Jennifer Sor Traders work on the floor of the New York Stock Exchange (NYSE) in New York City, New York, U.S., March 10, 2020. Andrew Kelly/Reuters The Dow Jones Industrial Average notched its 11th straight winning session on Monday. Alphabet and Microsoft report late Tuesday, while Facebook parent Meta reports late Wednesday. Traders also expect… Continue reading Dow notches 11th straight win as traders look to big tech earnings, Fed meeting

German ATMs keep getting bombed as a crime wave exploits the country’s preference for cash

In the past few years, Germany has become a hotbed for ATM bombings, the Financial Times wrote. That’s because Germans still favor cash over electronic payments, making ATMs ripe targets. Last year, about 30 million euros were stolen via ATM bombings, up 53% from a year earlier. Loading Something is loading. Thanks for signing up!… Continue reading German ATMs keep getting bombed as a crime wave exploits the country’s preference for cash

Orange juice has never been this expensive

Orange futures just reached a record high, Bloomberg data shows. Citrus greening, a crop disease, is spreading in Brazil and Florida, two top orange producers. Brazil, the world’s biggest juice exporter, will export 1.7% less orange juice to the US compared to last year. Loading Something is loading. Thanks for signing up! Access your favorite… Continue reading Orange juice has never been this expensive

Bitcoin could soar to $180,000 before the April 2024 halving as potential BlackRock ETF helps drive demand, Fundstrat says

The price of bitcoin could soar to $180,000 before the scheduled April 2024 halving, according to Fundstrat.Fundstrat said a bitcoin ETF from BlackRock could drive a boost in daily demand for the crypto token.If the SEC approves a bitcoin ETF from BlackRock, it could lead to the largest ETF launch ever. Loading Something is loading.… Continue reading Bitcoin could soar to $180,000 before the April 2024 halving as potential BlackRock ETF helps drive demand, Fundstrat says

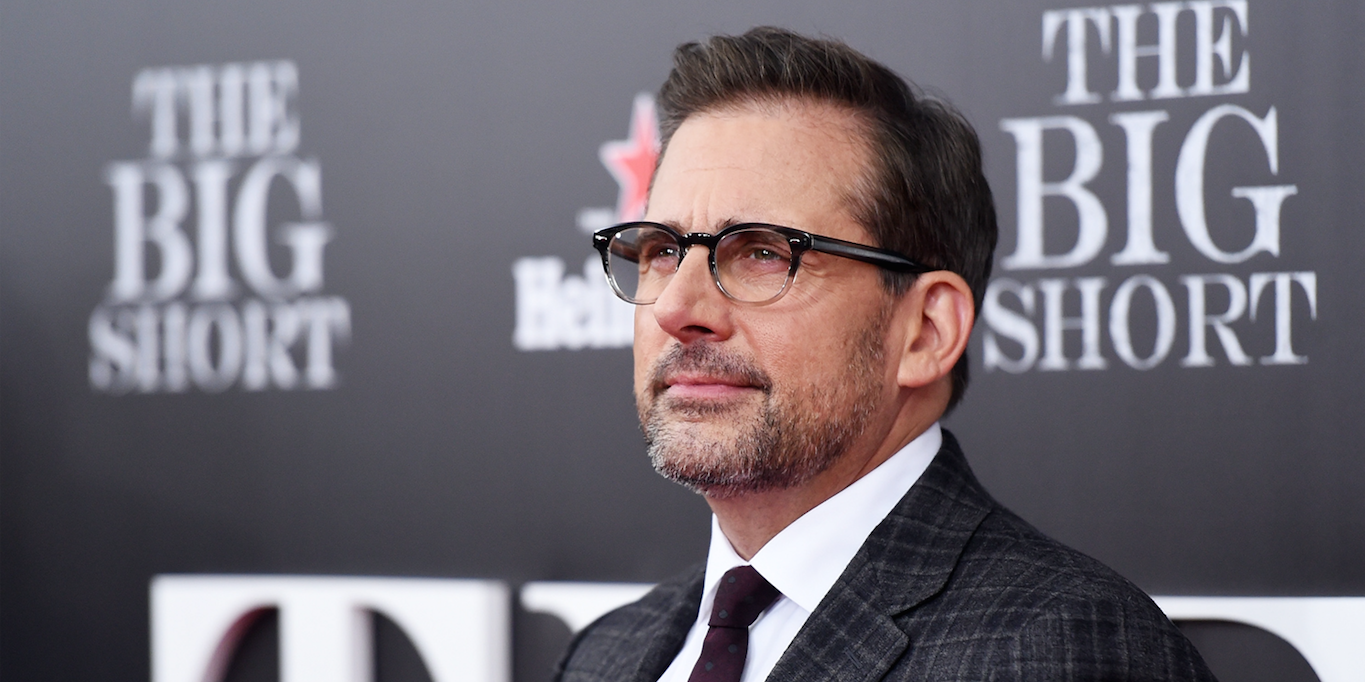

‘Big Short’ investor Steve Eisman says the market will continue to melt up as long as there’s no recession – and there’s still no sign of one

There’s no indication of a recession, “Big Short” investor Steve Eisman told CNBC. Due to that, many investors are playing market catch-up, helping fuel further gains. “So as long as there’s no evidence of recession, I think the market will probably continue to melt up — people are chasing.” Loading Something is loading. Thanks for… Continue reading ‘Big Short’ investor Steve Eisman says the market will continue to melt up as long as there’s no recession – and there’s still no sign of one

A bitcoin positive-feedback loop could more than quadruple the price beyond $120,000, analyst says

Bitcoin could soar above $120,000 if miners keep holding onto tokens, Standard Chartered analyst Geoff Kendrick said. In an interview with Insider, he acknowledged bitcoin’s price gains help fuel a positive-feedback loop. “And so your point about this becoming self-fulfilling, I suspect is actually a very important driver.” Loading Something is loading. Thanks for signing… Continue reading A bitcoin positive-feedback loop could more than quadruple the price beyond $120,000, analyst says

China’s economy is in trouble – and its youth unemployment crisis is at the heart of the problem

China’s youth unemployment problem is the root of its economic woes, according to economist Nancy Qian. Unemployment among workers aged 16-24 hit a record 21% last quarter. That’s largely due to a shortage of high-skill, high-paying jobs, which will weigh on its economy. Loading Something is loading. Thanks for signing up! Access your favorite topics… Continue reading China’s economy is in trouble – and its youth unemployment crisis is at the heart of the problem

FOMO, YOLO, RINO: The quirkiest catchphrases explaining the surprising buoyancy of the stock market and economy

Experts have struggled to find textbook explanations for the surprising economic buoyancy and stock-market rally of 2023. Many commentators have instead turned to trendy catchphrases – such as FOMO and YOLO – to describe the behavior of investors and consumers. Here’s a roundup of the quirkiest buzzwords used to comment on US equities and the… Continue reading FOMO, YOLO, RINO: The quirkiest catchphrases explaining the surprising buoyancy of the stock market and economy