China has re-emerged as the second-biggest bitcoin miner after the US, despite Beijing’s ban on crypto activity. A surge in covert operations has made it a major mining hub again, the Cambridge Centre for Alternative Finance found. China’s crackdown resulted in a swift drop in global bitcoin mining, which has now recovered to hit all-time… Continue reading China is now the world’s 2nd-biggest bitcoin miner after activity bounced back from the government’s crackdown

It’s possible the US can dodge a recession but stagflation is unavoidable, Mohamed El-Erian says

The US economy can potentially dodge a recession, but stagflation is coming, Mohamed El-Erian told Bloomberg TV on Wednesday. “What is unavoidable is stagflation. We’re seeing growth coming down, and we’re seeing inflation remaining high.” A significant slowdown in economic growth hasn’t been priced into the stock market yet, he warned. Loading Something is loading.… Continue reading It’s possible the US can dodge a recession but stagflation is unavoidable, Mohamed El-Erian says

Weekly NFT sales plunge 50% to $255 million amid crypto bear market. These were the 5 best-selling digital collections.

NFTs have had a breakthrough year, and over the past 12 months, volume has hit $29 billion.But a significant decline in the cryptocurrency market has helped fuel a pullback in NFT sales. Loading Something is loading. The cryptocurrency boom over the past few years has helped propel a newer market to record heights: digital collectibles… Continue reading Weekly NFT sales plunge 50% to $255 million amid crypto bear market. These were the 5 best-selling digital collections.

Russia faces a full block on dollar bond payments as a key US sanctions waiver is expected to expire — putting Moscow closer to a historic default: report

The Treasury Department is expected to block Russia’s ability to pay US bondholders, sources told Bloomberg, raising the likelihood of a default. US sanctions on Russia for its invasion of Ukraine included an exemption for bond payments. But that exemption expires on May 25, and officials aren’t expected to renew it. Loading Something is loading.… Continue reading Russia faces a full block on dollar bond payments as a key US sanctions waiver is expected to expire — putting Moscow closer to a historic default: report

The SEC just charged a US subsidiary of investment giant Allianz in a multibillion dollar fraud scheme that targeted pensions and other investors

A subsidiary of Allianz agreed to pay $6 billion and pleaded guilty to charges of fraud and misleading investors. The Justice Department brought charges against Allianz Global Investors US for the March 2020 scheme. The Securities and Exchange Commission also sued three men and accused them of securities fraud. Loading Something is loading. Allianz Global… Continue reading The SEC just charged a US subsidiary of investment giant Allianz in a multibillion dollar fraud scheme that targeted pensions and other investors

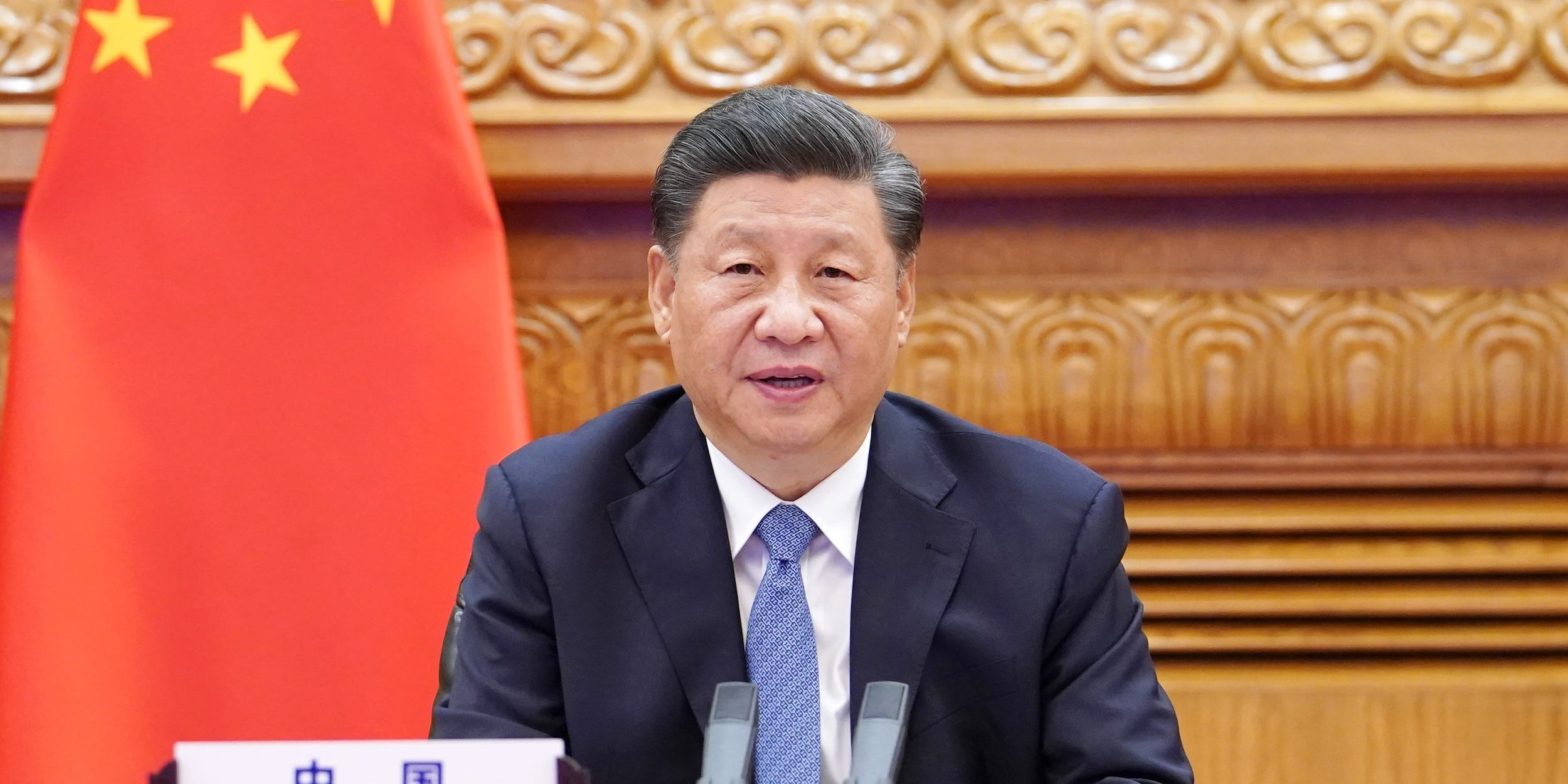

China just saw a record bond sell-off. Now its main trading platform isn’t publishing foreign debt trades, report says.

China’s main bond trading platform for foreign investors stopped publishing data on May 11, Bloomberg reports. The move follows a recent sell-off in the Chinese debt markets. BlackRock last week forecasted a “rapidly worsening” outlook for the world’s second-largest economy. Loading Something is loading. After record net sales of sovereign debt, China’s primary bond trading… Continue reading China just saw a record bond sell-off. Now its main trading platform isn’t publishing foreign debt trades, report says.

The dollar and euro are on the verge of parity for the first time in 20 years — and it could happen within a month. Here’s what to know.

The dollar and euro are on the verge of being equal for the first time since 2002. A top economist told Insider that parity could be reached within “a month or so.” The euro has lost nearly 14% against the dollar in the past year and is far below its March 2008 peak of roughly… Continue reading The dollar and euro are on the verge of parity for the first time in 20 years — and it could happen within a month. Here’s what to know.

The US dollar is at a 20-year high and that’s raising risks for the global economy and financial stability, says Mohamed El-Erian

The dollar’s rise to 20-year highs poses global financial risks, economist Mohamed El-Erian said. Dollar strength makes imports more expensive for developing countries already dealing with cost crunches from COVID. The DXY index last week marked a 10% rise for 2022. Loading Something is loading. Famed economist Mohamed El-Erian said Tuesday higher import prices for… Continue reading The US dollar is at a 20-year high and that’s raising risks for the global economy and financial stability, says Mohamed El-Erian