Investors are always on the hunt for secular growth stocks that could become the next mega-cap giant like Apple or Microsoft.Goldman Sachs identified financial characteristics that could help investors in their search.This is the “Rule of 10” screening tactic used by Goldman to identify secular growth stocks. Loading Something is loading. Thanks for signing up!… Continue reading The ‘Rule of 10’ can help investors identify the next big stock market winners, according to Goldman Sachs

Credit markets are headed for ‘slow motion car crash,’ hedge fund billionaire says

Credit markets will soon look like a “slow-motion car crash,” King Street Capital’s Brian Higgins said. The billionaire investor’s hedge fund made billions in the aftermath of the 2008 debt crisis. Experts have been warning of a credit crunch that could rival 2008 as financial conditions tighten. Loading Something is loading. Thanks for signing up!… Continue reading Credit markets are headed for ‘slow motion car crash,’ hedge fund billionaire says

Over half a million silver coins just vanished – now the metals dealer behind the ‘fraudulent’ scheme must pay $146 million

A precious metals dealer has been asked to pay up $146 million in damages after over half a million silver coins went missing. Robert Higgins ran a “fraudulent and deceptive scheme” linked to the purchase and sale of precious metals, the CFTC said. From 2014 to 2022, Higgins led a ‘fraudulent silver leasing program’ that… Continue reading Over half a million silver coins just vanished – now the metals dealer behind the ‘fraudulent’ scheme must pay $146 million

The pain is just starting for commercial real estate – and plunging prices could reignite the banking crisis and choke the US economy, Columbia professor says

A Columbia professor has issued a bleak outlook for commercial real estate in the US. Office values are plunging and threaten to cause an “urban doom loop,” Stijn Van Nieuwerburgh said. The sector’s challenges could spill into the banking sector and hurt the wider economy, he said. Loading Something is loading. Thanks for signing up!… Continue reading The pain is just starting for commercial real estate – and plunging prices could reignite the banking crisis and choke the US economy, Columbia professor says

Stocks’ bull run from the first half won’t last – high interest rates and slumping growth will kill the rally, UBS says

The stock-market rally will fade over the second half of 2023, according to UBS. Further rate hikes and weak economic data “could quickly unravel optimism,” strategists said. Equities have started the year on a tear, with tech stocks posting their best first half since 1983. Loading Something is loading. Thanks for signing up! Access your… Continue reading Stocks’ bull run from the first half won’t last – high interest rates and slumping growth will kill the rally, UBS says

Emerging economies are decoupling from China, helping them stay strong despite rising interest rates, market veteran says

Emerging markets are proving resilient amid post-pandemic challenges, Ruchir Sharma wrote in The Financial Times. They are also seeing new opportunities after moving away from Chinese dependence. “The old notion that ’emerging’ is another word for reckless no longer applies,” Sharma said. Loading Something is loading. Thanks for signing up! Access your favorite topics in… Continue reading Emerging economies are decoupling from China, helping them stay strong despite rising interest rates, market veteran says

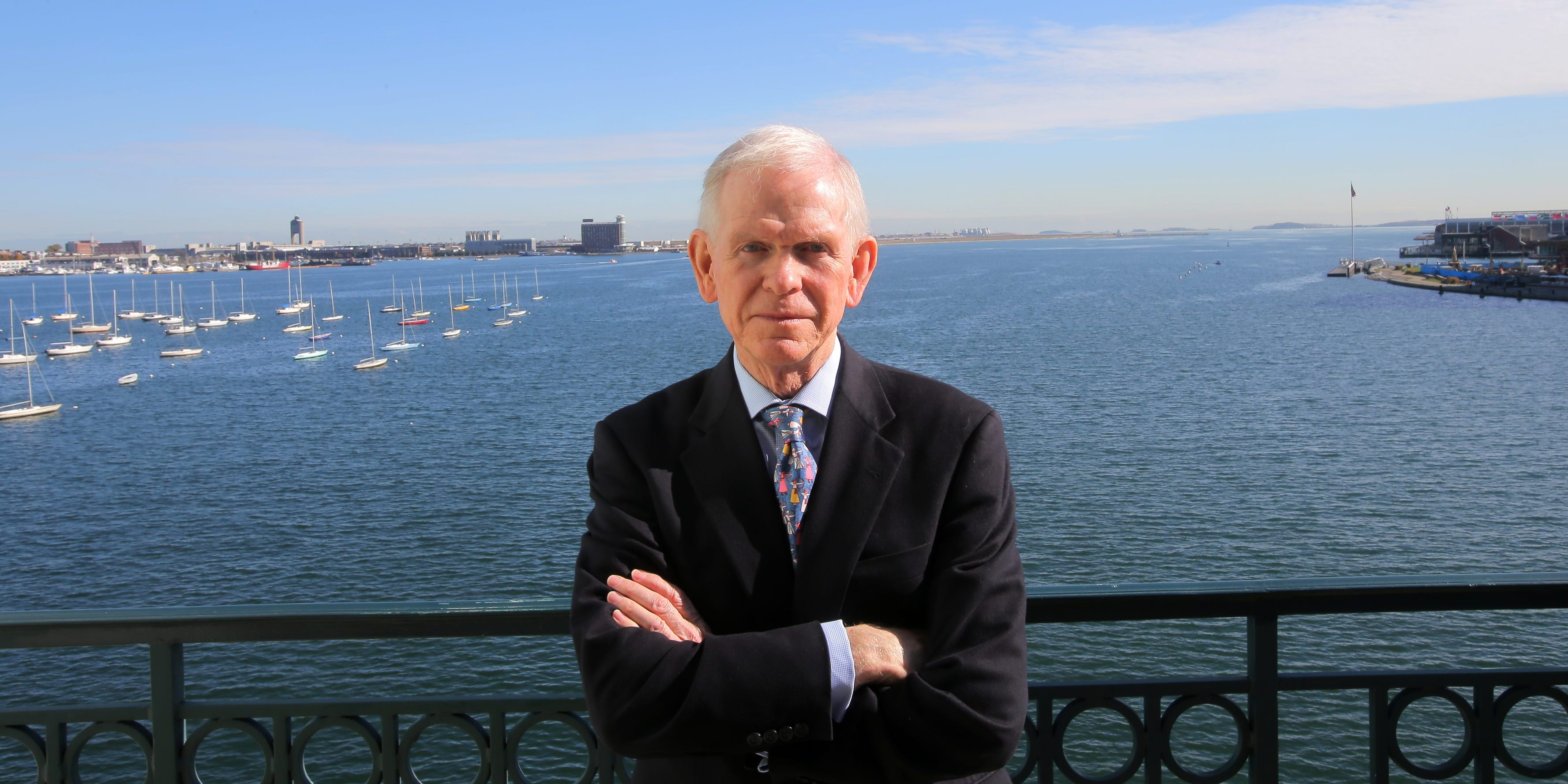

The stock market has 70% chance of crashing in a few years, according to legendary investor Jeremy Grantham

Stocks have a 70% chance of crashing in a few years, legendary investor Jeremy Grantham said. The GMO co-founder pointed to parallels between the current market and previous crashes. Grantham originally estimated an 85% chance the market was in another bubble on the verge of bursting. Loading Something is loading. Thanks for signing up! Access… Continue reading The stock market has 70% chance of crashing in a few years, according to legendary investor Jeremy Grantham

US stocks gain to start the 2nd half of the year as traders wrap up early for Independence Day

Matthew Fox Xinhua/Wang Ying/ Getty Images US stocks gained in a shortened day of trading on Monday ahead of Independence Day.The S&P 500 surged 16% in the first half of the year, and investors are hoping to extend those gains into the second half.Tesla stock surged as much as 9% after the company announced second-quarter… Continue reading US stocks gain to start the 2nd half of the year as traders wrap up early for Independence Day