Phil Rosen NYSE US stocks ended higher as traders try to reinvigorate a rally that’s stalled in August. The Nasdaq Composite was up over 1% after coming off back-to-back losing weeks for the first time in 2023. Investors will be watching retail sales data from July to publish Tuesday, as well as key earnings results… Continue reading US stocks rise as investors try to shake off August slump ahead of retail data

These are the top 10 holdings of the Mormon Church’s $49 billion stock portfolio

The $100 billion investment arm of the Mormon Church revealed some of its holdings in a 13F filing on Monday.The church has amassed a portfolio of individual stocks worth nearly $50 billion.These are the top 10 holdings of the Mormon Church’s stock portfolio as of June 30. Loading Something is loading. Thanks for signing up!… Continue reading These are the top 10 holdings of the Mormon Church’s $49 billion stock portfolio

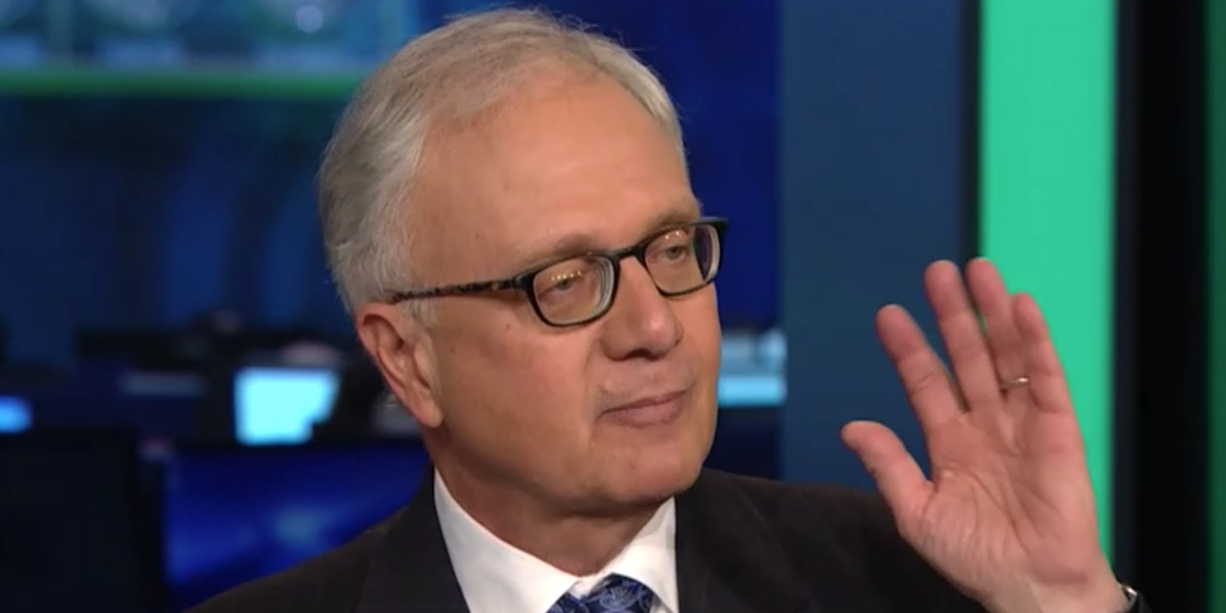

Bond markets are flashing warning signs even as recession forecasts get dialed back, market vet Ed Yardeni says

The economy could be in for pain even if there’s a soft-landing, according to market veteran Ed Yardeni. De-inversion of the yield curve is often cheered, but a risk today is the 10-year yield moving even higher, in line with short-term yields. The 10-year Treasury yield passed 4% in July, edging closer to the 2-year… Continue reading Bond markets are flashing warning signs even as recession forecasts get dialed back, market vet Ed Yardeni says

Investors should bet on risky stocks as the market enters early-cycle phase of expansion

Investors should buy risky stocks as the market shows signs of entering the early cycle of an expansion, said Bank of America. The bank double-upgraded consumer discretionary stocks and downgraded consumer staples stocks. Here’s why Bank of America thinks investors should be focusing on riskier cyclical stocks. Loading Something is loading. Thanks for signing up!… Continue reading Investors should bet on risky stocks as the market enters early-cycle phase of expansion

Bad weather, natural disasters, and disease are hobbling crops right now. Here’s how the food commodity markets are responding.

Natural catastrophes and bad weather have wreaked havoc on food crops across the world. Orange juice futures, cacao beans, and rice have hit all-time highs of late – while Chinese pork has slumped. Here’s a round-up of the main movements in food commodity prices this week. Loading Something is loading. Thanks for signing up! Access… Continue reading Bad weather, natural disasters, and disease are hobbling crops right now. Here’s how the food commodity markets are responding.

The US is facing a debt storm. Here’s 5 charts that show trouble is brewing.

There’s a storm of private and public debt troubles that’s headed for the market. Warning signs have sprung up in rising credit card balances, delinquencies, and other indicators. Here are the signs that the US is dealing with troubles stemming from its mountain of debt. Loading Something is loading. Thanks for signing up! Access your… Continue reading The US is facing a debt storm. Here’s 5 charts that show trouble is brewing.

Morningstar: These 10 dividend stocks have increased their payouts every year for the past 5 years and look cheap right now

Growth stocks have soared higher this year on the back of artificial intelligence hype. Most dividend stocks have been left in the dust, but that means they’re cheap right now. Morningstar found 10 stocks that have consistently raised dividends every year for the last 5 years. The S&P 500 has skyrocketed over 16% year-to-date, led… Continue reading Morningstar: These 10 dividend stocks have increased their payouts every year for the past 5 years and look cheap right now

Americans can’t get a break thanks to surging mortgages, food and fuel costs. Here are all the ways consumers are getting screwed.

The cost of living, eating and driving is going up, leaving consumers with nothing but empty wallets. Americans can’t get a break financially, largely thanks to higher interest rates and “greedflation.” Here’s all the ways consumers are getting screwed and why. Loading Something is loading. Thanks for signing up! Access your favorite topics in a… Continue reading Americans can’t get a break thanks to surging mortgages, food and fuel costs. Here are all the ways consumers are getting screwed.