The Ukraine war’s impact on supply chains and trade could result in a global “anti-Goldilocks” economy, Pimco said. Higher energy prices could help lead to “stagflation”, where inflation is too hot and growth is too cold. Even once the war ends, sanctions will likely persist and make supply-chain and trade flow issues worse, they said.… Continue reading Pimco says the risks have increased for an ‘anti-Goldilocks economy’ — where growth is too cold and inflation is far too hot

Humble Swap Makes Defi Safe for Everyone, launches on March 28

, /PRNewswire/ — Humble Swap (https://humble.sh) is on a mission to make the decentralized finance world safer and accessible to everyone. Humble Swap is a new, decentralized exchange that has passed stringent security assessments to ensure customer funds’ safety. In preparation for the launch, Reach Co-Founder and CEO Chris Swenor stated, “We engaged with Kudelski… Continue reading Humble Swap Makes Defi Safe for Everyone, launches on March 28

It’s TikTok meets Spotify meets Robinhood: Investing app Alinea is going after Gen-Z women with Silicon Valley backing

A new investing app called Alinea is targeting Gen Z women with familiar terms and design. The Y Combinator-backed startup already has thousands of users, most of whom are young females. Users can now also buy and sell more than 20 cryptocurrencies. Loading Something is loading. Forget Robinhood — a new investing app is chasing… Continue reading It’s TikTok meets Spotify meets Robinhood: Investing app Alinea is going after Gen-Z women with Silicon Valley backing

With the US dollar’s dominance in question, here’s how China’s yuan could become a global reserve currency — and why it wouldn’t be all bad

China’s yuan could develop into a global reserve currency, but Beijing would have to drastically loosen its grip on the economy. A downgrade in the US dollar’s dominance could also provide some upside, said a China expert at USC. “But whether the yuan could be perceived as a store of value — a safe haven… Continue reading With the US dollar’s dominance in question, here’s how China’s yuan could become a global reserve currency — and why it wouldn’t be all bad

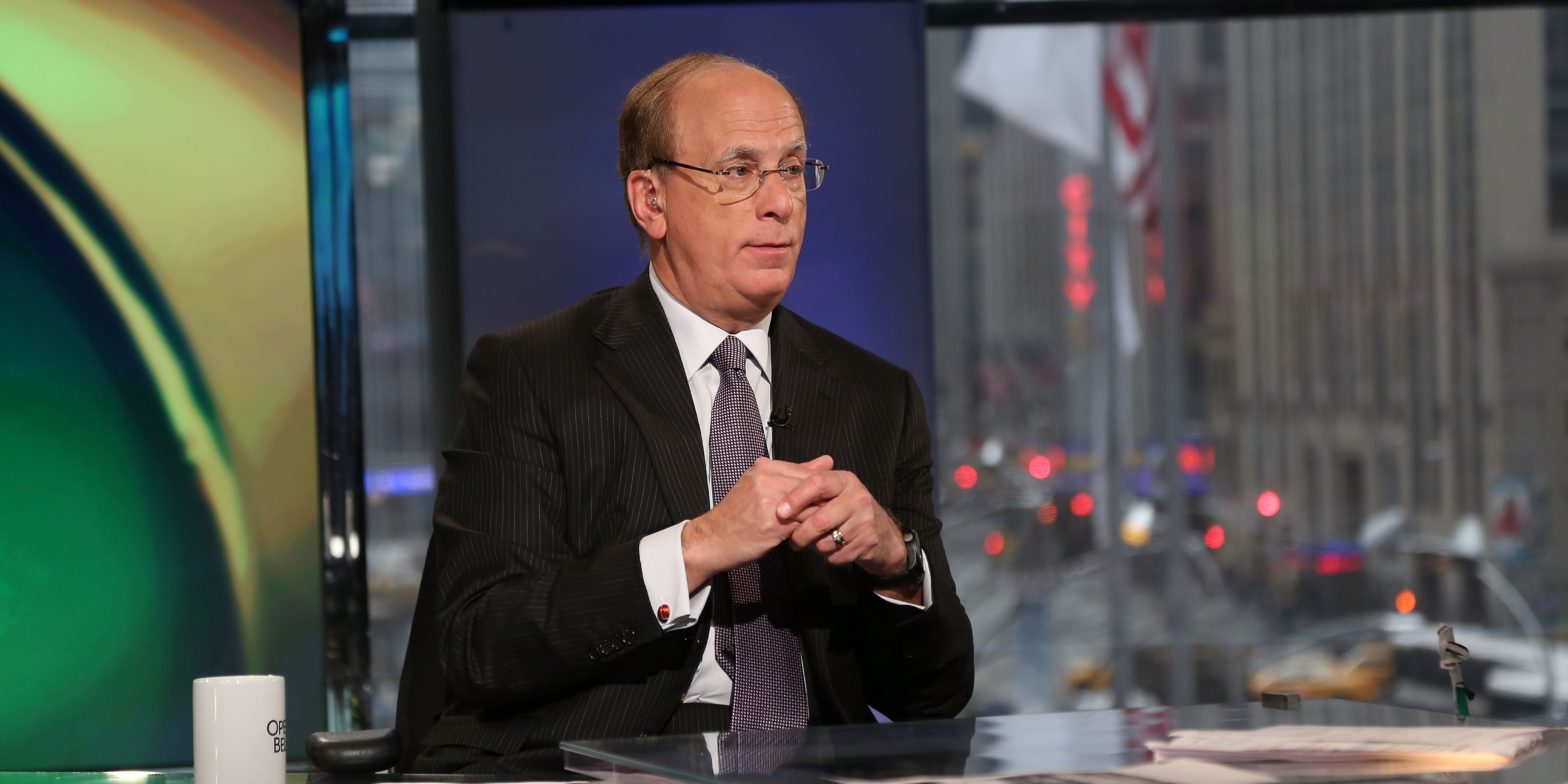

Market giants Larry Fink and Howard Marks say the Ukraine conflict will end globalization. Here are 3 key takeaways for investors.

BlackRock’s Larry Fink and Oaktree’s Howard Marks have predicted that globalization is coming to an end. The Russia-Ukraine war and COVID-19 are making companies and countries rethink their reliance on others, they said. Deglobalization would have dramatic consequences for the economy, and for investors used to a highly integrated world. Loading Something is loading. Globalization… Continue reading Market giants Larry Fink and Howard Marks say the Ukraine conflict will end globalization. Here are 3 key takeaways for investors.

A 30-year market vet warns that a load of technical indicators show stocks are still hurtling toward a bear market — and that the ongoing rally is just a fake-out

Stocks are up almost 9% from their March 14 bottom. But according to Jon Wolfenbarger, many of the market’s technical indicators are still bearish. He warned that the recent reversal could be a “bear market rally.” After falling 13% to start the year, the S&P 500 has rallied over the last two weeks to close… Continue reading A 30-year market vet warns that a load of technical indicators show stocks are still hurtling toward a bear market — and that the ongoing rally is just a fake-out

3 charts show the best investments to make going into aggressive Fed rate hikes, Russia’s war, and a worldwide energy shock

Fed rate hikes, Russia’s war, and soaring energy prices have upended equities, crypto and bonds this year. Macro Hive’s Bilal Hafeez shared how investors should position themselves for this period. Cash and commodities might be the best investments, he says. Loading Something is loading. The Fed’s era of ultra-easy monetary policy has begun to unwind, and… Continue reading 3 charts show the best investments to make going into aggressive Fed rate hikes, Russia’s war, and a worldwide energy shock

Janet Yellen says crypto has its benefits and the Treasury hopes to offer guidance on regulations that foster ‘healthy innovation’

US Secretary of the Treasury Janet Yellen told CNBC that she recognizes the benefits of crypto. “We recognize the innovation in the payment system can be a healthy thing,” Yellen said. She wants the Treasury to issue regulatory guidance that fosters innovation. Loading Something is loading. US Secretary of the Treasury Janet Yellen nodded to… Continue reading Janet Yellen says crypto has its benefits and the Treasury hopes to offer guidance on regulations that foster ‘healthy innovation’