Famed investor Bill Ackman’s hedge fund has revealed a new stake in Alphabet. Pershing Square has bet big on Google’s parent company, snapping up more than $1 billion worth of shares. The investment coincides with Alphabet’s foray into artificial intelligence. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized… Continue reading Billionaire Bill Ackman’s hedge fund unveils a new Alphabet stake worth over $1 billion in a nod to the company’s AI push

Big Tech’s blistering rally lifted the whole stock market in 2023. But that may be about to end – JPMorgan, Morgan Stanley, BofA warn

Mega-cap tech stocks have powered the US stock market’s 2023 rally, but that may not last for long. Analysts at top banks including Morgan Stanley, JPMorgan and BofA warn the sector faces a selloff as a recession looms. Here is a selection of the most recent Wall Street commentary on tech stocks. Loading Something is… Continue reading Big Tech’s blistering rally lifted the whole stock market in 2023. But that may be about to end – JPMorgan, Morgan Stanley, BofA warn

Ray Dalio’s Bridgewater fund dumped GameStop and AMC last quarter – while Jim Simons’ RenTech bet on Tesla and Bed Bath & Beyond

Bridgewater Associates and Renaissance Technologies parted ways on trendy stocks last quarter. Bridgewater, founded by Ray Dalio, sold its stakes in GameStop and AMC Entertainment. Jim Simons’ RenTech bolstered its bet on Elon Musk’s Tesla and bought Bed Bath & Beyond shares. Loading Something is loading. Thanks for signing up! Access your favorite topics in… Continue reading Ray Dalio’s Bridgewater fund dumped GameStop and AMC last quarter – while Jim Simons’ RenTech bet on Tesla and Bed Bath & Beyond

Tech stocks aren’t immune to economic pain – and could be the next domino to fall, Morgan Stanley advisor says

Tech stocks could be the next domino to fall as the market factors in looming economic risks, according to Morgan Stanley’s Chris Toomey. “I don’t think the technology industry is immune from the overall economy,” Toomey told CNBC. The tech sector has enjoyed a sizzling rally so far this year, thanks in part to the… Continue reading Tech stocks aren’t immune to economic pain – and could be the next domino to fall, Morgan Stanley advisor says

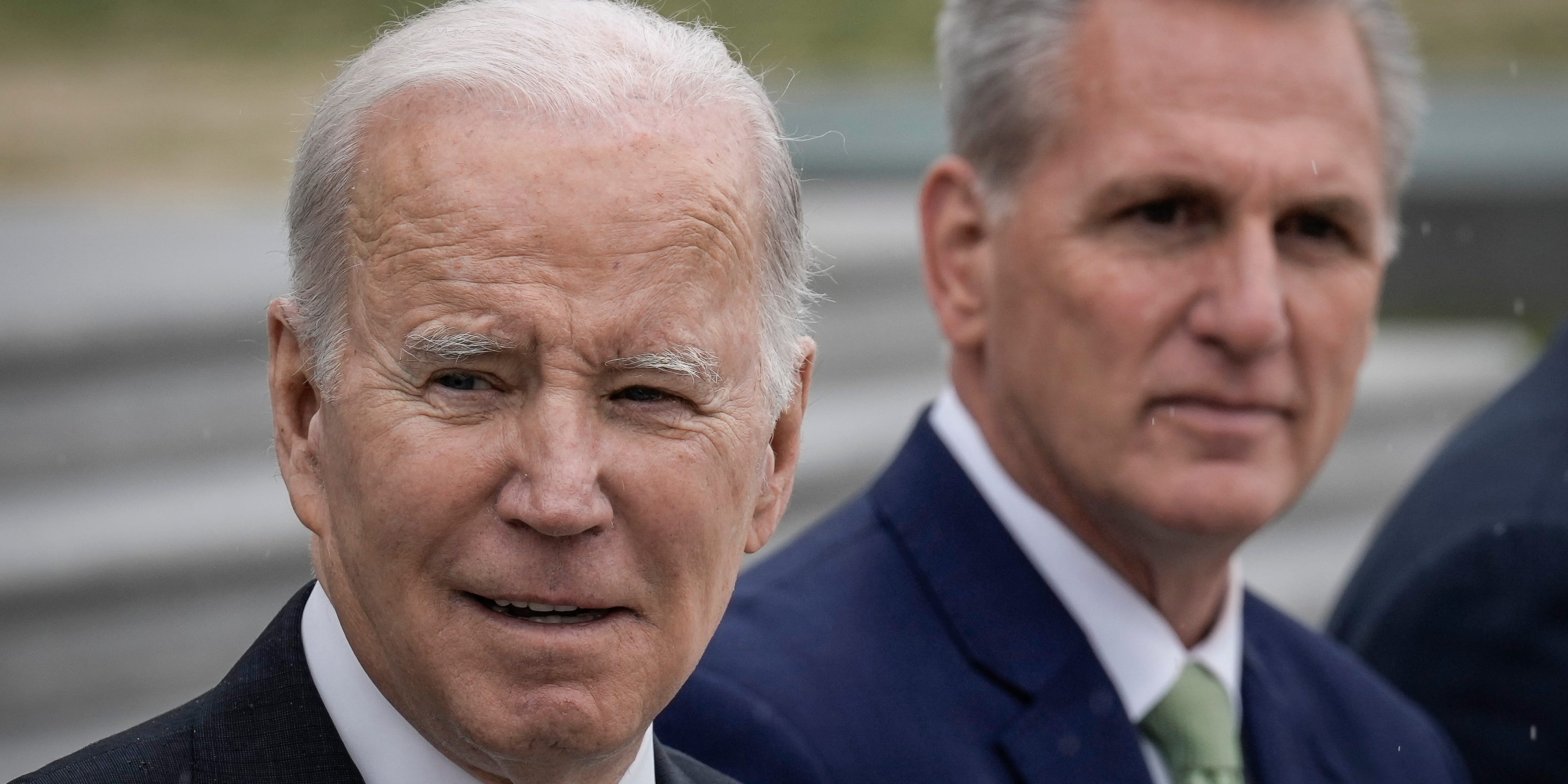

US lawmakers are running out of time to end the debt-limit standoff – so dump stocks and buy bonds, JPMorgan strategist says

Investors should buy Treasurys with debt-ceiling negotiations set to go down to the wire, according to a JPMorgan strategist. The Biden administration and the House of Representatives held talks about resolving the stand-off at the weekend. “They are running out of time… there’s just not that many days left to negotiate,” Alex Wolf told Bloomberg… Continue reading US lawmakers are running out of time to end the debt-limit standoff – so dump stocks and buy bonds, JPMorgan strategist says

Taylor Swift showed her financial savvy when she avoided a FTX deal. She puts her money in a niche type of fund, an elite investor says.

Taylor Swift showed her financial savvy by escaping a deal with FTX, the bankrupt crypto exchange. The pop superstar invests in a specific type of mutual fund, Boaz Weinstein revealed. “For many reasons, it’s hard not to be a Swifty,” the hedge fund manager tweeted after a concert. Loading Something is loading. Thanks for signing… Continue reading Taylor Swift showed her financial savvy when she avoided a FTX deal. She puts her money in a niche type of fund, an elite investor says.

Billionaire investor George Soros’ fund dumped its entire Tesla stake in the first quarter – cashing out on the EV’s maker’s 2023 rebound

Billionaire investor George Soros’ family office dumped its entire stake in Tesla during the first quarter of 2023. Soros Fund Management likely enjoyed gains from the EV stock’s 68% surge in the January-March period. The fund also reduced its exposure to First Horizon Bank amid the banking turbulence. Loading Something is loading. Thanks for signing… Continue reading Billionaire investor George Soros’ fund dumped its entire Tesla stake in the first quarter – cashing out on the EV’s maker’s 2023 rebound

These 7 charts show that the stock market’s secular bull rally is still alive and well

The secular bull rally in the stock market is still alive and well, according to Ned Davis Research.From positive GDP growth to an incredibly low unemployment rate, investors should prepare for more gains in stock prices.These are the seven charts that suggest the secular bull rally in stocks still has room to run, according to… Continue reading These 7 charts show that the stock market’s secular bull rally is still alive and well