Proposed minimum tax on oligarch-like billionaires and millionaires decried as ‘un-American’ by reality VC. A proposal by the Biden administration to assess a minimum tax on the super-rich has drawn sharp criticism from Kevin O’Leary of TV’s “Shark Tank.” “This is un-American, this idea,” O’Leary said in an interview on CNBC Monday. “If you take… Continue reading Elon Musk Shouldn’t Be Taxed, ‘Shark Tank’’s Kevin O’Leary Says

6 Stocks Rewarding Investors With Generous Buybacks | Kiplinger

Stock buybacks for 2021 might exceed $1 trillion according to preliminary data from Standard & Poor’s. That’s a big number. To put it in context, the market capitalization of the New York Stock Exchange (NYSE) at the end of December 2021 was $27 trillion, suggesting that about 4% of shares are being repurchased. But it’s… Continue reading 6 Stocks Rewarding Investors With Generous Buybacks | Kiplinger

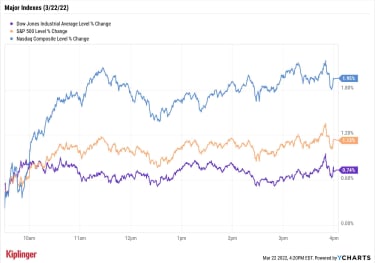

Stock Market Today: Markets Rebound Despite Higher Rate Expectations | Kiplinger

Stocks broadly recovered Tuesday as investors continued to weigh Federal Reserve Chair Jerome Powell’s more hawkish tone on inflation and its potential impact on the size and pace of future interest rate hikes. Kristina Hooper, chief global market strategist for Invesco, says the Fed might be hoping to influence the yield curve more by words… Continue reading Stock Market Today: Markets Rebound Despite Higher Rate Expectations | Kiplinger

4 Regional Bank Stocks Rooting for More Rate Hikes | Kiplinger

bank stocks Rate-sensitive regional bank stocks could be among the top beneficiaries of the Fed’s hiking cycle, especially if the U.S. manages to avoid a yield inversion.The Federal Reserve recently announced a much-anticipated hike in interest rates – a 25-basis-point uptick that’s expected to be just the first of several this year. The Fed’s hawkishness… Continue reading 4 Regional Bank Stocks Rooting for More Rate Hikes | Kiplinger

Stock Market Today: Stocks Slip After Powell Talks Rate Hikes | Kiplinger

Stock Market Today Powell indicated the central bank could get more aggressive with rate hikes to combat inflation that is “too high.”Stocks’ positive momentum faded to start the new week after Federal Reserve Chair Jerome Powell said the central bank is prepared to move “expeditiously” towards tighter monetary policy in order to fight inflation. “We… Continue reading Stock Market Today: Stocks Slip After Powell Talks Rate Hikes | Kiplinger

Warren Buffett’s Berkshire Hathaway to Buy Insurer Alleghany for $11.6 Billion | Kiplinger

stocks Warren Buffett’s holding company tapped into its massive cash pile to make its biggest acquisition in years.Warren Buffett put some of Berkshire Hathaway’s (BRK.B, $342.41) massive cash pile to work on Monday, striking a deal to acquire insurer Alleghany (Y, $676.75) for $11.6 billion. The purchase adds to Berkshire’s already sprawling core of insurance… Continue reading Warren Buffett’s Berkshire Hathaway to Buy Insurer Alleghany for $11.6 Billion | Kiplinger

The market is flashing a buy signal suggesting stocks will rally one last time before an ‘epic’ selling opportunity in the 2nd-quarter, Bank of America says

The stock market flashed a contrarian buy signal this week that has led to swift gains in the past. Bank of America’s bull/bear indicator fell to the 2.0 level for the first time since March 18, 2020.While a stock market rally is likely over the next few weeks, it will represent an “epic” sell opportunity… Continue reading The market is flashing a buy signal suggesting stocks will rally one last time before an ‘epic’ selling opportunity in the 2nd-quarter, Bank of America says

Interest rates are rising and bond yields are up but investors should be confident that stocks are still the more attractive bet for now, experts say

US stocks and bonds have largely been selling off this year, with bond yields across the curve stepping higher. Richer rates offered to investors to buy government bonds may look somewhat alluring but stocks, for now, are the better bet, two market experts told Insider. Inflation is running around 8%, denting returns for bondholders. Loading… Continue reading Interest rates are rising and bond yields are up but investors should be confident that stocks are still the more attractive bet for now, experts say