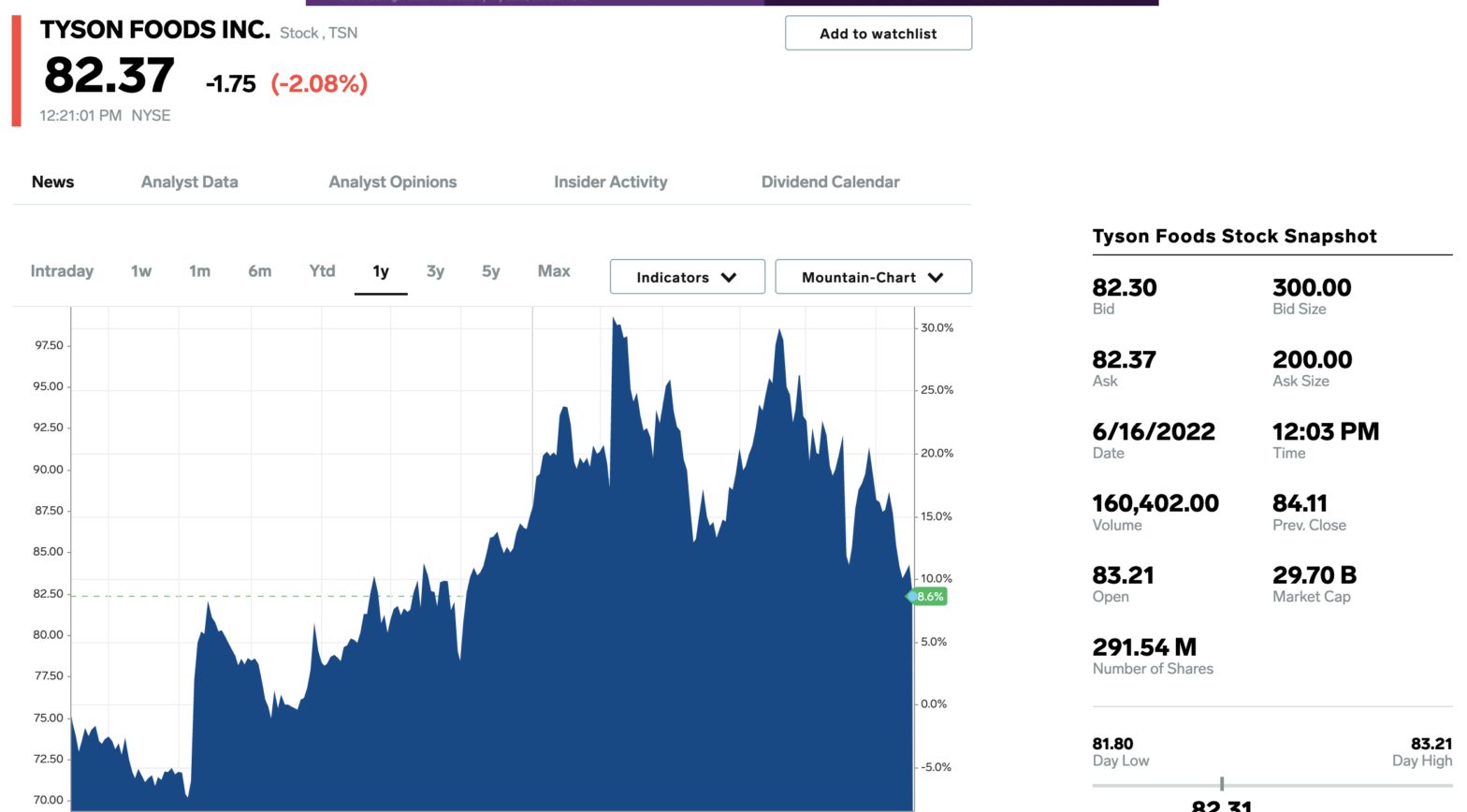

Stock prices are sinking, and it remains to be seen if earnings estimates will drop as well. Goldman Sachs Chief US Equity Strategist David Kostin expects a rally in stocks later in 2022. Kostin says these 16 stocks will be bargains even if analysts slash their forecasts dramatically. Two of the most fundamental questions in… Continue reading GOLDMAN SACHS: As a bear market sets in, investors should buy these 16 stocks that look inexpensive now and will still be attractive if earnings are slashed

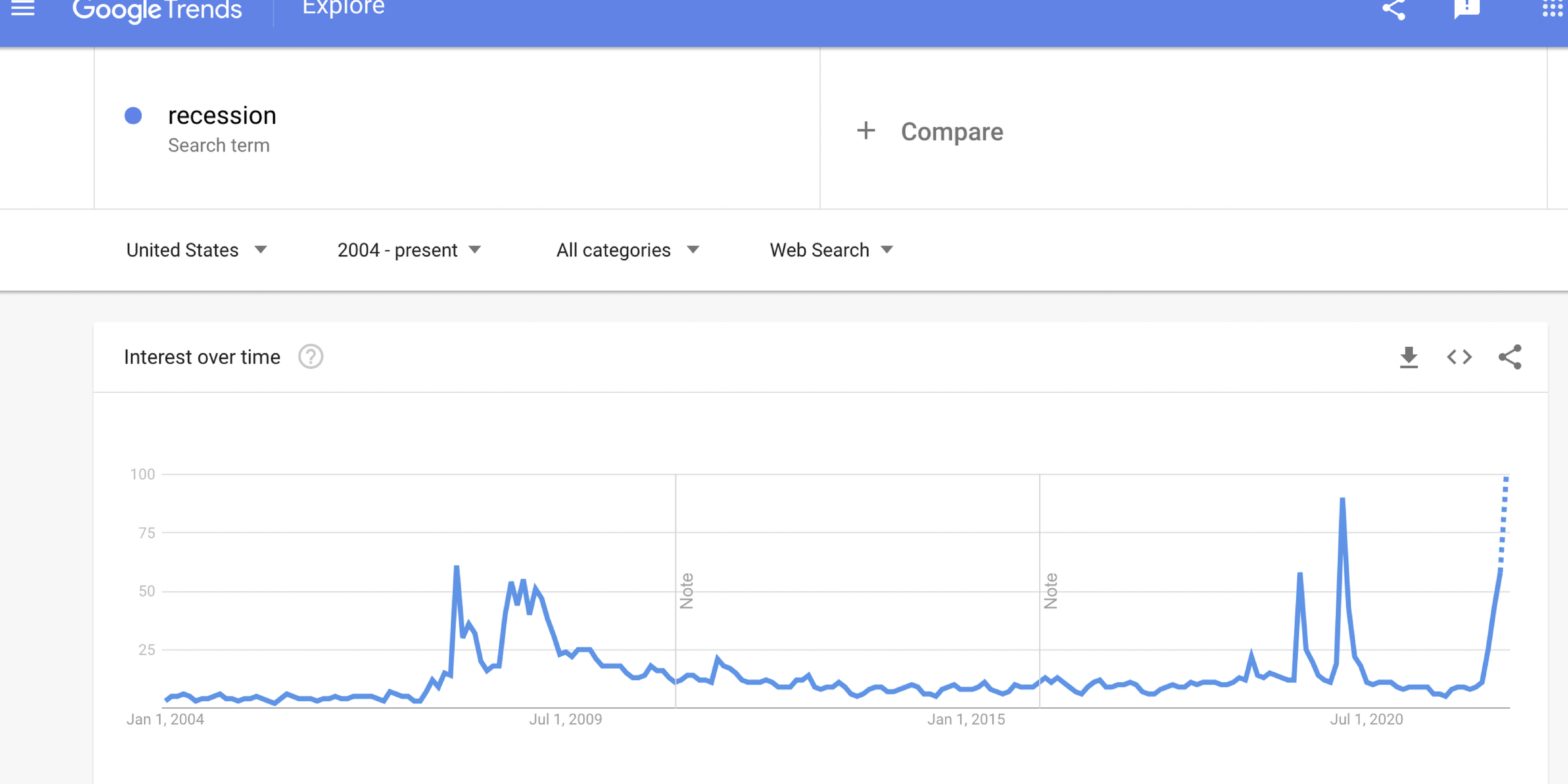

Joe Biden says the US economy can deal with inflation — and yet more Americans are googling “recession” than at any time since 2004

Americans are getting increasingly worried about recession as inflation continues to bite the US economy. Google search trends show more and more people in the US are looking up the word “recession.” Economists are predicting the US will tip into a recession as the Fed plays a dangerous game of catch-up. Loading Something is loading.… Continue reading Joe Biden says the US economy can deal with inflation — and yet more Americans are googling “recession” than at any time since 2004

These 6 European countries paid Russia $40 billion for fuel in the three months of the war, despite impending bans and sanctions on imports

Germany, Italy, and France are among European countries that have been snapping up cheap Russian fuel. Their purchases made up almost half of the to $97 billion in revenue Russia got from fuel exports. The EU plans to phase out Russian oil imports this year — but not natural gas yet. Loading Something is loading.… Continue reading These 6 European countries paid Russia $40 billion for fuel in the three months of the war, despite impending bans and sanctions on imports

Oil markets are heading for an ‘insanely difficult’ summer, with Russian production plunging under EU sanctions

Despite tough economic sanctions, Russia’s oil exports have risen this year as India has snapped up its crude. Yet analysts say Russian output is about to tumble as the EU moves to ban roughly 90% of imports by the end of the year. The impending drop is setting oil markets up for an “insanely difficult”… Continue reading Oil markets are heading for an ‘insanely difficult’ summer, with Russian production plunging under EU sanctions

The S&P 500 just notched a grim milestone that’s only been seen in 7 other years since World War II

Recession fears overtook the S&P 500 a day after the Fed meeting, reversing gains seen midweek. The S&P 500 has been higher only 43.5% of all trading days in 2022, a gloomy marker, according to Bespoke Investment Group. Meanwhile, it said the Fed is facing a “policy error” in focusing on headline inflation that’s swayed… Continue reading The S&P 500 just notched a grim milestone that’s only been seen in 7 other years since World War II

The stock market’s nightmare scenario of a 50% drop is now more likely after the ‘stubborn’ Fed’s biggest rate hike in decades, hedge-fund strategist says

A “stubborn” Federal Reserve has increased the likelihood of a prolonged recession, according to Axonic Capital’s Peter Cecchini. That’s because the Fed could cause economic whiplash that leads it to cutting interest rates sooner than expected.”The 1970’s drawdown scenario of almost 50% for the S&P 500 is becoming all the more likely,” Cecchini said. Loading Something… Continue reading The stock market’s nightmare scenario of a 50% drop is now more likely after the ‘stubborn’ Fed’s biggest rate hike in decades, hedge-fund strategist says

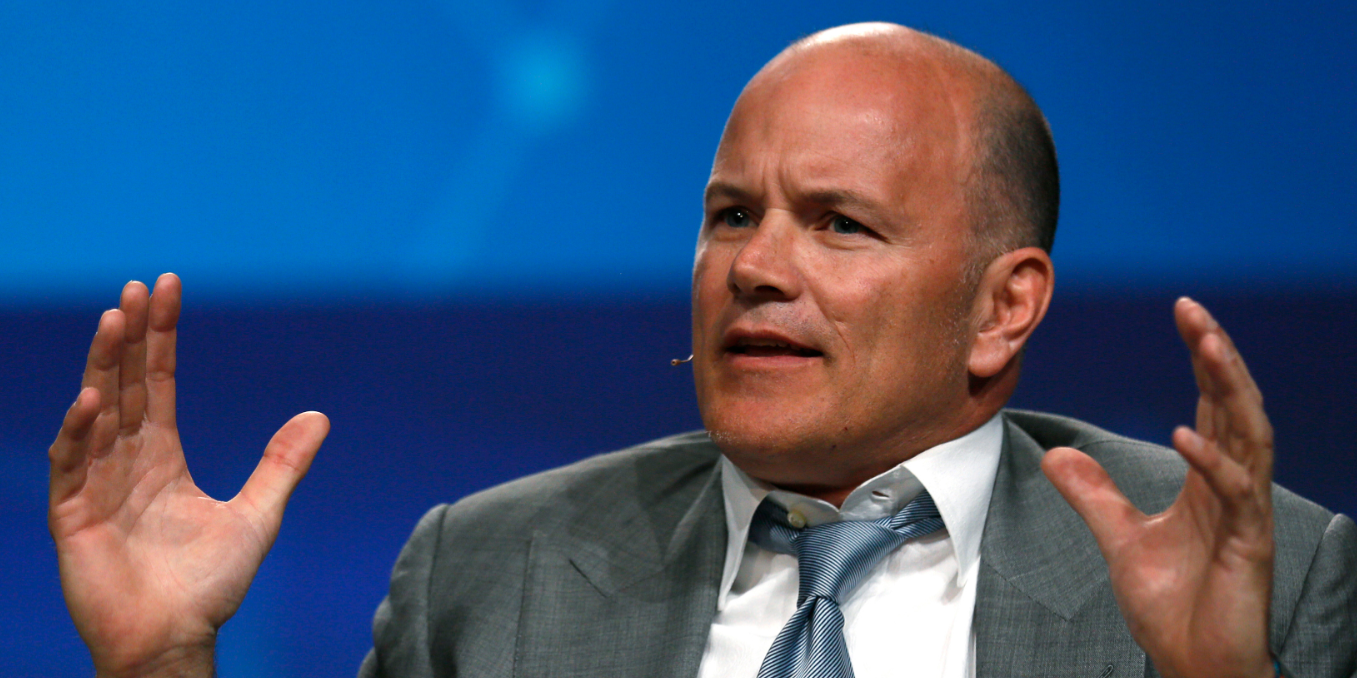

Mike Novogratz pounded the recession alarm, warned stocks would plunge further, and predicted some benefits from the crypto crash this week. Here are the 12 best quotes.

Mike Novogratz predicted the US economy would rapidly slump into a deep recession. Tha Galaxy Digital CEO warned asset prices might not recover until the Fed reins in inflation. Novogratz suggested the crypto crash could wash out some of the industry’s excesses. Loading Something is loading. Mike Novogratz predicted the US economy would quickly fall… Continue reading Mike Novogratz pounded the recession alarm, warned stocks would plunge further, and predicted some benefits from the crypto crash this week. Here are the 12 best quotes.

The Fed is now following its 1994 playbook — when aggressive rate hikes led to a ‘bond market massacre’

The Federal Reserve raised interest rates by 75 basis points Wednesday — its largest hike since 1994. Jerome Powell looks increasingly likely to copy Alan Greenspan’s 1990s playbook, analysts said. Greenspan’s Fed hiked interest rates seven times in 13 months, driving a massive bond sell-off. Loading Something is loading. The Federal Reserve implemented its largest… Continue reading The Fed is now following its 1994 playbook — when aggressive rate hikes led to a ‘bond market massacre’