Hotter-than-expected inflation has prompted Wall Street to take stock of the Federal Reserve. With another jumbo rate hike on deck, investors worry the Fed risks a recession by going too far. Here’s what Stanley Druckenmiller, Jeff Gundlach and 4 other Fed watchers had to say. Loading Something is loading. A surprisingly hot US inflation number… Continue reading The Fed’s like a ‘reformed smoker’, Stanley Druckenmiller says, while Jeff Gundlach warns it’s driving the US into a dumpster. 6 market experts talk straight about rate hikes.

Goldman Sachs: Buy these 26 stocks with solid financials that are set to outperform as beneficiaries of the Fed’s rate hikes

Goldman Sachs’s US Economics team is anticipating three rate hikes this year, ending at a 4% rate. The rising cost of capital will have a negative impact on valuation expansion, strategists say. Therefore, companies with high-quality fundamentals are attractive to buy. It’s looking like interest rate hikes aren’t going away anytime soon even as financial… Continue reading Goldman Sachs: Buy these 26 stocks with solid financials that are set to outperform as beneficiaries of the Fed’s rate hikes

‘Big Short’ trader Greg Lippmann discusses his career, his iconic bet against the housing bubble, and his Fed outlook in a new interview. Here are the 8 best quotes.

Greg Lippmann of “The Big Short” fame discussed his famous bet against the US housing bubble. The former Deutsche Bank trader detailed how he identified the lucrative opportunity. Lippmann also reflected on his career path, and being played by Ryan Gosling on screen. Loading Something is loading. Greg Lippmann, the Deutsche Bank trader portrayed by… Continue reading ‘Big Short’ trader Greg Lippmann discusses his career, his iconic bet against the housing bubble, and his Fed outlook in a new interview. Here are the 8 best quotes.

The Fed may ‘just get it over with’ by raising rates as much as 100 basis points at the next meeting and then hiking one more time, says market bull Ed Yardeni

The Fed could “just get it over with” by lifting rates 100 basis points this month and then hiking one more time, according to Ed Yardeni. The market bull suggested the Fed may decide to frontload its rate hikes to tackle inflation more aggressively. Markets are pricing in an 84% probability that the central bank… Continue reading The Fed may ‘just get it over with’ by raising rates as much as 100 basis points at the next meeting and then hiking one more time, says market bull Ed Yardeni

Here’s what comes next for the world’s top currencies as Fed moves and global growth fears weigh on foreign exchange markets

The US Dollar has spiked up against major currencies this year, including a 24% surge against the Japanese yen. The Federal Reserve’s rate hikes are a key factor lifting the dollar but there are others at play, too. Spiking energy prices and growth worries are contributing to weakness in the greenback’s rivals. Loading Something is… Continue reading Here’s what comes next for the world’s top currencies as Fed moves and global growth fears weigh on foreign exchange markets

Wall Street strategists are torn on whether the stock market is about to crash or soar 20% ahead of next week’s Fed meeting. Here’s where 6 market experts stand.

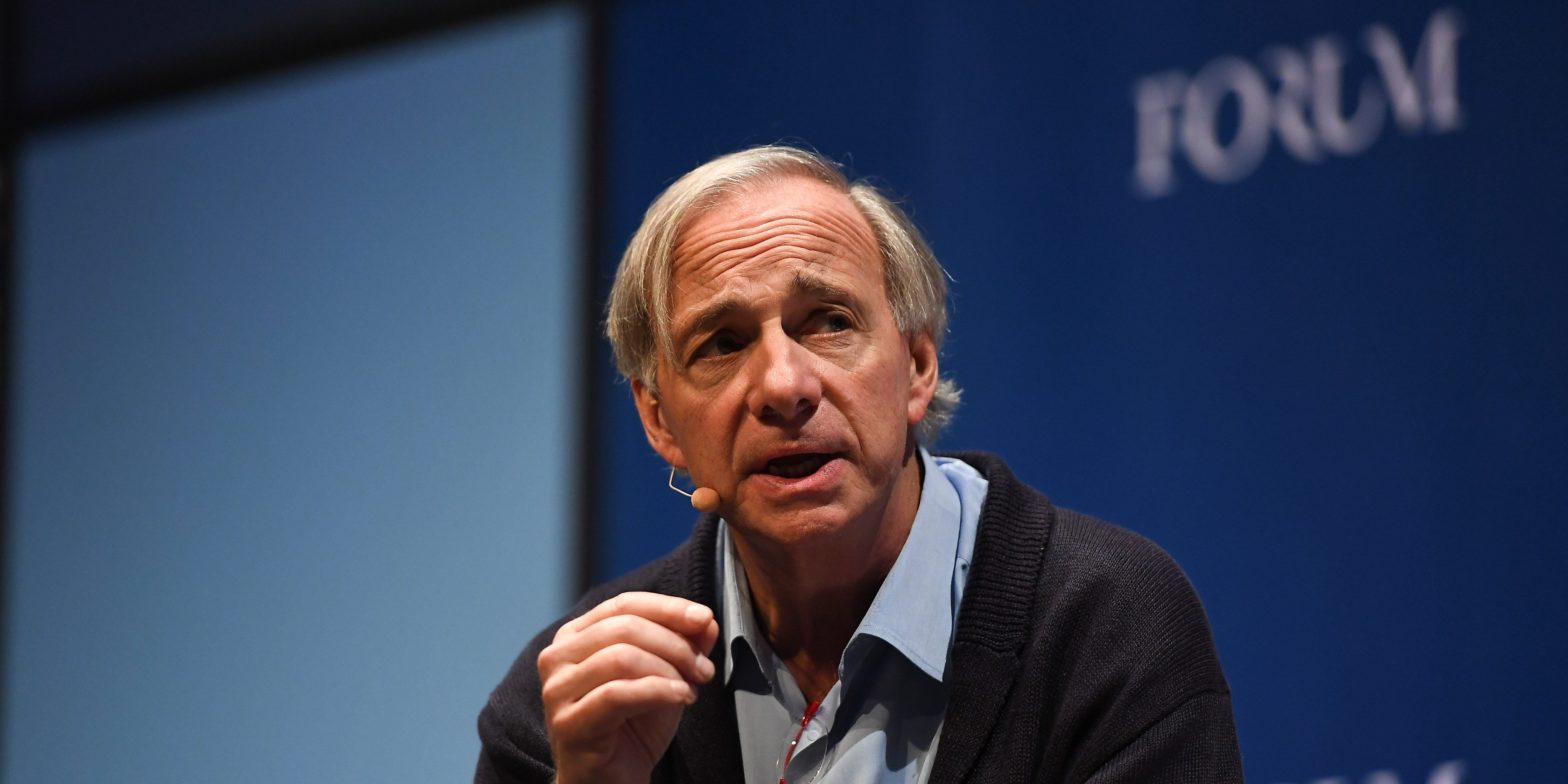

Ahead of the Fed’s anticipated interest rate hike next week, Wall Street investors are torn on the outlook for stocks.Some Wall Street strategists expect a sharp rebound in stocks by year-end as inflation cools off.That conflicts with the view of Ray Dalio and Scott Minerd, who say the S&P 500 can fall an additional 20%.… Continue reading Wall Street strategists are torn on whether the stock market is about to crash or soar 20% ahead of next week’s Fed meeting. Here’s where 6 market experts stand.

Ray Dalio’s co-chief rang the alarm on inflation, recession, and a global financial bubble this week. Here are the 10 best quotes.

Greg Jensen warned the Fed’s rate hikes could spark a market downturn and a deep recession. The Bridgewater Associates boss predicted stubborn inflation, slower growth, and weaker earnings. Jensen said the US is at the center of a global financial bubble that may be about to burst. Loading Something is loading. Investors are delusional if… Continue reading Ray Dalio’s co-chief rang the alarm on inflation, recession, and a global financial bubble this week. Here are the 10 best quotes.

Russian energy giant Gazprom may be able to withstand Western sanctions by buying back its bonds, Barclays says

High natural gas prices have put Gazprom on track for record profits this year. The Russian energy giant is exploring strategies to buy back its own bonds, Barclays said. That would reduce debt and help insulate Gazprom from Western sanctions against Russia. Loading Something is loading. High natural gas prices have put Gazprom on track… Continue reading Russian energy giant Gazprom may be able to withstand Western sanctions by buying back its bonds, Barclays says