The federal rescue of SVB depositors means all bank deposits are guaranteed, Roger Altman said. If that’s the case, “should the taxpayer allow the shareholders to realize the benefit of that?” He also told CNBC that SVB’s demise signals fragility in finance as well as out-of-date policies. Loading Something is loading. Thanks for signing up!… Continue reading The Silicon Valley Bank rescue means regulators have guaranteed deposits for the entire US financial system, Evercore founder Roger Altman says

SVB’s collapse completely screwed things up for companies with bad credit

The SVB collapse is going to make it a lot more expensive for companies with bad credit to raise capital.The spread on junk-rated bonds relative to US Treasuries has surged to the widest level since December 30.SVB’s fall also eliminates a key source of funding for start-ups that would typically be denied by traditional banks.… Continue reading SVB’s collapse completely screwed things up for companies with bad credit

The Fed says it will investigate its oversight of Silicon Valley Bank following the biggest bank failure since 2008

The Fed will investigate its oversight of Silicon Valley Bank, Chairman Jerome Powell said Monday. “The events surrounding Silicon Valley Bank demand a thorough, transparent, and swift review by the Federal Reserve.” SVB became the biggest bank failure since 2008 after regulators closed it Friday. Loading Something is loading. Thanks for signing up! Access your… Continue reading The Fed says it will investigate its oversight of Silicon Valley Bank following the biggest bank failure since 2008

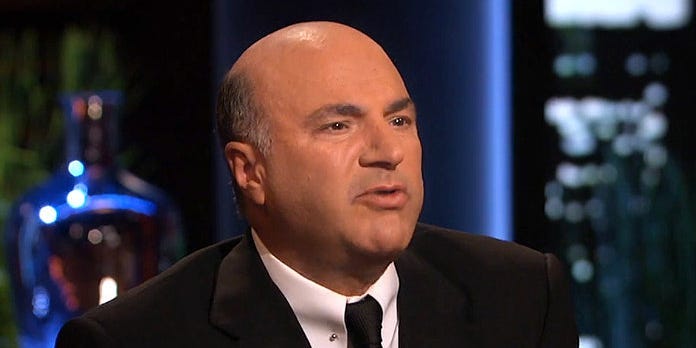

‘Shark Tank’ star Kevin O’Leary says he will never buy a bank stock again as Biden has essentially nationalized the industry post-SVB

“Shark Tank” star Kevin O’Leary won’t invest in banks, expecting tighter regulation to kill profits. Although the crisis began with regional banks, O’Leary sees stricter policies hitting bigger lenders. “If you thought putting your money into bank stocks was a good idea, you should change your mind this morning — forever.” Loading Something is loading.… Continue reading ‘Shark Tank’ star Kevin O’Leary says he will never buy a bank stock again as Biden has essentially nationalized the industry post-SVB

US stocks shake off contagion fears to trade mixed amid hopes SVB crisis spurs Fed policy shift

Matthew Fox Reuters US stocks managed to prove resilient and shake off a potential regional bank crisis, with stocks mixed.The implosion of Silicon Valley Bank and Signature Bank spurred hopes that the Fed will end its interest rate hikes.”We are looking at a historic 2-day drop in the 2-year yield, the largest since right after… Continue reading US stocks shake off contagion fears to trade mixed amid hopes SVB crisis spurs Fed policy shift

Crypto just lost 3 of its most important banking partners in a week. Here’s what experts say the impact will be on the industry.

Insider asked crypto execs and experts where the industry will go after critical partners failed. Markets are at risk of more volatility and less liquidity in the near term, one cofounder said. Others see a bull case for decentralized finance and parking assets in non-custodial wallets. Loading Something is loading. Thanks for signing up! Access… Continue reading Crypto just lost 3 of its most important banking partners in a week. Here’s what experts say the impact will be on the industry.

Sell any rally in the stock market as fallout from Silicon Valley Bank’s failure isn’t over after government intervention, Morgan Stanley’s chief stock strategist says

Sell bounces in the stock market as the impact of SVB’s failure plays out, said Morgan Stanley. The government’s assurance to depositors eases contagion fears, but earnings are under pressure. “We suggest selling any bounces … until we make new bear market lows, at a minimum,” said CIO Mike Wilson. Loading Something is loading. Thanks… Continue reading Sell any rally in the stock market as fallout from Silicon Valley Bank’s failure isn’t over after government intervention, Morgan Stanley’s chief stock strategist says

Adidas stock price faces these 6 threats with Yeezy split set to wipe out $1.3 billion in earnings

Adidas’ share price could be under threat after the sportswear giant ended its Yeezy partnership. The company warned last month that it faces a $1.3 billion earnings wipeout after cutting ties with Ye. It’s also been battered by declining sales in China and Nike’s recent surge. Loading Something is loading. Thanks for signing up! Access… Continue reading Adidas stock price faces these 6 threats with Yeezy split set to wipe out $1.3 billion in earnings