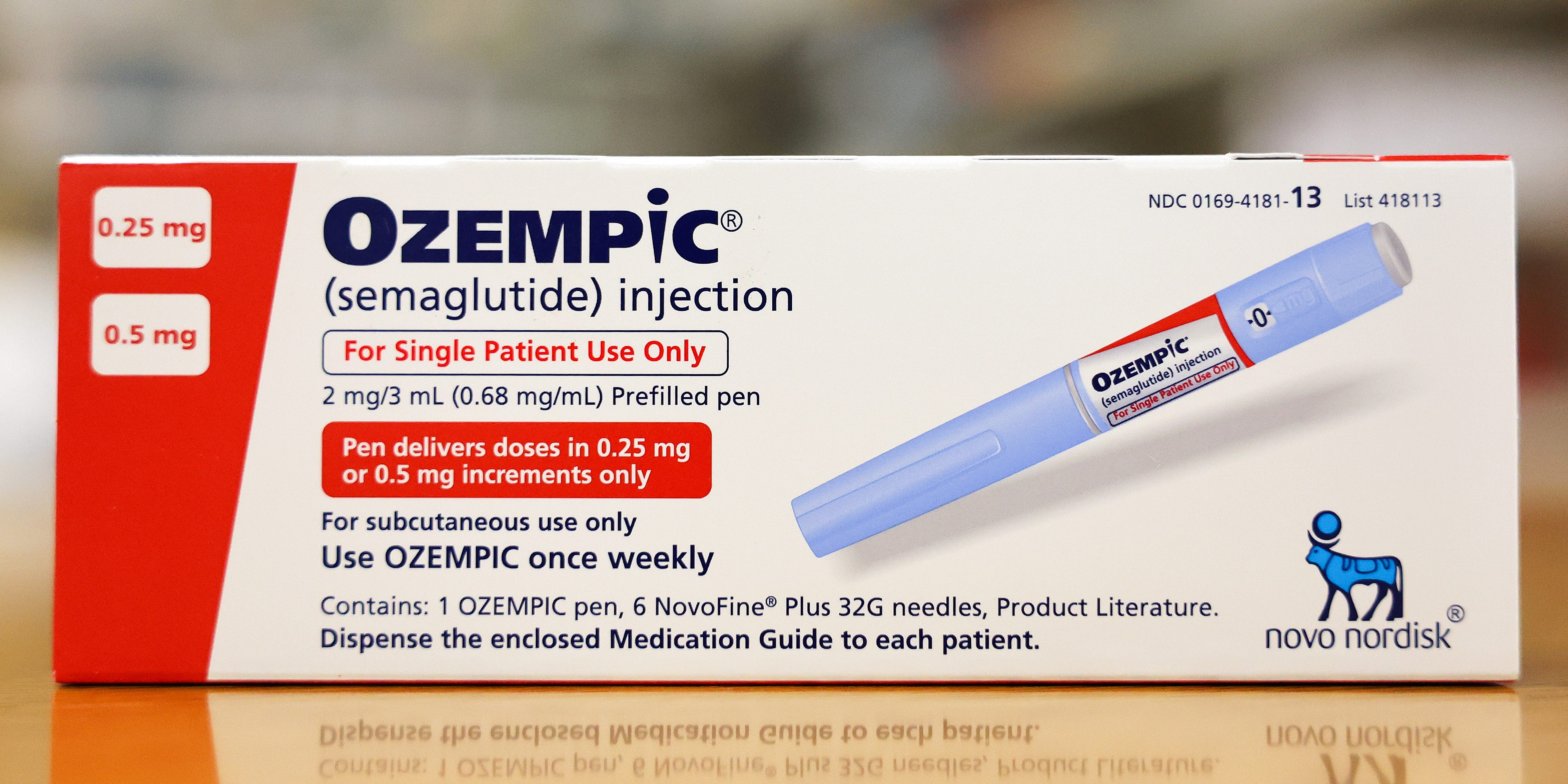

A new class of weight loss drugs are powering massive stock market gains for Novo Nordisk and Eli Lilly.Both stocks surged more than 16% on Tuesday, boosting the combined valuation of both companies to nearly $1 trillion.A new study showed Novo Nordisk’s Wegovy lowered the risk of heart attack or stroke by 20%. Loading Something… Continue reading A new class of weight loss drugs is powering massive stock-market gains for Novo Nordisk and Eli Lilly

Rising interest rates could re-emerge as a threat to stocks, Bank of America says

Stocks plunged last year as the Fed started raising interest rates, but they’ve bounced back in 2023. And yet, it might be time for investors to start worrying again, according to Bank of America. High rates “may pose an underpriced risk for the equity market,” analysts said in a note to clients Tuesday. Loading Something… Continue reading Rising interest rates could re-emerge as a threat to stocks, Bank of America says

A $2 trillion corporate debt wall will spark job losses in 2024, Goldman Sachs says

A $2 trillion corporate debt wall is about to shake the economy with job losses, according to Goldman Sachs.The bank estimated that the economy could shed 5,000 jobs per month in 2024 due to rising debt interest costs. “Companies will need to devote a greater share of their revenue to cover higher interest expense as they… Continue reading A $2 trillion corporate debt wall will spark job losses in 2024, Goldman Sachs says

US stocks rise as investors digest 2nd-quarter earnings beats

Matthew Fox Lucas Jackson/Reuters US stocks climbed on Monday as investors continue to digest 2nd-quarter earnings results.With 85% of S&P 500 companies having reported results, 81% beat profit estimates.Investors are turning their attention to the Thursday release of the July inflation report. Loading Something is loading. Thanks for signing up! Access your favorite topics in… Continue reading US stocks rise as investors digest 2nd-quarter earnings beats

China’s working population will shrink in the coming decades and keep the nation’s economy from surpassing America’s, research firm says

Decades of China’s one-child policy have led to an aging population and lopsided ratio between elderly and youth. The country is on pace to lose nearly half of its current population by 2100, per Terry Group, which says that bodes poorly for economic growth. Chinese government data showed China’s population shrank in 2022 for the… Continue reading China’s working population will shrink in the coming decades and keep the nation’s economy from surpassing America’s, research firm says

De-dollarization will be a vicious cycle as hyperinflation leads to higher rates that will further erode the greenback’s power, think tank says

De-dollarization could lead to a vicious cycle of economic destruction, according to an Australian economic think tank. That’s because waning use of the dollar could bring on hyperinflation, researcher Michael Roach said. Hyperinflation could lead to higher interest rates, which will weigh on asset prices, according to Roach. Loading Something is loading. Thanks for signing… Continue reading De-dollarization will be a vicious cycle as hyperinflation leads to higher rates that will further erode the greenback’s power, think tank says

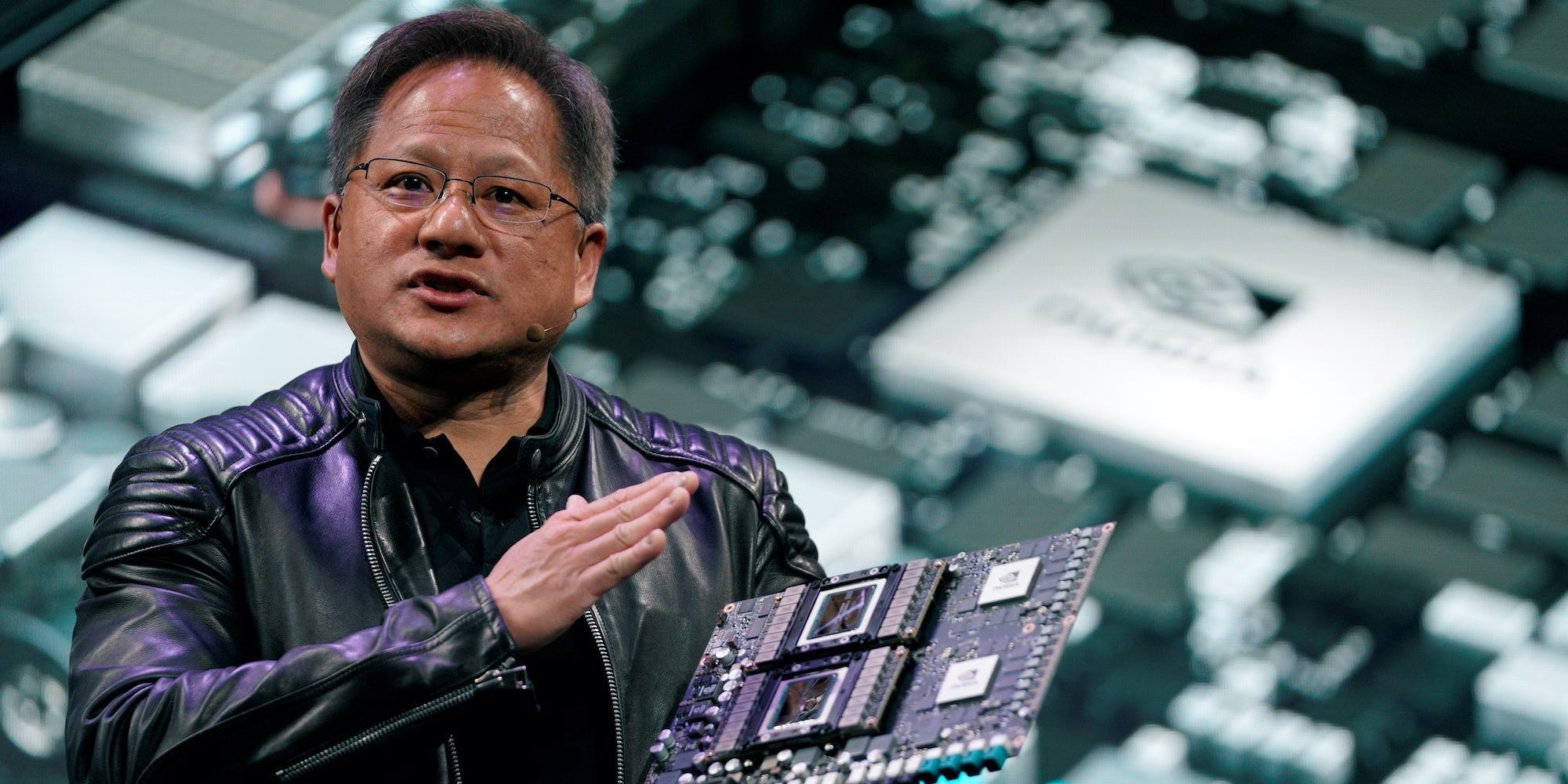

Nvidia stock is still a ‘top pick’ at Bank of America even after its stunning AI-driven 209% rally

Nvidia is still a “top pick” stock at Bank of America, even after its AI-driven year-to-date rally of 209%.The bank said Nvidia’s upcoming 2nd-quarter earnings report will be “less shock and awe” and more about execution.The biggest risk for Nvidia is its ability to scale the supply of its AI-enabling GPU chips, according to BofA.… Continue reading Nvidia stock is still a ‘top pick’ at Bank of America even after its stunning AI-driven 209% rally

The S&P 500 could triple to 14,000 by 2034 as secular bull market cycle takes hold

The stock market’s strong year-to-date performance could just be the continuation of a long-term bull market.RBC’s Robert Sluymer said in a recent note that the S&P 500 could nearly triple to 14,000 by 2034.”The long-term secular trend for US equity markets remains positive with an underlying 16 to 18 year cycle supportive of further upside.”… Continue reading The S&P 500 could triple to 14,000 by 2034 as secular bull market cycle takes hold