To lower inflation back to 2%, the Federal Reserve needs to cut interest rates, not raise them.That’s according to Barry Ritholtz, who argued that rate hikes won’t cure the current drivers behind rising prices.”Raising rates won’t fix these issues and arguably, makes them worse,” Ritholtz said. Loading Something is loading. Thanks for signing up! Access… Continue reading The Fed needs to cut interest rates, not raise them, if it wants to tame inflation back to 2%, CIO says

Wheat prices head for biggest single-day gain since Russia invaded Ukraine after fresh attacks on key grain facilities

Wheat prices on Wednesday were on track for their biggest one-day gain since February 2022. On Tuesday, Russia launched missiles at the port of Odesa, one of Ukraine’s key grain-exporting hubs. Russia this week also backed out of a deal that had ensured safe passage for Ukraine exports in the Black Sea. Loading Something is… Continue reading Wheat prices head for biggest single-day gain since Russia invaded Ukraine after fresh attacks on key grain facilities

Apple just added $71 billion in market value on news it’s developing an ‘Apple GPT’ AI

Apple stock briefly jumped as much as 2% on Wednesday after Bloomberg reported on the company’s AI ambitions.The stock-price surge added as much as $71 billion to the company’s market cap.According ot the report, Apple is building a large language model and already has an internal chatbot. Loading Something is loading. Thanks for signing up!… Continue reading Apple just added $71 billion in market value on news it’s developing an ‘Apple GPT’ AI

Disinflation will shift to deflation, hitting earnings and sending stocks lower, Morgan Stanley CIO says

Deflation could become a headwind for stocks, Morgan Stanley’s Mike Wilson warned. That’s because falling prices takes away firms’ pricing power, which hurts earnings. “[T]his is a slippery slope for earnings growth and hence stock valuations, which are now quite extended,” Wilson said. Loading Something is loading. Thanks for signing up! Access your favorite topics… Continue reading Disinflation will shift to deflation, hitting earnings and sending stocks lower, Morgan Stanley CIO says

Office vacancy hits an all-time high despite more people returning to in-person work

The US office vacancy rate rose to 13.1%, according to the National Association of Realtors. That’s a new record high, despite more people returning to in-person work. NAR cited hybrid work, as tenants have decreased the average square footage per person. Loading Something is loading. Thanks for signing up! Access your favorite topics in a… Continue reading Office vacancy hits an all-time high despite more people returning to in-person work

De-dollarization risks aren’t priced in despite rising US dysfunction and tension with China, JPMorgan says

De-dollarization risks aren’t priced in despite rising US dysfunction and tension with China, JPMorgan said. The dollar is “very expensive in historical terms, suggesting that a narrative of secular dollar decline is not prevalent in the market.” Investors should go underweight on the dollar, as well as US markets, bonds, and financial equities, analysts said.… Continue reading De-dollarization risks aren’t priced in despite rising US dysfunction and tension with China, JPMorgan says

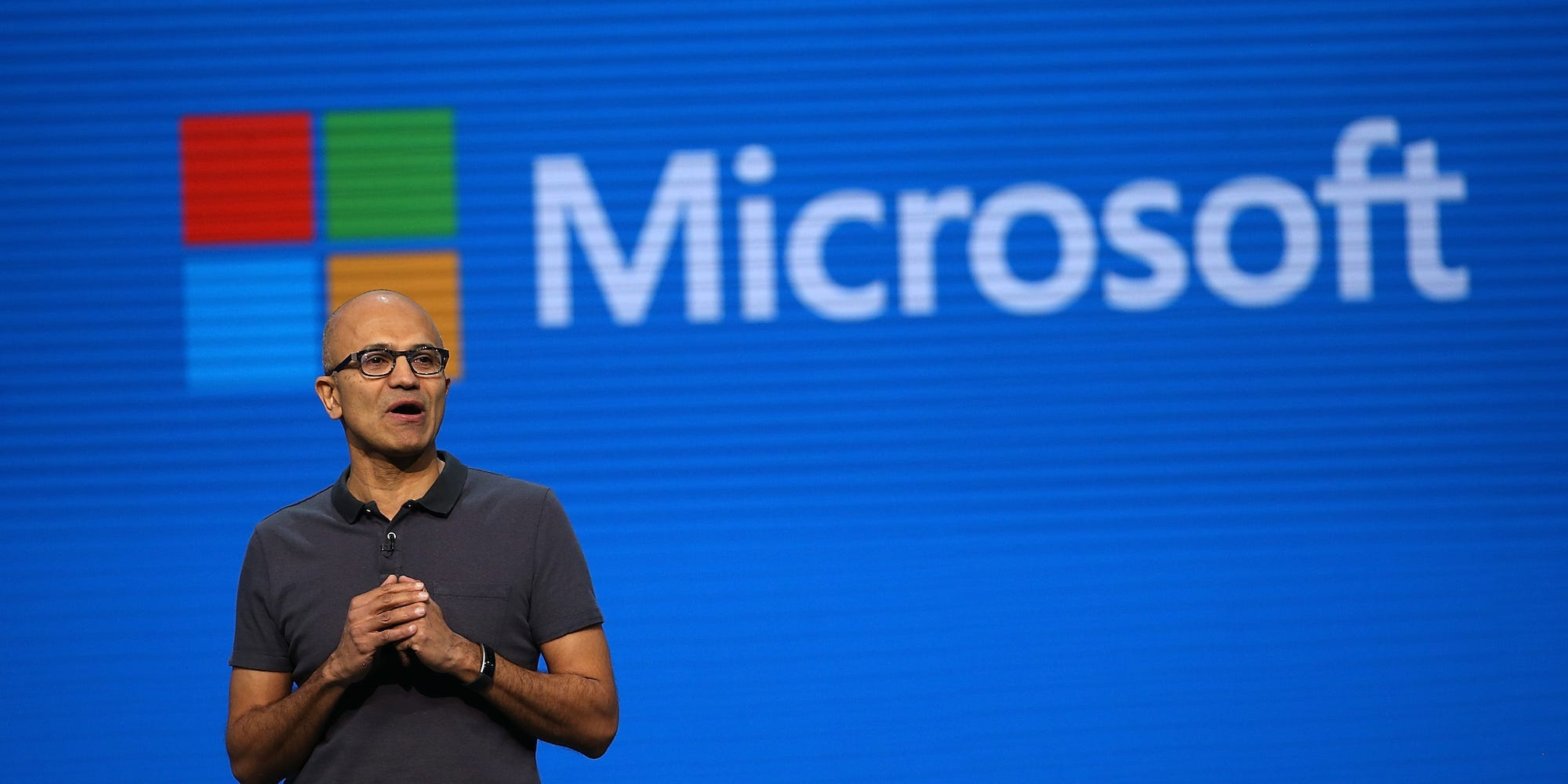

Microsoft adds $154 billion in market value after it announces $30 per month AI subscription

Microsoft stock surged as much as 6% on Tuesday after the company unveiled an AI subscription for its Office 365 platform.The software giant will charge $30 per month per user to have AI capabilities integrated into its Microsoft Office platform.At its peak on Tuesday, Microsoft added $154 billion to its market value, which is bigger… Continue reading Microsoft adds $154 billion in market value after it announces $30 per month AI subscription

The first ETF offering protection against 100% of stock losses just launched

Innovator Capital Management launched a buffer ETF Tuesday with 100% downside protection. The fund trades under the ticker TJUL and will track the S&P 500 over a two-year period. “Our aim is for TJUL to provide a way for our clients to stay in the market with significant built-in risk management.” Loading Something is loading.… Continue reading The first ETF offering protection against 100% of stock losses just launched