Key Takeaways • Not everyone needs to file a tax return each year as several factors come into play when determining your filing requirements. • Generally, if you earn less than the standard deduction for your applicable filing status, you don’t need to file unless you have special tax circumstances. • Not filing a return… Continue reading What Happens If I Don’t File Taxes?

How Changes in Your Life Can Save You Money

Whether you got married last year or purchased your first home, changes experienced in your life can bring about many questions and uncertainties. Although you may have questions about how life events affect your finances, one thing is certain, your (what might seem crazy) ever-changing life can save you money on your taxes. Our TurboTax… Continue reading How Changes in Your Life Can Save You Money

Are Medical Expenses Tax Deductible?

For information on the third coronavirus relief package, please visit our “American Rescue Plan: What Does it Mean for You and a Third Stimulus Check” blog post. Key Takeaways • In 2021, the IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7.5% of their adjusted gross income. Our TurboTax… Continue reading Are Medical Expenses Tax Deductible?

Tax deductions: 9 things you didn’t know about

1. Sales taxesYou have the option of deducting sales taxes or state income taxes off your federal income tax. In a state that doesn’t have its own income tax, this can be a big money saver. Even if you paid state taxes, the sales tax break might be a better deal if you made a… Continue reading Tax deductions: 9 things you didn’t know about

When Can You Claim a Tax Deduction for Health Insurance?

We all know how expensive healthcare can be, so being able to claim a tax deduction for some of your insurance costs can help you save come tax time. Since there are specific rules and qualifications you must follow, here’s an overview of when you can and cannot claim a deduction on your health insurance.… Continue reading When Can You Claim a Tax Deduction for Health Insurance?

Where’s My Tax Refund? The IRS Refund Timetable Explained

Key Takeaways • When you e-file, it typically takes 24 to 48 hours for the IRS to accept your return. • Once your return is accepted, you are on the IRS’ refund timetable. • The IRS typically issues refunds in less than 21 days. • You can use the IRS Where’s My Refund? tool or… Continue reading Where’s My Tax Refund? The IRS Refund Timetable Explained

Guide to Unemployment and Taxes

Key Takeaways • The IRS and some states consider unemployment compensation to be taxable income, which you must report on your federal tax return. • The amount of compensation to report will be located in Box 1 of Form 1099-G “Certain Government Payments,” which your state unemployment division will issue to you. Keep this form… Continue reading Guide to Unemployment and Taxes

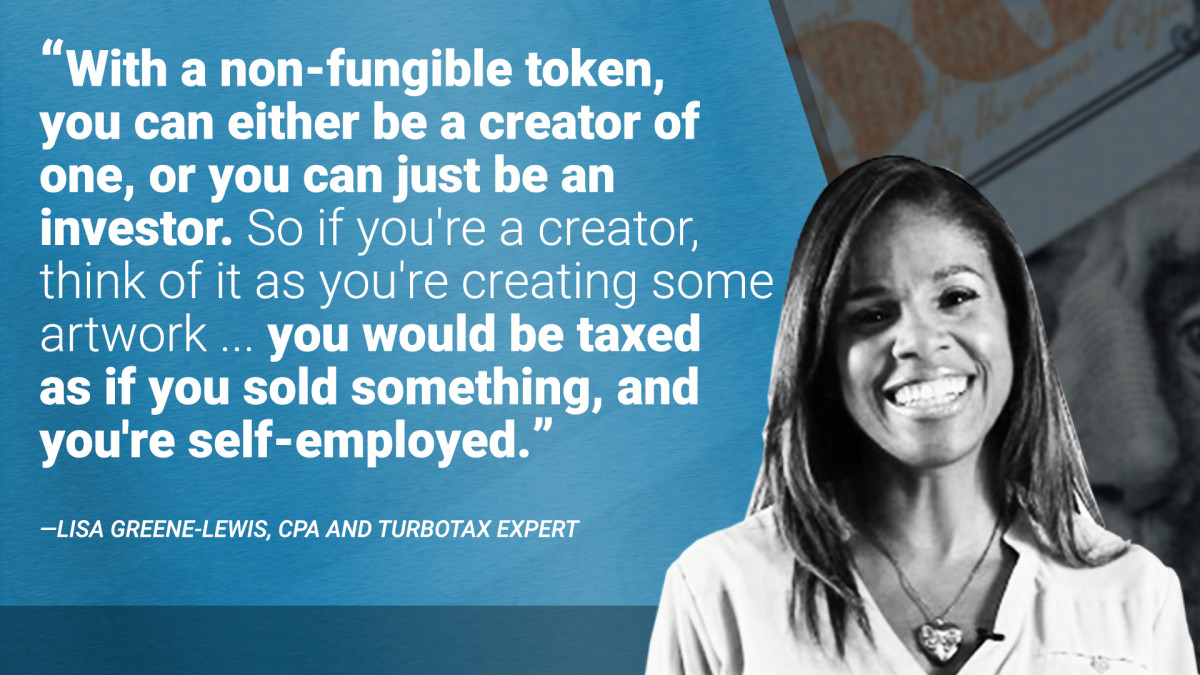

NFT Tax Tips for Investors and Creators

The NFT marketplace exploded in 2021, generating over $23 billion in trading volume, according to blockchain analytics company DappRadar. That total was up from less than $100 million in the year prior. And while the market has lost momentum, the IRS just cares if you made money or not. In the video above, Lisa Greene-Lewis,… Continue reading NFT Tax Tips for Investors and Creators