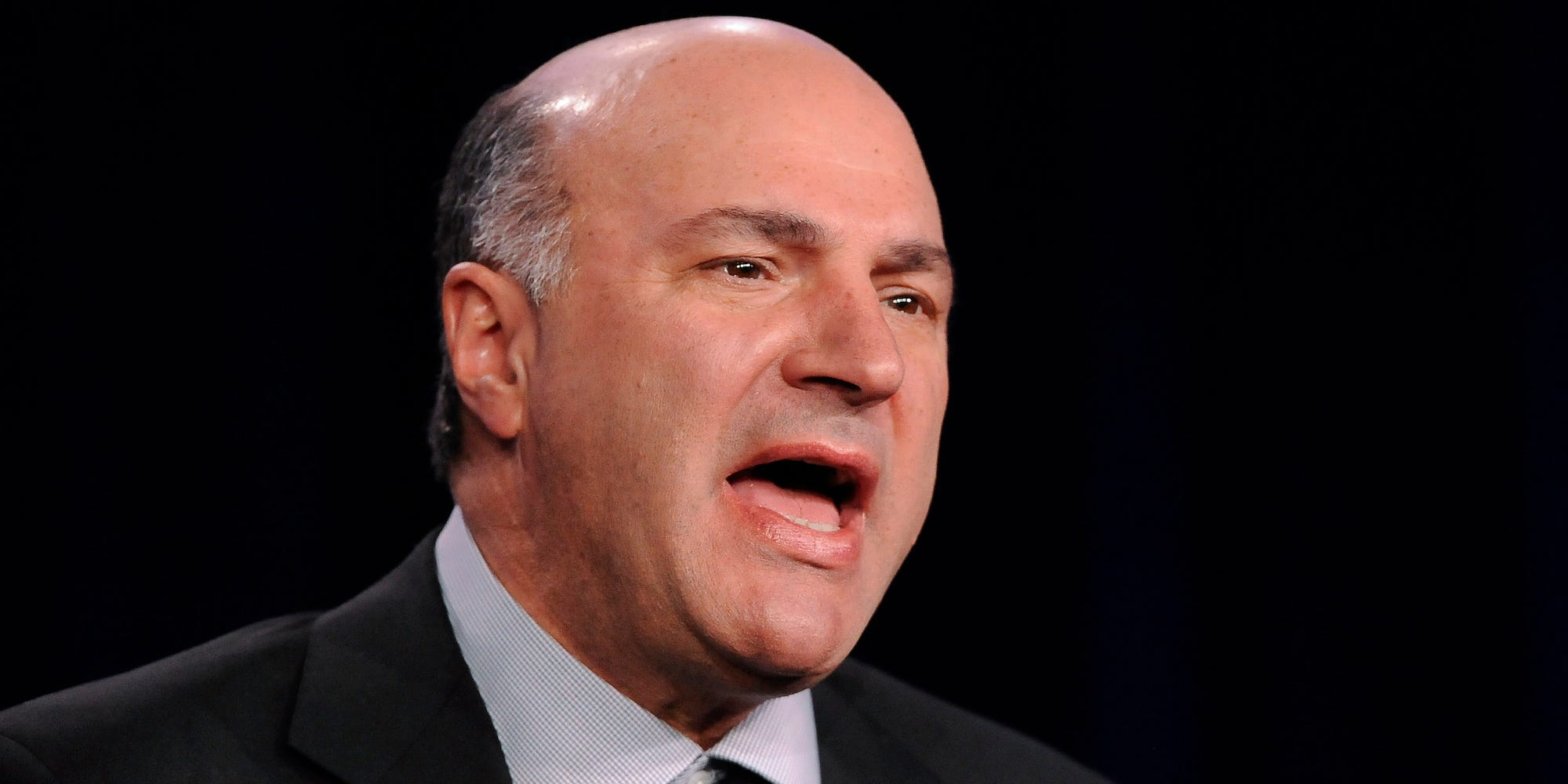

The Fed will likely spark more pain for the US economy, according to “Shark Tank” star Kevin O’Leary. He predicted the Fed will push interest rates to 6% in a bid to lower inflation. That could spark pain for small businesses, Loading Something is loading. Thanks for signing up! Access your favorite topics in a… Continue reading ‘Shark Tank’ investor Kevin O’Leary warns of more pain coming for the economy as the Fed is poised to hike rates higher and as oil prices keep rising

Home values could collapse as rising climate dangers wreak havoc on insurance markets, study says

US home values could collapse as climate change boosts insurance costs, a study from First Street Foundation said. More insurers are hiking premiums or leaving at-risk areas, forcing homeowners to rely on costlier state-run programs. First Street estimated that 39 million homes are still insured at prices that don’t match the climate risks they face.… Continue reading Home values could collapse as rising climate dangers wreak havoc on insurance markets, study says

US stocks rise but head for losing week amid spike in bond yields and surging oil prices

Phil Rosen Lucas Jackson/Reuters US stocks ticked higher Friday but were on track for a losing week. Oil prices and bond yields surged during the week, with Brent crude up 0.75% Friday. Policymakers made no rate adjustment Wednesday, but could make one more hike before year’s end. Loading Something is loading. Thanks for signing up!… Continue reading US stocks rise but head for losing week amid spike in bond yields and surging oil prices

A small New York hedge fund has secretly managed $7 billion for a Russian oligarch for over a decade, the SEC says

The SEC this week charged a small New York hedge fund with acting as an unregistered investment advisor. Concord Management earned tens of millions of dollars advising a Russian tycoon, the SEC said. The New York Times said the businessman in question was the former Chelsea FC owner Roman Abramovich. Loading Something is loading. Thanks… Continue reading A small New York hedge fund has secretly managed $7 billion for a Russian oligarch for over a decade, the SEC says

Stocks Close Lower After Hawkish Fed Pause

Stocks were choppy in the lead up to this afternoon’s policy announcement from the Federal Reserve. The major indexes failed to lift off after the central bank held interest rates steady, as expected, but signaled they will stay higher for longer. Today’s anticipated pause by the Fed left the short-term federal funds rate at a… Continue reading Stocks Close Lower After Hawkish Fed Pause

The Fed Holds Interest Rates Steady

Federal Reserve officials held the benchmark interest rate steady at the current 5.25% to 5.5% target range today as they seek to ease inflation and avoid a recession. At the Sept. 20 conclusion of its two-day policy meeting, the Federal Open Market Committee (FOMC) announced that, while it will maintain the federal funds rate, inflation… Continue reading The Fed Holds Interest Rates Steady

Higher for longer interest rates won’t derail the tech sector, Wedbush says

Technology stocks can navigate a period of higher for longer interest rates, according to Wedbush.That’s because there are strong underlying fundamental drivers like AI that should accelerate growth for the sector.Wedbush says it’s eyeing the “biggest tech revolution we have seen in 30 years” on the horizon. Loading Something is loading. Thanks for signing up!… Continue reading Higher for longer interest rates won’t derail the tech sector, Wedbush says

Russia’s economy is headed for stagnation as the path of monetary policy is being chosen ‘very poorly,’ economists say

Russia’s economy is stumbling and could be headed for stagnation, economists said. That’s because policymakers have timed interest rate hikes “very poorly,” a new report says. Russian inflation could hit 5.6% this month, the nation’s own economists forecasted. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized feed while… Continue reading Russia’s economy is headed for stagnation as the path of monetary policy is being chosen ‘very poorly,’ economists say