Shares of a Francis Bacon painting are set to become publicly traded, The Wall Street Journal reported. It will allow retail investors to join the high-value art market, purchasing fractional ownership. The IPO is led by Artex, with shares only available on a specially made art stock exchange. Loading Something is loading. Thanks for signing… Continue reading Shares of famous artwork are going public for the first time with a top painting’s IPO expected to draw $55 million

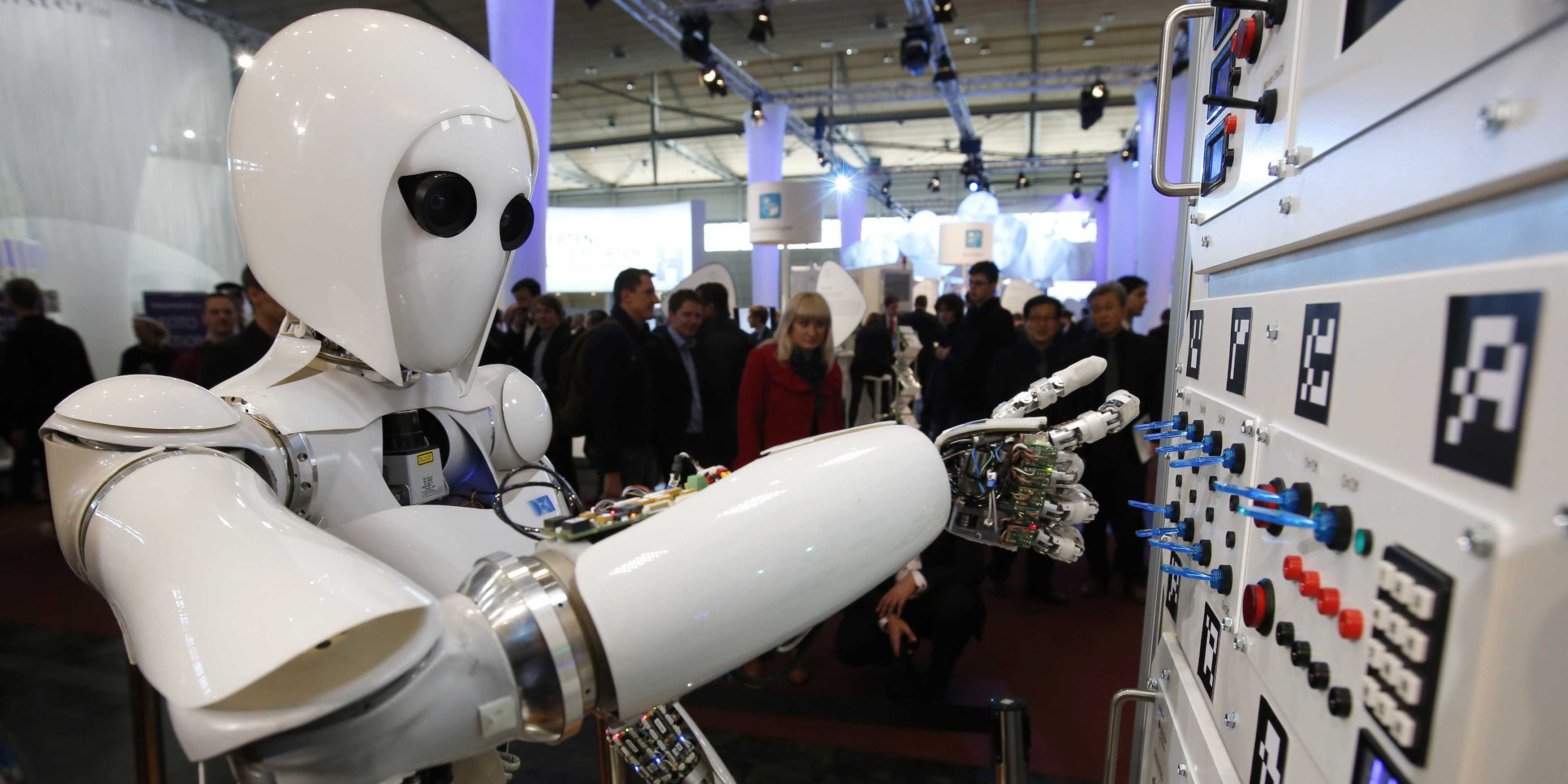

AI fever will carry the bull market higher even as the US tips into recession, veteran trader says

AI fever will carry the bull market even higher, according to Virtus’ Joe Terranova. Terranova pointed to the strong success of AI stocks this year, which have carried the S&P 500. The power of generative AI won’t be wiped away, even if the US tips into a downturn, he said. Loading Something is loading. Thanks… Continue reading AI fever will carry the bull market higher even as the US tips into recession, veteran trader says

The stock market is presenting investors with another ‘buy the dip’ opportunity as sidelined cash piles up and the economy continues to expand, Fundstrat says

A small stock market pullback over the past week represents another “buy the dip” opportunity for investors, according to Fundstrat.Fundstrat highlighted a reawakening IPO market, a growing pile of sidelined cash, and an expanding economy as reasons why investors should buy.”This looks increasingly like an economy slipping into an expansion, not sliding into a recession.”… Continue reading The stock market is presenting investors with another ‘buy the dip’ opportunity as sidelined cash piles up and the economy continues to expand, Fundstrat says

Homeowners now have less equity than a year ago, the first annual decline in a decade

The average US homeowner with a mortgage has less home equity now than 12 months ago. Equity per borrower slipped 1.9% from the same time last year, CoreLogic data shows. It’s the first annual decline in homeowner equity since 2012. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized… Continue reading Homeowners now have less equity than a year ago, the first annual decline in a decade

The housing market is seeing its worst inventory shortage in over a decade as high rates trap homeowners and slow the spring homebuying rush

Active home listings dropped 7% in May to the lowest number Redfin has ever recorded going back to 2012. New listings, meanwhile, fell 25% year over year to 465,000 last month. That’s due to high mortgage rates, which have discouraged owners from selling their homes. Loading Something is loading. Thanks for signing up! Access your… Continue reading The housing market is seeing its worst inventory shortage in over a decade as high rates trap homeowners and slow the spring homebuying rush

Goldman Sachs: Despite slowing macroeconomic conditions, these 50 stocks are poised to increase their profitability faster than the rest of the market

The global profits recession that has been plaguing investors for months may finally be easing. In a recent report, Goldman Sachs identified 50 stocks expected to grow their profitability. The median stock should increase profitability by 13% over the next year, well above the S&P 500. For months, Wall Street analysts have pointed to a… Continue reading Goldman Sachs: Despite slowing macroeconomic conditions, these 50 stocks are poised to increase their profitability faster than the rest of the market

Markets guru David Rosenberg says the tech-stock frenzy reminds him of the dot-com bubble – and warns the US economy is barreling towards recession

David Rosenberg sees shades of the dot-com bubble in the fanfare around tech stocks and the economy. The veteran economist compares AI hype today to internet mania in the early 2000s. A recession appears to be a virtual certainty as the US economy runs out of steam, Rosenberg says. Loading Something is loading. Thanks for… Continue reading Markets guru David Rosenberg says the tech-stock frenzy reminds him of the dot-com bubble – and warns the US economy is barreling towards recession

Short sellers are betting more than $1 trillion against US stocks after big run

Total US short interest exceeded $1 trillion as of last Friday, S3 Partners data shows. The top five shorts are mega-cap tech stocks Tesla, Apple, Microsoft, Nvidia and Amazon. That comes after big stock market gains so far this year. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized… Continue reading Short sellers are betting more than $1 trillion against US stocks after big run