Executives at First Republic Bank and Silicon Valley Bank sold stock right before the banking crisis.First Republic’s chief risk officer sold shares two days before the Silicon Valley Bank implosion.President Joe Biden called on Congress to allow regulators to claw back bank executives’ compensation following the collapse. Loading Something is loading. Thanks for signing up!… Continue reading Executives at Silicon Valley Bank and First Republic Bank sold millions of stock right before the crash

Fed Chair Jerome Powell reportedly blocked a statement on regulatory flaws that led to SVB’s collapse

The NYT reported that Fed Chair Powell blocked a mention of regulatory failings in a report on SVB. The final joint statement on SVB’s fall speaks mostly of regulators’ work since the 2008 crisis. Some have blamed the fall of SVB on a lack of oversight stemming from policy rollbacks by the Trump Administration. Loading… Continue reading Fed Chair Jerome Powell reportedly blocked a statement on regulatory flaws that led to SVB’s collapse

Home prices fell annually for the first time since 2012, but the collapse of Silicon Valley Bank is bringing more buyers to the housing market

In February, home prices fell on a year-over-year basis for the first time since 2012, Redfin said. But March has seen a shift in the market with the implosion of Silicon Valley Bank. More homebuyers came into the market as mortgage rates dropped. Loading Something is loading. Thanks for signing up! Access your favorite topics… Continue reading Home prices fell annually for the first time since 2012, but the collapse of Silicon Valley Bank is bringing more buyers to the housing market

Dow jumps 372 points as US stocks surge on rescue plans for struggling banks

US stocks closed higher Thursday, swinging from earlier losses. First Republic Bank will receive a $30 billion deposit from larger rivals. JPMorgan earlier estimated the Fed’s emergency loan program may inject $2 trillion into the US banking system. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized feed… Continue reading Dow jumps 372 points as US stocks surge on rescue plans for struggling banks

Home construction unexpectedly surged in February as slump in lumber prices offset pain of rising mortgage rates

US housing starts surged in February, with the upside surprise boosted by falling lumber prices in the month. Construction projects pushed through a period of rising mortgage rates. Lumber prices climbed Thursday to trade above $400 per thousand board feet Thursday. Loading Something is loading. Thanks for signing up! Access your favorite topics in a… Continue reading Home construction unexpectedly surged in February as slump in lumber prices offset pain of rising mortgage rates

Cathie Wood blames the Fed for driving SVB and Signature Bank to collapse

Cathie Wood said the central bank’s tightening campaign was fuel for the banking crisis. In a series of tweets, she described the Fed as the “primary culprit” for SVB’s failure. “I am baffled that banks and regulators could not convince the Fed that disaster loomed.” Loading Something is loading. Thanks for signing up! Access your… Continue reading Cathie Wood blames the Fed for driving SVB and Signature Bank to collapse

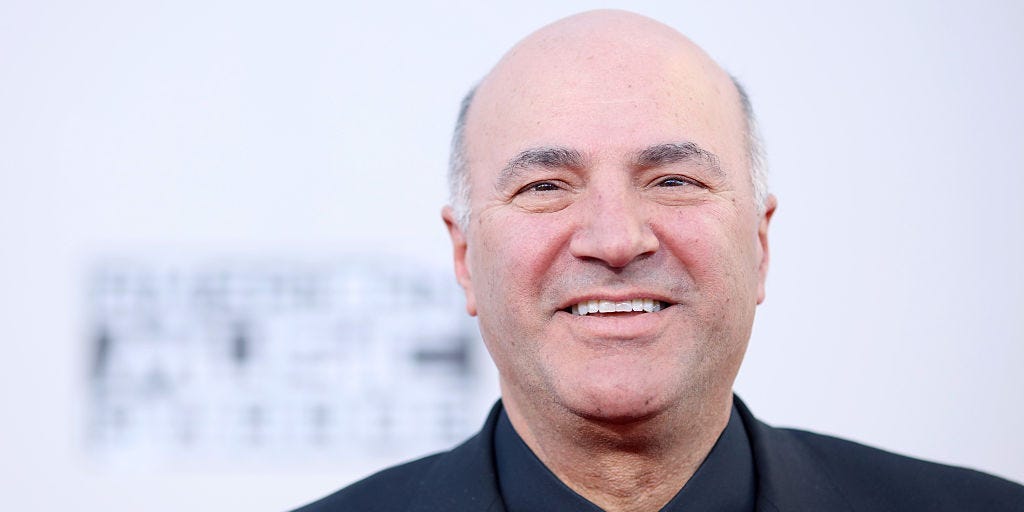

‘Shark Tank’ investor Kevin O’Leary says he’s telling startup CEOs to limit bank deposits and brace for the next ‘black swan idiot’ blowup

“Shark Tank” investor Kevin O’Leary is advising his CEOs to limit their deposits at banks. That comes after the blowup of SVB, which was caused by “idiot” bank managers, O’Leary said. “There’s always the next black swan idiot manager in big and small banks,” O’Leary said. Loading Something is loading. Thanks for signing up! Access… Continue reading ‘Shark Tank’ investor Kevin O’Leary says he’s telling startup CEOs to limit bank deposits and brace for the next ‘black swan idiot’ blowup

Silicon Valley Bank acted like a hedge fund, and ‘they deserve what they got,’ bank analyst says

SVB was a “hedge fund in drag,” taking risky bets at a poor time, Chris Whalen said. But other banks shouldn’t be blamed for losses in their bond portfolios, he told CNBC. Instead, the losses are the Fed’s responsibility after it hiked rates aggressively, he added. Loading Something is loading. Thanks for signing up! Access… Continue reading Silicon Valley Bank acted like a hedge fund, and ‘they deserve what they got,’ bank analyst says