Consumers are looking for every possible way to save money after facing increased inflation and higher costs, as companies grapple with a rise in labor expenses and supply chain bottlenecks. Shoppers are also looking for ways to cut costs as their bills for groceries and gasoline have been rising steadily for several months. “Consumer discretionary… Continue reading How to Save Money as The Economy Rebounds

Capture Adventure This Summer with $30 Off the GoPro Hero10

Whether you’re headed to the beach, a tropical island, or off on a week-long adventure, this waterproof action camera is ideal for capturing what lies ahead. The Arena Media Brands, LLC and respective content providers to this website may receive compensation for some links to products and services on this website. Summertime is all about… Continue reading Capture Adventure This Summer with $30 Off the GoPro Hero10

Tax Deductions for Rental Property Depreciation

Explaining depreciationDepreciation is the process by which you would deduct the cost of buying or improving rental property. Depreciation spreads those costs across the useful life of the property. TurboTax Premier is designed for all levels of investing and investment types from stocks, to crypto, to ESPPs, and even rental income. It guides you through… Continue reading Tax Deductions for Rental Property Depreciation

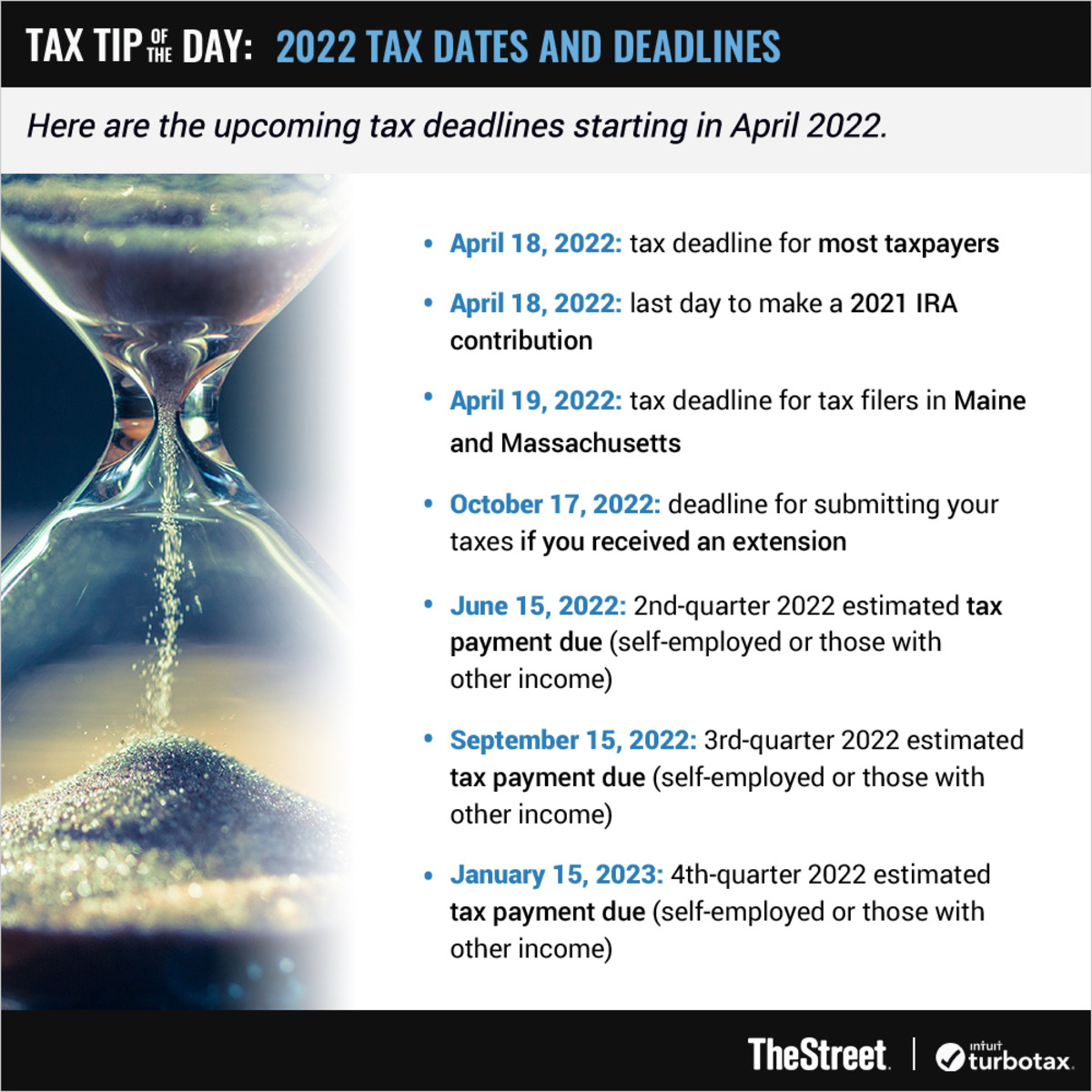

Don’t Miss These Tax Deadlines (You’re Running Out of Time)

The tax deadline is quickly approaching. This year, it’s NOT April 15. Here’s a rundown of the most important tax deadlines and dates to know! 2022 tax filers beware. For most, the tax deadline is on Monday, April 18, 2022. According to the Internal Revenue Service (IRS), holidays impact tax deadlines in the same way… Continue reading Don’t Miss These Tax Deadlines (You’re Running Out of Time)

Guide to Schedule D: Capital Gains and Losses

Most people use the Schedule D form to report capital gains and losses that result from the sale or trade of certain property during the year. As of 2011, however, the Internal Revenue Service created a new form, Form 8949, that some taxpayers will have to file along with their Schedule D and 1040 forms.… Continue reading Guide to Schedule D: Capital Gains and Losses

What Is IRS Form 5498: IRA Contributions Information?

For information on the third coronavirus relief package, please visit our “American Rescue Plan: What Does it Mean for You and a Third Stimulus Check” blog post. When you save for retirement with an individual retirement arrangement, you probably receive Form 5498 each year. The institution that manages your IRA must report all contributions you… Continue reading What Is IRS Form 5498: IRA Contributions Information?

Here’s Where Americans Are Spending Their Money

Americans have found themselves spending the majority of their money on a narrow slice of items, as the economy continues to attempt a rebound from the pandemic. The price of many items have risen exponentially due to a higher cost from labor expenses and supply chain hurdles. Higher inflation rates have increased in various sectors,… Continue reading Here’s Where Americans Are Spending Their Money

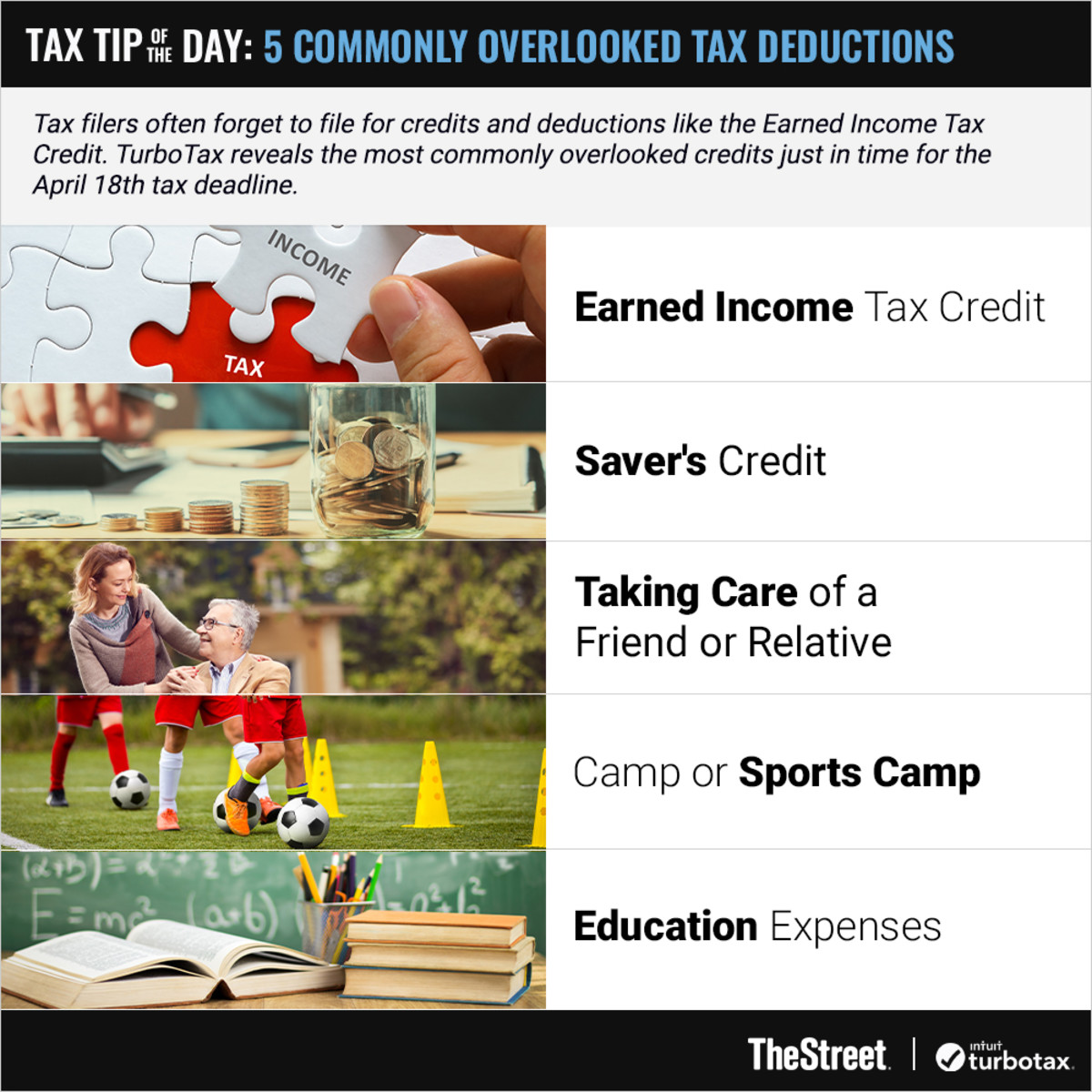

5 Tax Deductions Commonly Overlooked

Only 1-in-5 tax filers claim a little-known tax credit called the Saver’s Credit (Retirement Savings Contributions Credit). There are others, too. 5 Tax Deductions Commonly OverlookedEarned Income Tax CreditSaver’s CreditTaking Care of a Friend or RelativeCamp or Sports Camp Education Expenses Graphic: Tax Tip of The Day: 5 Commonly Overlooked Tax Deductions Watch the video above, Lisa… Continue reading 5 Tax Deductions Commonly Overlooked