The S&P 500 briefly entered bear market territory on Friday for the first time since March 2020. A bear market is technically defined as a decline of at least 20% in the stock market from its peak.Here’s everything you need to know about this vicious part of the stock market cycle. Loading Something is loading. The… Continue reading The S&P 500 just fell into a bear market for the first time since the pandemic. Here’s what to know about this vicious part of the stock-market cycle.

Companies are bemoaning the strongest dollar in 20 years. Here’s what experts say to expect for the greenback in the next few months.

The US dollar has been sharply advancing this year, with the widely watched US Dollar Index hitting a 20-year high. Multinational companies including Apple and Pfizer have noted dollar strength could dent financial results. The DXY has jumped 10% during 2022 and it’s likely to stick around high levels in the coming months, experts say. … Continue reading Companies are bemoaning the strongest dollar in 20 years. Here’s what experts say to expect for the greenback in the next few months.

RBC says these 10 beaten-down internet stocks have the most upside in the sector, and names 4 top favorites — as well as the ones most vulnerable in a consumer-led slowdown

US stocks are flirting with a bear market, and it’s been even worse for tech stocks. Based on earnings reports and trends, Brad Erickson of RBC identifies his top picks in the space. Erickson also discussed which stocks are best-positioned for the second half of the year. Stocks are continuing to slide, and at some… Continue reading RBC says these 10 beaten-down internet stocks have the most upside in the sector, and names 4 top favorites — as well as the ones most vulnerable in a consumer-led slowdown

Bank of America says it sees a 1-in-3 chance of a US recession some time next year, but it will be mild by historical standards

Bank of America sees a 1-in-3 chance of a US recession next year, but sees a ‘bumpy landing’ as more likely. If the US does plunge into recession, it will be mild by historical standards, the bank’s economists said. They expect the Federal Reserve to hike interest rates by 30 basis points more than the… Continue reading Bank of America says it sees a 1-in-3 chance of a US recession some time next year, but it will be mild by historical standards

Putin ally China is boosting Russian oil purchases by nearly 50% after initially cutting back

China is ramping up its purchases of Russian oil and picking up the slack of Western buyers. The world’s top oil importer is nearing 1.1 million barrels per day of Russian crude brought by sea, Reuters said. China previously recorded imports of 750,000 barrels per day in the first quarter in 2022. Loading Something is… Continue reading Putin ally China is boosting Russian oil purchases by nearly 50% after initially cutting back

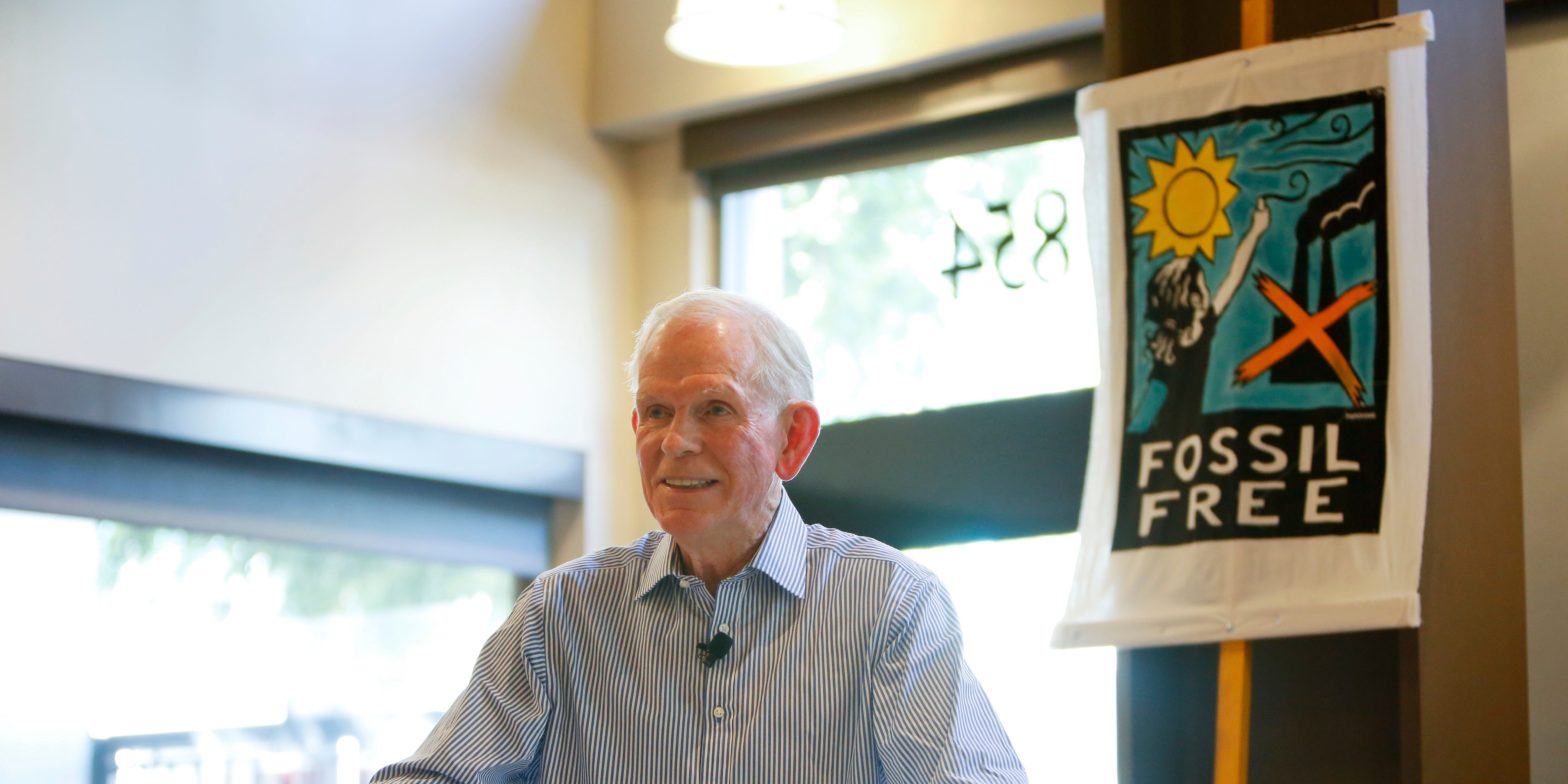

Jeremy Grantham’s GMO says investors can still make money on commodities stocks — and should load up on fossil fuel names as the world transitions to clean energy

Even after the rapid rise of commodity prices, it’s not too late for investors to buy energy stocks, according to Jeremy Grantham’s GMO.GMO highlighted attractive valuations and favorable supply and demand dynamics that suggest there’s plenty of more upside ahead for commodity stocks.”The clean energy transition will take decades to play out and will, in… Continue reading Jeremy Grantham’s GMO says investors can still make money on commodities stocks — and should load up on fossil fuel names as the world transitions to clean energy

The commodities shock has raised fears of 1970s-style stagflation happening again. Here’s why this time could be different.

Rising commodity prices will put pressure on global economic growth, the Bank for International Settlements said. By some measures, today’s situation looks even more disruptive than what was seen in the 1970s, a BIS report noted. But a repeat of the 1970s stagflation, with low or no growth and high inflation, is unlikely, BIS said.… Continue reading The commodities shock has raised fears of 1970s-style stagflation happening again. Here’s why this time could be different.

Warren Buffett, Michael Burry, and other elite investors just revealed major changes to their stock portfolios. Here are 5 key trades they made.

Theron Mohamed Warren Buffett. Reuters Warren Buffett, Michael Burry of “The Big Short,” and others shared portfolio updates this week. Ray Dalio, Jim Simons, and Stanley Druckenmiller also disclosed their stock holdings as of March 31. Key trades included a big bet on Chevron, a wager against Apple, and several meme-stock purchases. Loading Something is… Continue reading Warren Buffett, Michael Burry, and other elite investors just revealed major changes to their stock portfolios. Here are 5 key trades they made.