The Fed making “stop-go” moves in raising interest rates would be a major policy error, economist Mohamed El-Erian told Bloomberg. The notion of a “Fed pause” has gained footing among equity investors in recent weeks. The best investors can hope for is a “soft-ish” landing for the US economy, he said. Loading Something is loading.… Continue reading Investors may be hoping for a ‘Fed pause’ to save them from higher interest rates, but that would be a big policy mistake, Mohamed El-Erian says

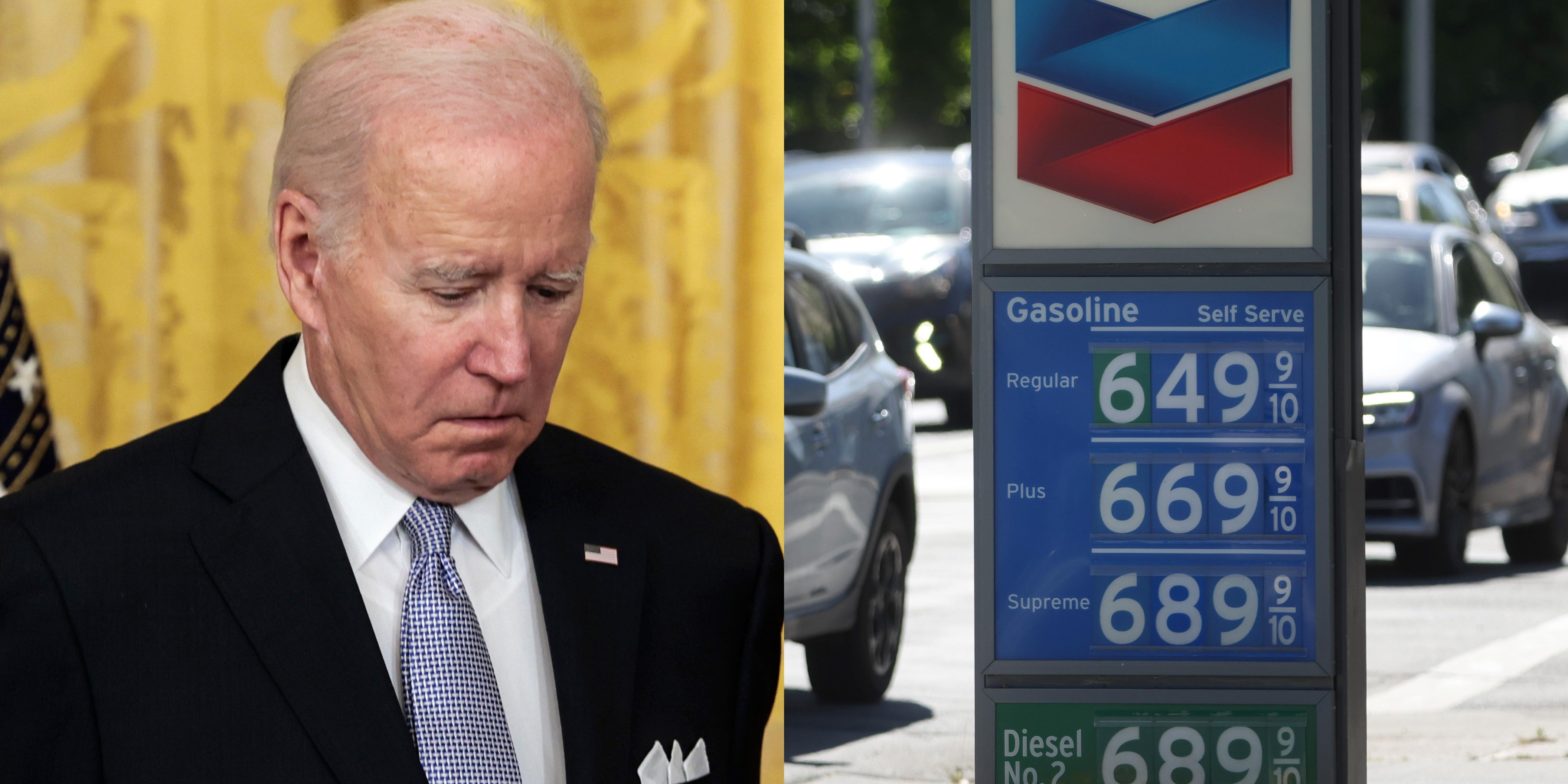

Gas prices have hit record highs but don’t expect Biden to lower them: ‘They already used their biggest bullet’

President Biden is scrambling to lower gas prices ahead of the midterm elections, but he has few tools to do so. US gas prices have hit records, and the strategic petroleum release won’t be able to bring them down. “There are very few tools the US administration has because the biggest driver for gasoline prices… Continue reading Gas prices have hit record highs but don’t expect Biden to lower them: ‘They already used their biggest bullet’

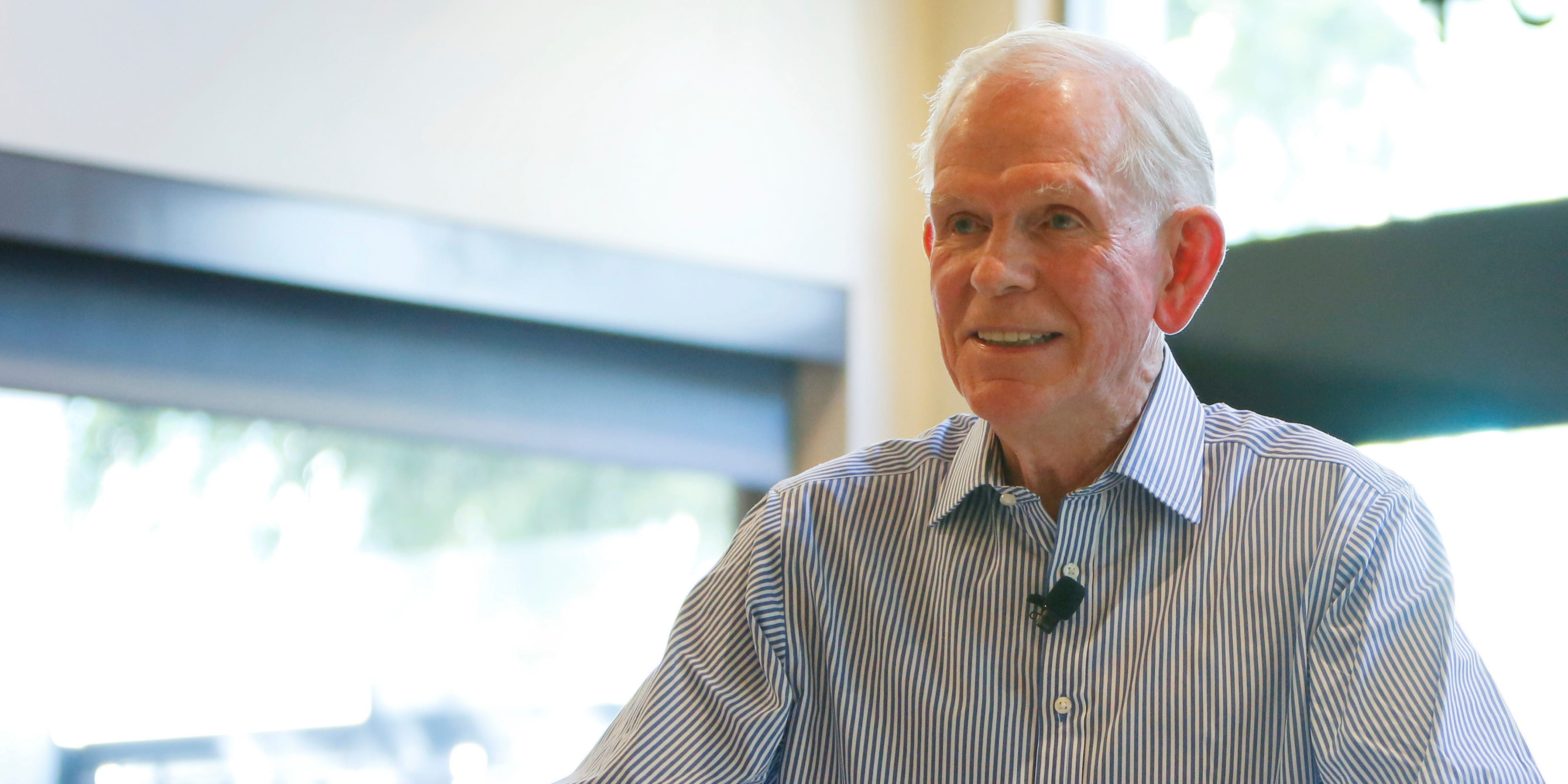

Jeremy Grantham, Michael Burry, and other market gurus expect stocks to plunge further. Here’s a roundup of their latest comments.

Theron Mohamed Jeremy Grantham. Alison Yin/AP Images for DivestInvest Jeremy Grantham, Michael Burry, and other market gurus expects stocks to fall further. Grantham and Burry both forecast the S&P 500 will drop by at least another 50%. David Rosenberg expects a 19% fall in the benchmark index from its current level. Loading Something is loading.… Continue reading Jeremy Grantham, Michael Burry, and other market gurus expect stocks to plunge further. Here’s a roundup of their latest comments.

A 29-year-old who built up a net worth of more than $1 million and quit his day job shares the savings and investing strategies he used

Tyler Wright increased his day job income from $30,000 a year to $250,000 in six years. He saved and invested most of his money, up to 80%, in the stock market and real estate. At 29, he’s worth over $1 million, owns three properties, and quit his job to run his own business. Tyler Wright’s… Continue reading A 29-year-old who built up a net worth of more than $1 million and quit his day job shares the savings and investing strategies he used

Nasdaq leaps 3% to lead US stock rally as the S&P 500 snaps 7-week slump on signs of cooling inflation

US stocks climbed Friday and marked the end of a long run of losing weeks. S&P 500 and the Nasdaq Composite secured their first weekly advances after seven weeks of losses. The core reading on the Fed’s preferred inflation gauge eased to 4.9% in April from 5.2% in March. Loading Something is loading. Investors in… Continue reading Nasdaq leaps 3% to lead US stock rally as the S&P 500 snaps 7-week slump on signs of cooling inflation

Cathie Wood’s ARK bought $44 million Nvidia shares after the gaming firm beat earnings

Cathie Wood’s ARK Invest bought almost 250,000 Nvidia shares for $43.7 million on Thursday. The chip designer reported strong revenues, but predicted declining sales and tough macroeconomic conditions. ARK bought Nvidia stock across three of its ETFs amidst analyst optimism on the company’s performance Loading Something is loading. Cathie Wood’s ARK Invest bought almost $44… Continue reading Cathie Wood’s ARK bought $44 million Nvidia shares after the gaming firm beat earnings

These were the 5 worst performing cryptos over the past week amid bitcoin bear market

While bitcoin and ethereum dominate the headlines, there are more than 19,000 crypto coins.With less liquidity and more volatility, these alternative cryptocurrencies can deliver investors massive losses or gains in a short period of time.These were the five worst performing cryptocurrencies over the past week, according to data from CoinMarketCap. Loading Something is loading. Bitcoin’s bear… Continue reading These were the 5 worst performing cryptos over the past week amid bitcoin bear market

A deeper drop in Russian oil supply is likely to trigger a global recession and a full-blown energy crisis, Bank of America warns

A further decline in Russian oil supply is likely to spark a global recession, Bank of America said Friday. The bank warned oil prices could hit $150 a barrel, and an energy crisis could ensue, if supplies fall sharply. Russia’s oil production has fallen by around 1 million barrels per day in 2022, as sanctions… Continue reading A deeper drop in Russian oil supply is likely to trigger a global recession and a full-blown energy crisis, Bank of America warns