The UK pound fell below $1.14 to a 37-year low Friday after a dive in retail sales fueled recession fears. The Bank of England is struggling to keep pace with the Federal Reserve’s tightening efforts. The pound is likely to fall further this year as US interest rate hikes continue, analysts said. Loading Something is… Continue reading British pound sinks to 37-year low against the dollar as retail sales crater, fueling fears about a UK recession

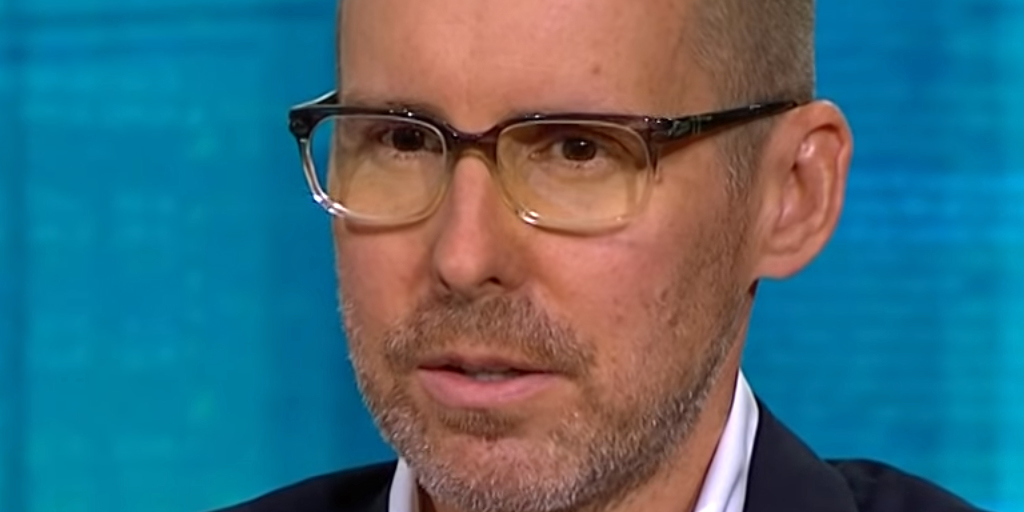

The boss of a ‘Black Swan’ fund warns the Fed’s rate hikes could cripple markets and the economy – and cause a bigger problem than inflation

Mark Spitznagel warned the Fed’s rate hikes risk causing huge damage to markets and the US economy. The Universa Investments boss cautioned higher interest rates could turn inflation into deflation. Spitznagel questioned whether the Fed will be able to stop a widescale crash if it causes one. Loading Something is loading. The Federal Reserve’s efforts… Continue reading The boss of a ‘Black Swan’ fund warns the Fed’s rate hikes could cripple markets and the economy – and cause a bigger problem than inflation

Billionaire investor Stanley Druckenmiller warns there’s a ‘high probability’ of the stock market being ‘flat’ for a decade

Stanley Druckenmiller said there’s a high probability of a flat stock market for 10 years. That’s because of a rollback in globalization and easy monetary policy. The Fed has already hiked interest rates four times this year. Loading Something is loading. Billionaire investor Stanley Druckenmiller sees a bleak outlook for the stock market, and that… Continue reading Billionaire investor Stanley Druckenmiller warns there’s a ‘high probability’ of the stock market being ‘flat’ for a decade

SIGO SEGUROS EXCEEDS EXPECTATIONS IN FIRST YEAR IMPACTING THE HISPANIC COMMUNITY

, /PRNewswire/ — Sigo Seguros, the insurtech startup enabling mobility for immigrant and working-class communities, has grown exponentially due to demand from the Hispanic community for fair auto insurance. Sigo Seguros has served thousands of drivers this year with transparent pricing directly from their mobile devices. “Our technology has driven underwriting profitability while allowing customers… Continue reading SIGO SEGUROS EXCEEDS EXPECTATIONS IN FIRST YEAR IMPACTING THE HISPANIC COMMUNITY

Warren Buffett’s Berkshire Hathaway saw $9 billion wiped off its Apple stake on Tuesday – as the iPhone maker shed $154 billion of market value in a single day

Warren Buffett’s Berkshire Hathaway saw the value of its Apple stake drop by $9 billion on Tuesday. Apple shares fell 6% as stocks tanked, slashing the iPhone maker’s market cap by $154 billion. The one-day drop in Apple’s market value was the sixth-largest in US stock-market history. Loading Something is loading. Warren Buffett’s Berkshire Hathaway… Continue reading Warren Buffett’s Berkshire Hathaway saw $9 billion wiped off its Apple stake on Tuesday – as the iPhone maker shed $154 billion of market value in a single day

Russia’s Rosneft paid just $1 for a Norwegian oil major’s main assets when the Ukraine war forced it to exit the country: report

Rosneft paid just 1 euro ($1) for Equinor’s main assets when the Norwegian oil major left Russia, per Reuters. Western oil majors have been trying to exit Russia given the sanctions its faces over the Ukraine war. The Kremlin allowed Equinor to drop $1 billion worth of its investment commitments as part of the deal.… Continue reading Russia’s Rosneft paid just $1 for a Norwegian oil major’s main assets when the Ukraine war forced it to exit the country: report

Billionaire ‘Bond King’ Jeff Gundlach says it’s time to get more bearish on US stocks, as the risk of deflation is much higher now

Jeff Gundlach said it’s time to be more bearish on stocks and he sees the S&P 500 dropping 20%. The billionaire “Bond King” told CNBC he now views deflation as the key risk to the US economy. He advised investors to buy long-term Treasurys and said the Fed should slow its rate hikes. Loading Something… Continue reading Billionaire ‘Bond King’ Jeff Gundlach says it’s time to get more bearish on US stocks, as the risk of deflation is much higher now

US stocks just suffered their biggest 1-day decline since June 2020. Here’s why an inflation surprise tanked the market.

US stocks on Tuesday registered their steepest one-day decline since June 2020. Investors dumped stocks and other assets after learning month-on-month inflation rose in August. Stubborn inflation may spur the Fed to keep hiking interest rates, potentially triggering a recession. Loading Something is loading. The US stock market suffered its worst one-day decline since June… Continue reading US stocks just suffered their biggest 1-day decline since June 2020. Here’s why an inflation surprise tanked the market.