Credit Suisse will receive liquidity if needed, a Swiss regulator and the country’s central bank said late Wednesday. Credit Suisse “meets the capital and liquidity requirements imposed on systemically important banks,” the authorities said. Credit Suisse shares crashed on Wednesday after its largest shareholder said no more financial backing will be granted. Loading Something is… Continue reading Switzerland’s central bank says it will provide liquidity to Credit Suisse if deemed necessary for the embattled lender

‘Dr. Doom’ Nouriel Roubini says Credit Suisse may be too big to save and risks igniting a ‘Lehman moment’

“Dr. Doom” economist Nouriel Roubini said Credit Suisse may be too big to fail and too big to save. He told Bloomberg TV there are doubts Switzerland could engineer a bailout. The Swiss National Bank said it will provide liquidity to Credit Suisse, if necessary. Loading Something is loading. Thanks for signing up! Access your… Continue reading ‘Dr. Doom’ Nouriel Roubini says Credit Suisse may be too big to save and risks igniting a ‘Lehman moment’

US stocks trade mixed as Credit Suisse troubles stoke fears of a banking crisis

Jennifer Sor Reuters / Brendan McDermid US stocks fell on Wednesday as fears of a banking crisis continued to rip through the market. Troubles at Credit Suisse alarmed investors, sparking a steep sell-off in shares of the Swiss bank. But the Swiss National Bank later said it will provide Credit Suisse with liquidity, if necessary.… Continue reading US stocks trade mixed as Credit Suisse troubles stoke fears of a banking crisis

Buy large cap US bank stocks as there’s no evidence of a systemic banking crisis, research firm says

Investors should treat the collapse of Silicon Valley Bank as an opportunity to buy large cap US bank stocks, according to TS Lombard.The investment research firm said it sees no evidence of a systemic banking crisis unfolding.”Market participants are now paying more attention to balance sheets, but the official response is enough to prevent contagion,”… Continue reading Buy large cap US bank stocks as there’s no evidence of a systemic banking crisis, research firm says

Credit Suisse is just the ‘tip of the iceberg’ as banking turmoil snarls financial markets, JPMorgan Asset Management investment chief says

JPMorgan Asset Management’s CIO predicts more pain ahead for the banking sector and the economy. Turmoil at Credit Suisse is just the “tip of the iceberg,” JPMorgan’s Bob Michele told Bloomberg. Michele says a recession is “inevitable” as panic ripples through markets. Loading Something is loading. Thanks for signing up! Access your favorite topics in… Continue reading Credit Suisse is just the ‘tip of the iceberg’ as banking turmoil snarls financial markets, JPMorgan Asset Management investment chief says

Charles Schwab CEO says clients poured in $4 billion at the height of the SVB panic

CEO Walter Bettinger said inflows grew significantly the day Silicon Valley Bank began to collapse. He also told CNBC that he bought 50,000 shares of Charles Schwab on Tuesday for his personal account. He said Charles Schwab is managed conservatively and has a different business model than regional banks. Loading Something is loading. Thanks for… Continue reading Charles Schwab CEO says clients poured in $4 billion at the height of the SVB panic

US stocks rise as bank stocks rebound and CPI shows inflation continues to cool

Morgan Chittum Michael M. Santiago/Getty Images US stocks closed higher on cooling inflation data as trader shrug off concerns of a potential regional bank crisis. The Dow Jones Industrial Average snapped its five-day losing steak on Tuesday. Elsewhere, bitcoin surged 15% and hit a 9-month high in the morning. Loading Something is loading. Thanks for… Continue reading US stocks rise as bank stocks rebound and CPI shows inflation continues to cool

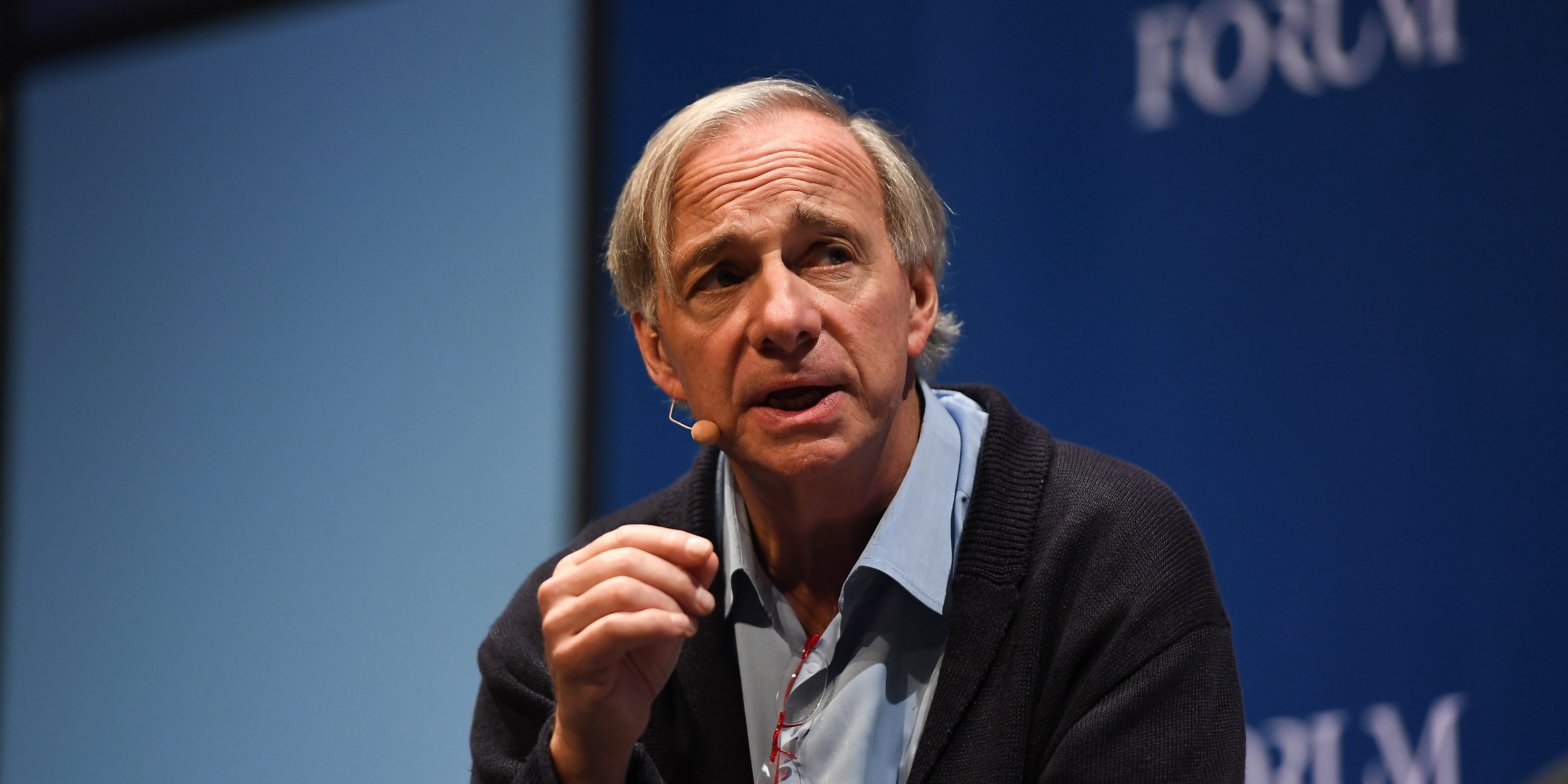

Billionaire investor Ray Dalio says the Silicon Valley Bank failure marks a ‘canary in the coal mine’ that will have repercussions beyond the VC world

Ray Dalio said the Silicon Valley Bank failure is a “canary in the coal mine” for what’s to come. Dalio wrote Tuesday that this is part of the classic “bubble-bursting part” of the short-term debt cycle. He explained how it fits into broader historical trends and debt cycles. Loading Something is loading. Thanks for signing… Continue reading Billionaire investor Ray Dalio says the Silicon Valley Bank failure marks a ‘canary in the coal mine’ that will have repercussions beyond the VC world