The SAFE Banking Act is back in focus as senators prepare to take the next step down the long, 10-year path of cannabis federal banking reform. Members of the Senate Banking Committee have reportedly reworked key sections of the Secure and Fair Enforcement (SAFE) Banking Act and found a “sweet spot” that allows for a… Continue reading SAFE Banking Act Hits a ‘Sweet Spot’: This Week in Cannabis Investing

US debt interest payments are unsustainable and flash ‘huge warning signs’ as they take over federal spending, budget expert warns

The trajectory of US debt interest payments is not sustainable, Maya MacGuineas told Insider. Interest will eclipse defense spending in four years, the Committee for a Responsible Federal Budget president said. By 2051, interest payments will be the single largest federal expenditure, topping Social Security. Loading Something is loading. Thanks for signing up! Access your… Continue reading US debt interest payments are unsustainable and flash ‘huge warning signs’ as they take over federal spending, budget expert warns

Crypto is growing up: Goodbye yacht parties and NFTs, hello regulation and practical tech

The three-day Messari Mainnet conference in New York was less expensive and less fun than it was a year ago. Gone were the Reddit bros and yacht parties, and in their place came suits and talk of regulation. Insider’s Phil Rosen caught up with dozens of attendees and executives at the conference. Loading Something is… Continue reading Crypto is growing up: Goodbye yacht parties and NFTs, hello regulation and practical tech

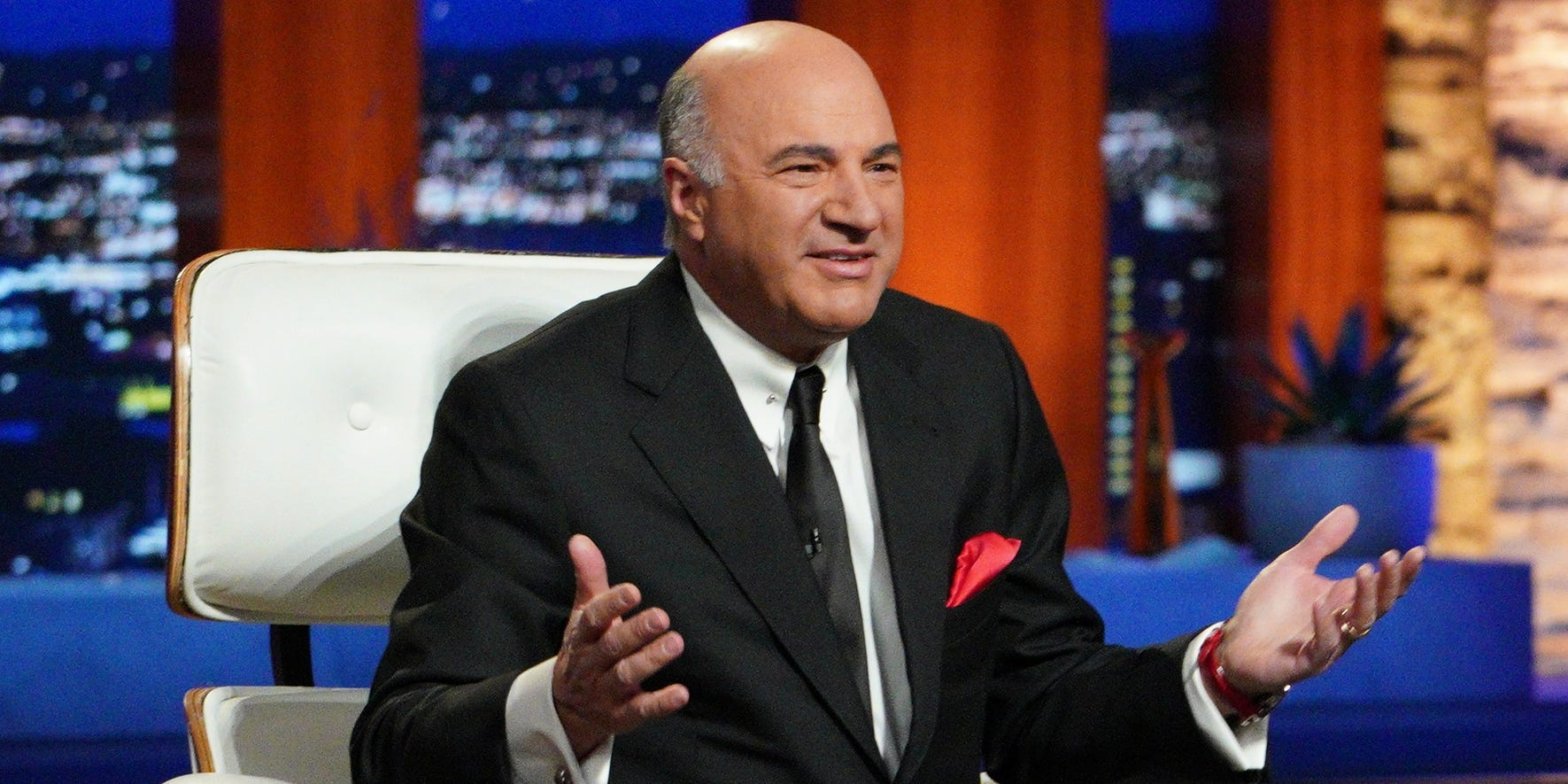

‘Shark Tank’ investor Kevin O’Leary likely made over 20 times his money on a startup selling genetic-testing kits for cats

Kevin O’Leary probably made over 20 times his money from one “Shark Tank” investment. He purchased a small stake in Basepaws, a startup offering at-home genetic testing for cats. Basepaws was acquired for over $50 million by Zoetis last year, netting O’Leary a monster return. Loading Something is loading. Thanks for signing up! Access your… Continue reading ‘Shark Tank’ investor Kevin O’Leary likely made over 20 times his money on a startup selling genetic-testing kits for cats

How two former Goldman Sachs traders built the No. 1 US coal exporting business

Two ex-Goldman bankers have made their fortune betting on a non-renewable resource, Bloomberg reported. Peter Bradley and Spencer Sloan have built a $1 billion commodities firm over the last eight years. Javelin Global Commodities is now the No. 1 US coal exporter despite the environmental concerns associated with the fuel. Loading Something is loading. Thanks… Continue reading How two former Goldman Sachs traders built the No. 1 US coal exporting business

Nvidia stock is a bubble waiting to burst – and the AI rush may be a modern version of 17th-century tulip mania, note says

Nvidia’s stock price has become a bubble, according to Rebellion Research. Shares could soon crash like 17th-century tulips or 1990s dot-com companies did, the think tank said. The semiconductor giant has soared 180% this year, thanks to the rise of generative AI. Loading Something is loading. Thanks for signing up! Access your favorite topics in… Continue reading Nvidia stock is a bubble waiting to burst – and the AI rush may be a modern version of 17th-century tulip mania, note says

Stock Market Today: Stocks Head South as Treasury Yields Hit New Highs

Stocks continued their post-Fed slump Thursday, with all 11 S&P 500 sectors finishing in the red. While the central bank held rates steady at its September meeting, it left the door open for another rate hike by year’s end – news that sent Treasury yields spiking to levels not seen in nearly two decades. Indeed,… Continue reading Stock Market Today: Stocks Head South as Treasury Yields Hit New Highs

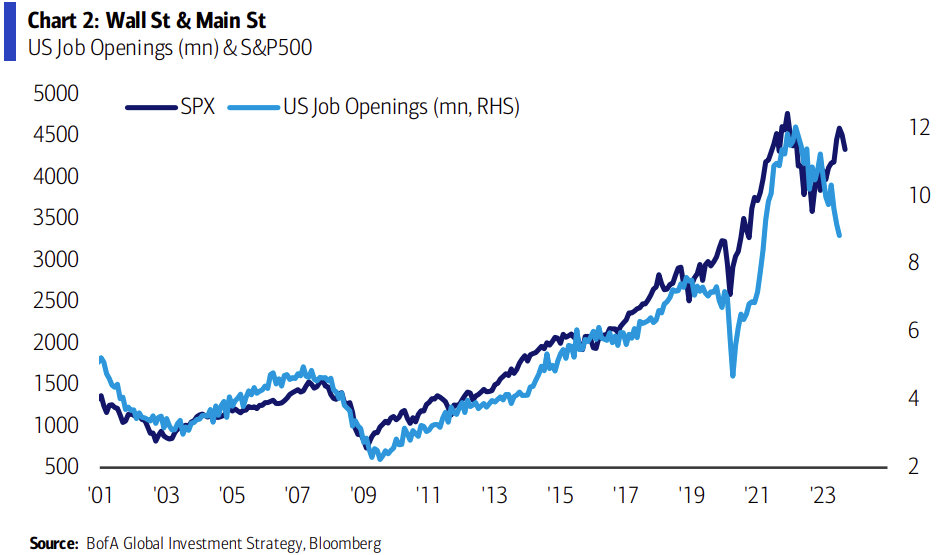

CHART OF THE DAY: Falling job openings raise red flags for the stock market – ‘Sell the last hike’

An ongoing decline in job openings is not a good sign for the stock market, according to Bank of America.Job openings have dropped 27% since their peak of 12 million in March 2022.The bank highlighted that since 2001, job openings and the S&P 500 have had a strong correlation. Loading Something is loading. Thanks for… Continue reading CHART OF THE DAY: Falling job openings raise red flags for the stock market – ‘Sell the last hike’