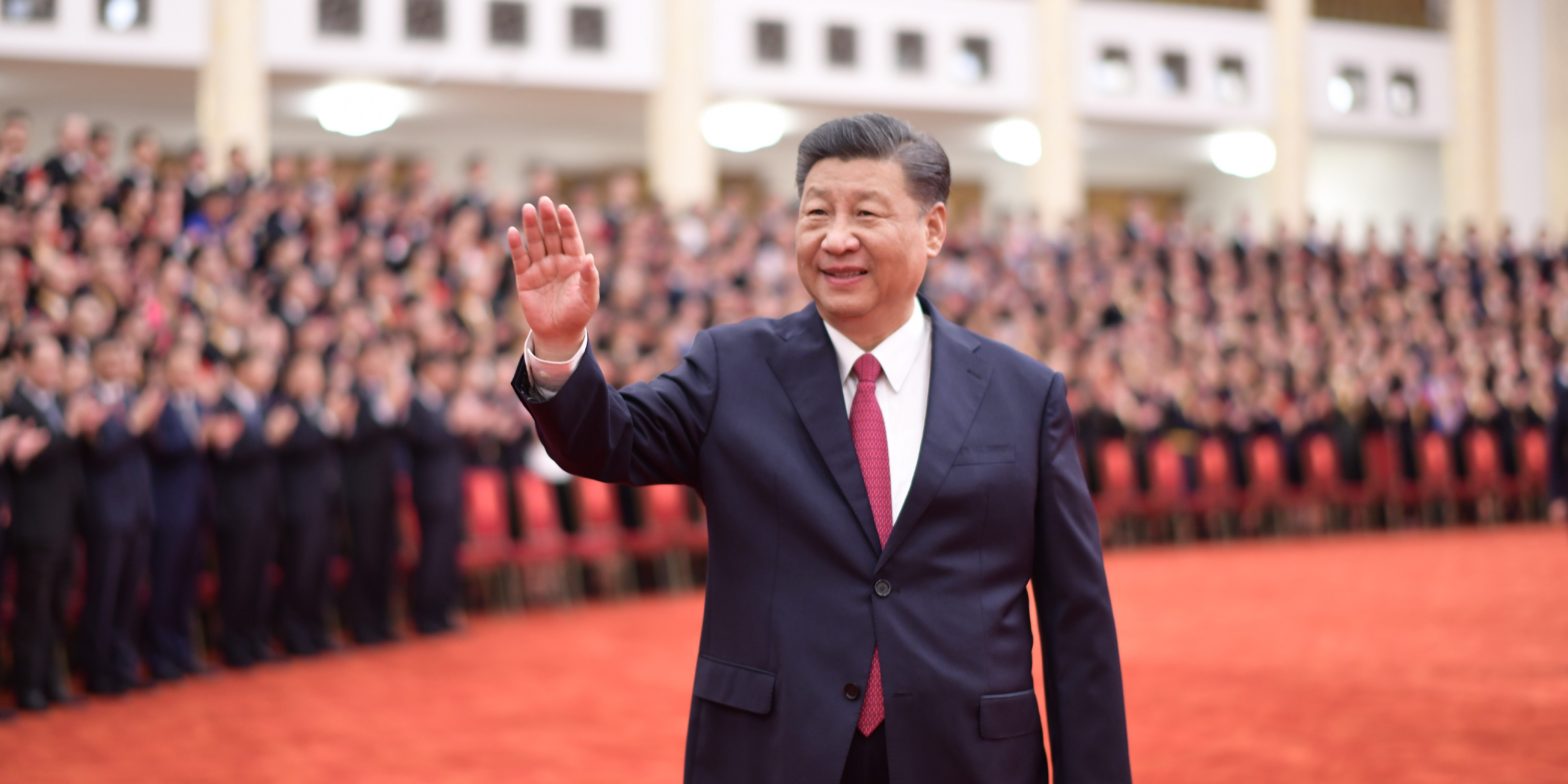

China is building a yuan currency reserve to compete with the dollar and prop up other economies facing volatility

Phil Rosen Chinese President Xi Jinping, also general secretary of the Communist Party of China CPC Central Committee and chairman of the Central Military Commission, waves while meeting with awardees of the titles of outstanding Party members, exemplary Party workers, and advanced community-level Party organizations from across the country before the ceremony to present the… Continue reading China is building a yuan currency reserve to compete with the dollar and prop up other economies facing volatility

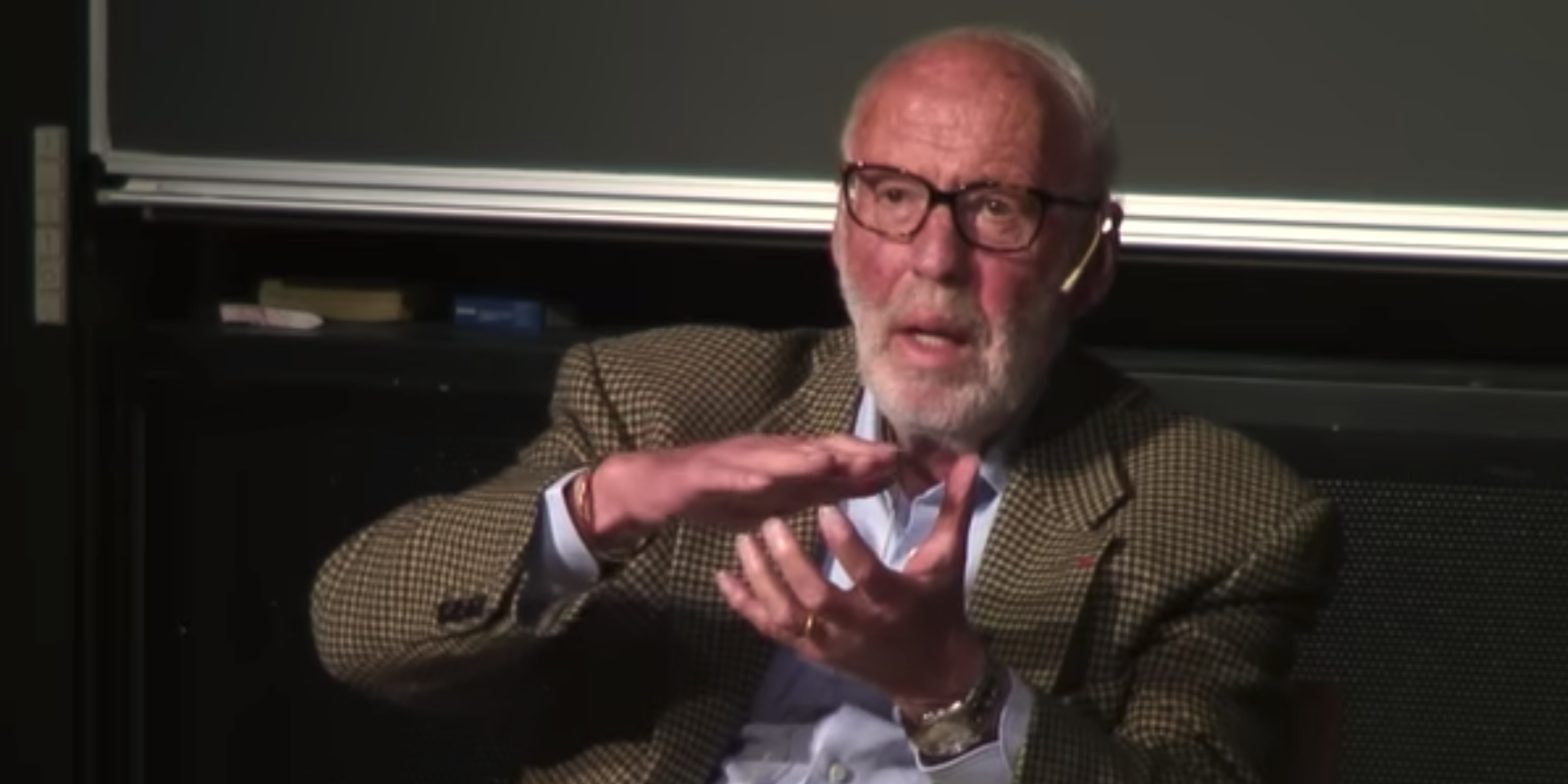

Quant-investing pioneer Jim Simons predicts Warren Buffett’s old-school approach will stay relevant — and lays out the 5 key principles he lives by

Jim Simons discussed why his hedge fund employs scientists instead of bankers, defended Warren Buffett’s relevance in an age of supercomputers and algorithmic trading, and shared the five principles he lives by in a recent, rare interview during the 2022 Abel Prize Week. “We hired statisticians, physicists, astronomers, mathematicians — the important thing was that… Continue reading Quant-investing pioneer Jim Simons predicts Warren Buffett’s old-school approach will stay relevant — and lays out the 5 key principles he lives by